Question

Bill Florio (age 37) is a bank vice president. He has been employed there for twelve years and has an annual salary of $70,000. Madelyn

Bill Florio (age 37) is a bank vice president. He has been employed there for twelve years and has an annual salary of $70,000. Madelyn Florio (age 37) is a full-time housewife. Bill and Madelyn have been married for eight years. They have two children, John (age 6) and Gabrielle (age 3), and are expecting their third child in two weeks. They have always lived in this community and expect to remain indefinitely in their current residence.

Health Insurance: The entire family is insured under Bills company plan (comprehensive major medical plan). There is a $200 family deductible, and it provides 80/20 major medical coverage. Bills employer pays the entire health insurance premium.

Life Insurance: Bill has a term life insurance policy with a face amount of $25,000 provided by his employer. The policy beneficiary is Madelyn.

Disability Insurance: Bill has a private disability insurance policy covering accidental disability for own occupation with a 30-day elimination period. In the event that Bill is disabled as provided under the policy, the benefit is $2,700 per month until age 65. The annual premium is $761 and is paid by Bill.

Homeowners Insurance: They have an HO3 policy for $195,000. The deductible is $250 and they have no endorsements.

Automobile Insurance: The annual premium is $500. Bodily damage and property damage coverage is 10/25/5. Comprehensive (OTC) deductible is $250. Collision deductible is $500.

While on a vacation in Montana, the Florios experience some unfortunate incidents. Bill rented a 200 horsepower jet ski and while skiing his wife was taken to the emergency room with an injury. Bill saw the ambulance load Madelyn and while staring he skied into a boat causing damage to the ski, the boat, and to Bill. The boat owner had minor medical injuries. A deer collided with their car causing $800 worth of damage to the front of the car. Upon returning home they discovered that their home had been damaged by a fire.

a) Assuming Madelyns hospital visit was $8,000, how much will the insurance company pay?

b) Bills collision with the boat caused $1,200 damage to the boat of the other party and $200 in medical expenses to the other party. Discuss any coverage provided or issue presented by the homeowners policy.

c) How much will the insurance company pay to have the front of the car repaired from accident with the deer?

d) The fire that damaged the home also destroyed much of their personal property. While the depreciated or actual cash value of all their ruined furniture/property is $5,000, it would cost the Florios about $37,000 to replace all of their lost prop

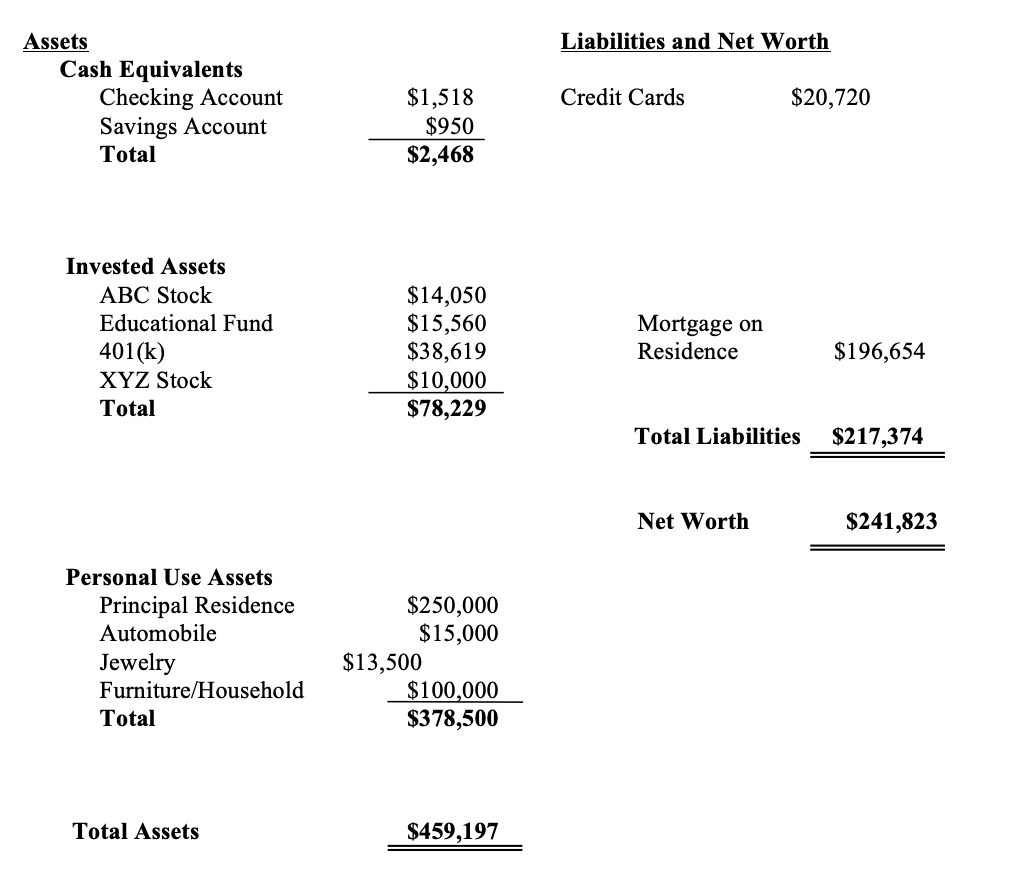

Assets Liabilities and Net Worth Cash Equivalents CheckingAccountSavingsAccountTotal$1,518$950$2,468CreditCards$20,720 Invested Assets Net Worth $241,823 Personal Use Assets Principal Residence $250,000 Automobile $15,000 Jewelry $13,500 Furniture/HouseholdTotal$100,000$378,500 Total Assets $459,197Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started