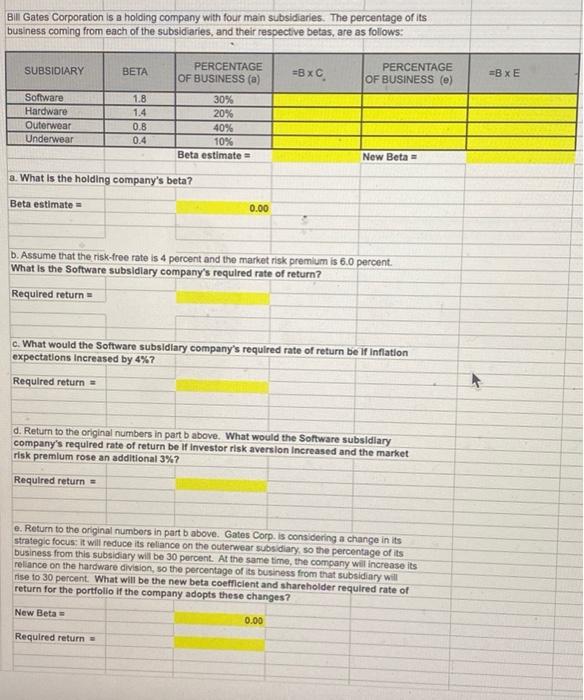

Bill Gates Corporation is a holding company with four main subsidiaries. The percentage of its business coming from each of the subsidiaries, and their respective betas, are as follows: SUBSIDIARY BETA =8x PERCENTAGE OF BUSINESS (0) =BXE Software Hardware Outerwear Underwear 1.8 1.4 0.8 0.4 PERCENTAGE OF BUSINESS (0) 30% 20% 40% 10% Beta estimate New Beta a. What is the holding company's beta? Beta estimate = 0.00 b. Assume that the risk-free rate is 4 percent and the market risk premium is 6.0 percent. What is the Software subsidiary company's required rate of return? Required return = c. What would the Software subsidiary company's required rate of return be if Inflation expectations Increased by 4%? Required return d. Return to the original numbers in part b above. What would the Software subsidiary company's required rate of return be if Investor risk aversion Increased and the market risk premium rose an additional 3%? Required return = e. Return to the original numbers in part b above. Gates Corp. is considering a change in its strategic focus: it will reduce its reliance on the outerwear subsidiary, so the percentage of its business from this subsidiary will be 30 percent. At the same time, the company will increase its reliance on the hardware division, so the percentage of its business from that subsidiary will rise to 30 percent. What will be the new beta coefficient and shareholder required rate of return for the portfolio If the company adopts these changes? New Beta 0.00 Required return Bill Gates Corporation is a holding company with four main subsidiaries. The percentage of its business coming from each of the subsidiaries, and their respective betas, are as follows: SUBSIDIARY BETA =8x PERCENTAGE OF BUSINESS (0) =BXE Software Hardware Outerwear Underwear 1.8 1.4 0.8 0.4 PERCENTAGE OF BUSINESS (0) 30% 20% 40% 10% Beta estimate New Beta a. What is the holding company's beta? Beta estimate = 0.00 b. Assume that the risk-free rate is 4 percent and the market risk premium is 6.0 percent. What is the Software subsidiary company's required rate of return? Required return = c. What would the Software subsidiary company's required rate of return be if Inflation expectations Increased by 4%? Required return d. Return to the original numbers in part b above. What would the Software subsidiary company's required rate of return be if Investor risk aversion Increased and the market risk premium rose an additional 3%? Required return = e. Return to the original numbers in part b above. Gates Corp. is considering a change in its strategic focus: it will reduce its reliance on the outerwear subsidiary, so the percentage of its business from this subsidiary will be 30 percent. At the same time, the company will increase its reliance on the hardware division, so the percentage of its business from that subsidiary will rise to 30 percent. What will be the new beta coefficient and shareholder required rate of return for the portfolio If the company adopts these changes? New Beta 0.00 Required return