Question

Bill gives Ted a loan of $4300 at 5.2% compounded monthly to be repaid in-full as a lump sum in 2 years. Ted, being

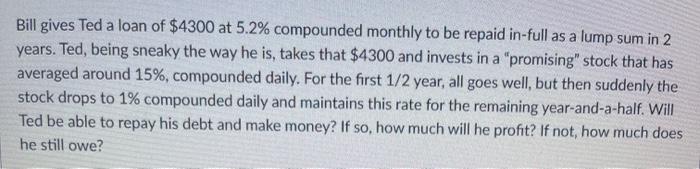

Bill gives Ted a loan of $4300 at 5.2% compounded monthly to be repaid in-full as a lump sum in 2 years. Ted, being sneaky the way he is, takes that $4300 and invests in a "promising" stock that has averaged around 15%, compounded daily. For the first 1/2 year, all goes well, but then suddenly the stock drops to 1% compounded daily and maintains this rate for the remaining year-and-a-half. Will Ted be able to repay his debt and make money? If so, how much will he profit? If not, how much does he still owe?

Step by Step Solution

3.42 Rating (142 Votes )

There are 3 Steps involved in it

Step: 1

Amount to be repaid by Ted P 4300 r 52 0052 n12 12 A P 1 ht 2013 4300 1 0653 12x2 A 12 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

College Mathematics for Business Economics Life Sciences and Social Sciences

Authors: Raymond A. Barnett, Michael R. Ziegler, Karl E. Byleen

12th edition

321614003, 978-0321614001

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App