Answered step by step

Verified Expert Solution

Question

1 Approved Answer

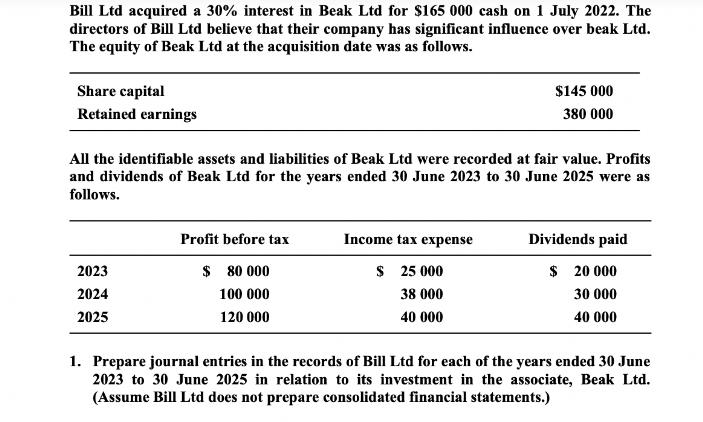

Bill Ltd acquired a 30% interest in Beak Ltd for $165 000 cash on 1 July 2022. The directors of Bill Ltd believe that

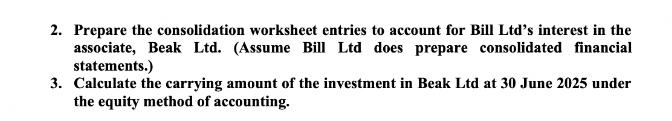

Bill Ltd acquired a 30% interest in Beak Ltd for $165 000 cash on 1 July 2022. The directors of Bill Ltd believe that their company has significant influence over beak Ltd. The equity of Beak Ltd at the acquisition date was as follows. Share capital Retained earnings All the identifiable assets and liabilities of Beak Ltd were recorded at fair value. Profits and dividends of Beak Ltd for the years ended 30 June 2023 to 30 June 2025 were as follows. 2023 2024 2025 Profit before tax $ 80 000 100 000 120 000 $145 000 380 000 Income tax expense $ 25 000 38 000 40 000 Dividends paid $ 20 000 30 000 40 000 1. Prepare journal entries in the records of Bill Ltd for each of the years ended 30 June 2023 to 30 June 2025 in relation to its investment in the associate, Beak Ltd. (Assume Bill Ltd does not prepare consolidated financial statements.) 2. Prepare the consolidation worksheet entries to account for Bill Ltd's interest in the associate, Beak Ltd. (Assume Bill Ltd does prepare consolidated financial statements.) 3. Calculate the carrying amount of the investment in Beak Ltd at 30 June 2025 under the equity method of accounting.

Step by Step Solution

★★★★★

3.45 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

Here are the journal entries for Bill Ltd for its investment in the associate Beak Ltd for each year ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started