Question

Bill owns 100% of an S corporation. This year, the corporation paid Bill a salary of $100,000. Bill's share of S corporation income for

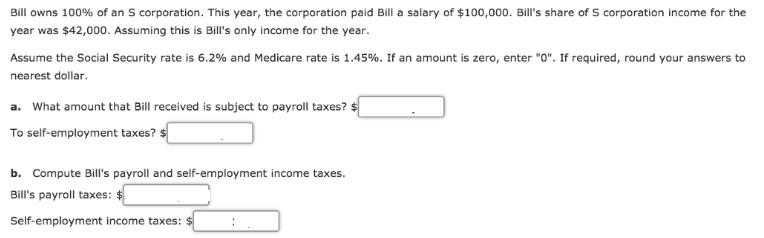

Bill owns 100% of an S corporation. This year, the corporation paid Bill a salary of $100,000. Bill's share of S corporation income for the year was $42,000. Assuming this is Bill's only income for the year. Assume the Social Security rate is 6.2% and Medicare rate is 1.45%. If an amount is zero, enter "0". If required, round your answers to nearest dollar. a. What amount that Bill received is subject to payroll taxes? $ To self-employment taxes? $ b. Compute Bill's payroll and self-employment income taxes. Bill's payroll taxes: $ Self-employment income taxes: $

Step by Step Solution

3.42 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

a Salary received by Bill from the corporation would be subject to payroll taxes A...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Business Law Text and Cases

Authors: Kenneth W. Clarkson, Roger Miller, Frank B. Cross

14th edition

978-1305967250, 1305967259, 978-1337514422, 133751442X, 978-1337374491

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App