Question

Bill Sharpe, owner of Sharper Knives Inc., is closing the scissor sharpening division of his business at the end of the current fiscal year. The

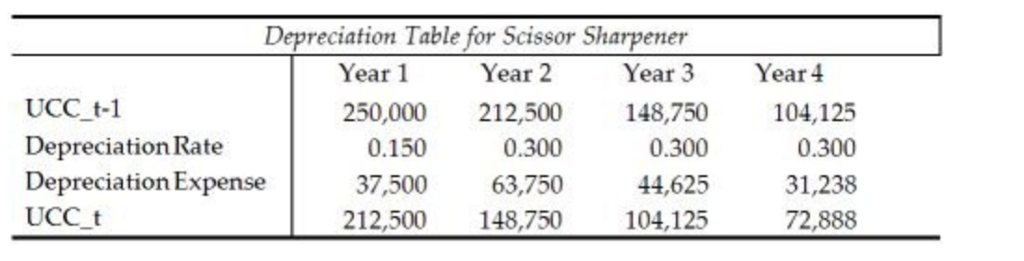

Bill Sharpe, owner of Sharper Knives Inc., is closing the scissor sharpening division of his business at the end of the current fiscal year. The division's sole asset, the scissorminussharpening machine, was purchased four years ago for $250,000. The asset is in Class 43 with a depreciation rate of 30%. A depreciation table for the asset is shown below. Bill has agreed to sell the machine at the end of the year (Year 4) for $100,000. What is the present value of the tax shields gained (lost) as a result of the sale of the machine? (As of Year 4.) The tax rate is 35% and Bill's cost of capital is 9.7%. Round your answers to the nearest dollar.

Please explain the answer step by step. Thank you!

Depreciation Table for Scissor Sharpener Year 1 Year 2 Year 3 148,750 0.300 44,625 104,125 Year4 UCC t-1 Depreciation Rate Depreciation Expense UCC t 250,000 212,500 0.300 63,750 212,500 148,750 104,125 0.300 31,238 72,888 0.150 37,500Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started