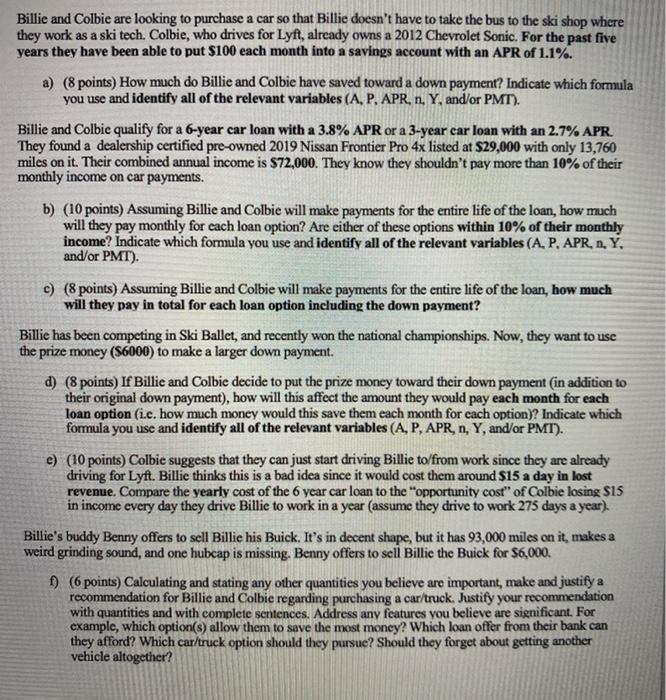

Billie and Colbie are looking to purchase a car so that Billie doesn't have to take the bus to the ski shop where they work as a ski tech. Colbie, who drives for Lyft , already owns a 2012 Chevrolet Sonic. For the past five years they have been able to put $100 each month into a savings account with an APR of 1.1%. a) (8 points) How much do Billie and Colbie have saved toward a down payment? Indicate which formula you use and identify all of the relevant variables (A, P, APR, n. Y, and/or PMT). Billie and Colbie qualify for a 6-year car loan with a 3.8% APR or a 3-year car loan with an 2.7% APR. They found a dealership certified pre-owned 2019 Nissan Frontier Pro 4x listed at $29,000 with only 13,760 miles on it. Their combined annual income is $72,000. They know they shouldn't pay more than 10% of their monthly income on car payments. b) (10 points) Assuming Billie and Colbie will make payments for the entire life of the loan, how much will they pay monthly for each loan option? Are either of these options within 10% of their monthly income? Indicate which formula you use and identify all of the relevant variables (A, P, APR, n. Y, and/or PMT). c) (8 points) Assuming Billie and Colbie will make payments for the entire life of the loan, how much will they pay in total for each loan option including the down payment? Billie has been competing in Ski Ballet, and recently won the national championships. Now, they want to use the prize money (56000) to make a larger down payment. d) (8 points) If Billie and Colbie decide to put the prize money toward their down payment in addition to their original down payment), how will this affect the amount they would pay each month for each loan option (i.e. how much money would this save them each month for each option)? Indicate which formula you use and identify all of the relevant variables (A, P, APR, n, Y, and/or PMT). c) (10 points) Colbie suggests that they can just start driving Billie to/from work since they are already driving for Lyft. Billic thinks this is a bad idea since it would cost them around $15 a day in lost revenue. Compare the yearly cost of the 6 year car loan to the opportunity cost of Colbie losing $15 in income every day they drive Billie to work in a year (assume they drive to work 275 days a year) Billie's buddy Benny offers to sell Billie his Buick. It's in decent shape, but it has 93,000 miles on it makes a weird grinding sound, and one hubcap is missing. Benny offers to sell Billie the Buick for $6,000. 1) (6 points) Calculating and stating any other quantities you believe are important, make and justify a recommendation for Billic and Colbic regarding purchasing a car/track. Justify your recommendation with quantities and with complete sentences. Address any features you believe are significant. For example, which option(s) allow them to save the most money? Which loan offer from their bank can they afford? Which car/truck option should they pursue? Should they forget about getting another vehicle altogether