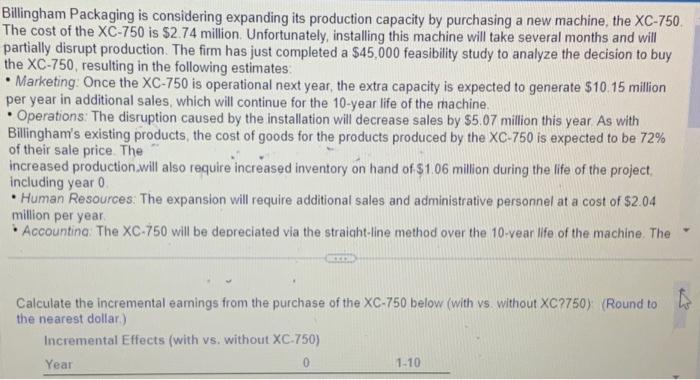

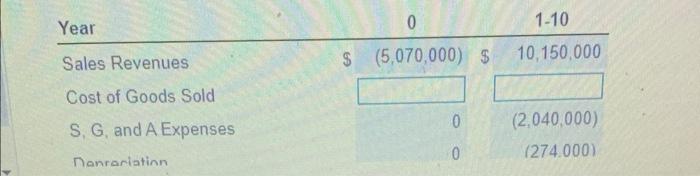

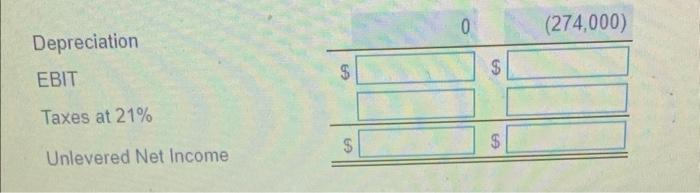

Billingham Packaging is considering expanding its production capacity by purchasing a new machine, the XC-750. The cost of the XC-750 is $2.74 million. Unfortunately, installing this machine will take several months and will partially disrupt production. The firm has just completed a $45,000 feasibility study to analyze the decision to buy the XC-750, resulting in the following estimates: - Marketing. Once the XC-750 is operational next year, the extra capacity is expected to generate $10.15 million per year in additional sales, which will continue for the 10 -year life of the machine. - Operations: The disruption caused by the installation will decrease sales by $5.07 million this year As with Billingham's existing products, the cost of goods for the products produced by the XC-750 is expected to be 72% of their sale price. The increased production.will also require increased inventory on hand of $1.06 million during the life of the project, including year 0 - Human Resources: The expansion will require additional sales and administrative personnel at a cost of $2.04 million per year. - Accountina: The XC-750 will be depreciated via the straiaht-line method over the 10-vear life of the machine. The Calculate the incremental eamings from the purchase of the XC750 below (with vs. without XC2750 ) (Round to the nearest dollar.) Incremental Effects (with vs. without XC.750) Depreciation EBIT Taxes at 21% Unlevered Net Income \begin{tabular}{l} 0(274,000) \\ \hline$$ \\ \hline$ \\ \hline \end{tabular} Billingham Packaging is considering expanding its production capacity by purchasing a new machine, the XC-750. The cost of the XC-750 is $2.74 million. Unfortunately, installing this machine will take several months and will partially disrupt production. The firm has just completed a $45,000 feasibility study to analyze the decision to buy the XC-750, resulting in the following estimates: - Marketing. Once the XC-750 is operational next year, the extra capacity is expected to generate $10.15 million per year in additional sales, which will continue for the 10 -year life of the machine. - Operations: The disruption caused by the installation will decrease sales by $5.07 million this year As with Billingham's existing products, the cost of goods for the products produced by the XC-750 is expected to be 72% of their sale price. The increased production.will also require increased inventory on hand of $1.06 million during the life of the project, including year 0 - Human Resources: The expansion will require additional sales and administrative personnel at a cost of $2.04 million per year. - Accountina: The XC-750 will be depreciated via the straiaht-line method over the 10-vear life of the machine. The Calculate the incremental eamings from the purchase of the XC750 below (with vs. without XC2750 ) (Round to the nearest dollar.) Incremental Effects (with vs. without XC.750) Depreciation EBIT Taxes at 21% Unlevered Net Income \begin{tabular}{l} 0(274,000) \\ \hline$$ \\ \hline$ \\ \hline \end{tabular}