Answered step by step

Verified Expert Solution

Question

1 Approved Answer

billy's exterminators, Inc., has sales of $817,000, costs of $343,000, depreciation expense of $51,000, interst expense of $38,000, and a tax rate of 21 percent.

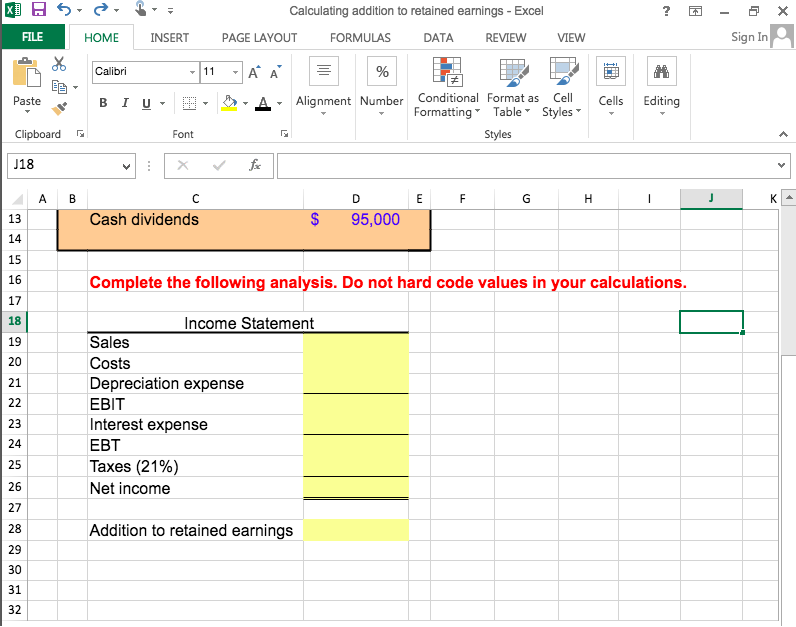

billy's exterminators, Inc., has sales of $817,000, costs of $343,000, depreciation expense of $51,000, interst expense of $38,000, and a tax rate of 21 percent. the firm just paid out $95,000 in cash dividends. what is the addition to retained earnings?

Solve in Excel, please

Calculating addition to retained earnings Excel FILE HOME INSERT PAGE LAYOUT FORMULAS DATAREVIEW VIEW Sign In Ob Calibri u- h4. 2.A. Cells Editing Paste Alignment Number Conditional Format as Cell Num FormattingTabl Styles- Clipboard r Font Styles U18 A B Cash dividends $ 95,000 13 14 15 16 17 18 19 20 21 Complete the following analysis. Do not hard code values in your calculations Income Statement Sales Costs Depreciation expense EBIT Interest expense EBT Taxes (21 % Net income 23 24 25 26 27 28 29 30 31 32 Addition to retained earnings

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started