Answered step by step

Verified Expert Solution

Question

1 Approved Answer

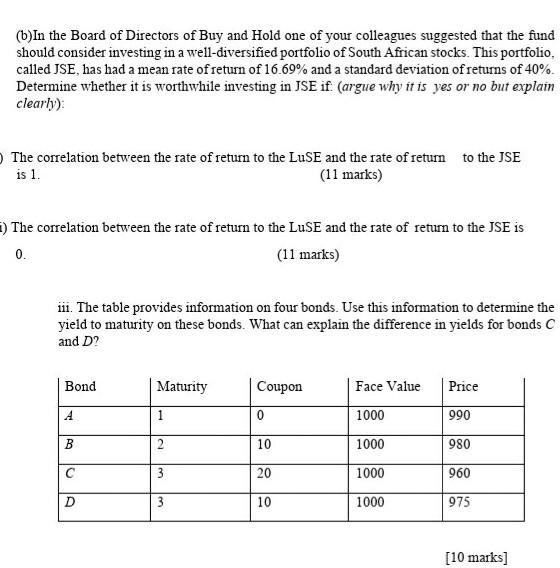

(b)In the Board of Directors of Buy and Hold one of your colleagues suggested that the fund should consider investing in a well-diversified portfolio of

(b)In the Board of Directors of Buy and Hold one of your colleagues suggested that the fund should consider investing in a well-diversified portfolio of South African stocks. This portfolio, called JSE, has had a mean rate of return of 16.69% and a standard deviation of returns of 40%. Determine whether it is worthwhile investing in JSE if (argue why it is yes or no but explain clearly) The correlation between the rate of return to the LuSE and the rate of return to the JSE is 1. (11 marks) 1) The correlation between the rate of return to the LuSE and the rate of return to the JSE is 0. (11 marks) iii. The table provides information on four bonds. Use this information to determine the yield to maturity on these bonds. What can explain the difference in yields for bonds C and D? Bond Maturity Coupon Face Value Price A 1 0 1000 990 B 2 10 1000 980 20 1000 960 D | 10 1000 975 [10 marks]

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started