Answered step by step

Verified Expert Solution

Question

1 Approved Answer

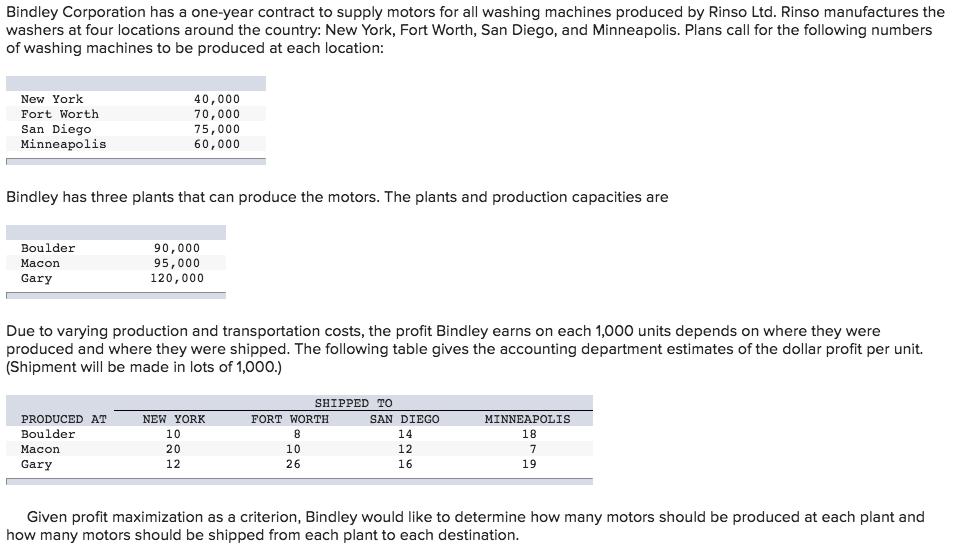

Bindley Corporation has a one-year contract to supply motors for all washing machines produced by Rinso Ltd. Rinso manufactures the washers at four locations

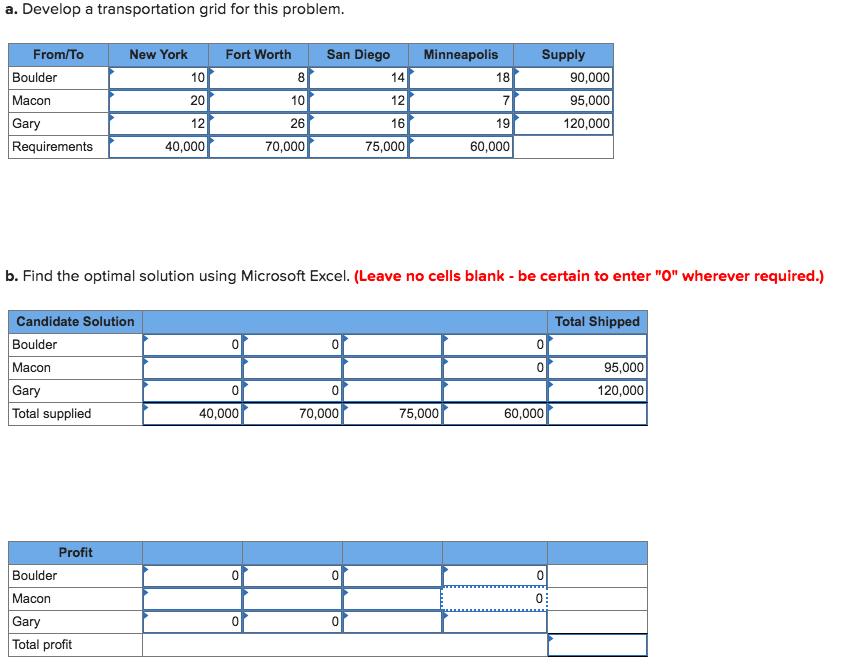

Bindley Corporation has a one-year contract to supply motors for all washing machines produced by Rinso Ltd. Rinso manufactures the washers at four locations around the country: New York, Fort Worth, San Diego, and Minneapolis. Plans call for the following numbers of washing machines to be produced at each location: New York Fort Worth 40,000 70,000 San Diego Minneapolis 75,000 60,000 Bindley has three plants that can produce the motors. The plants and production capacities are Boulder Macon Gary 90,000 95,000 120,000 Due to varying production and transportation costs, the profit Bindley earns on each 1,000 units depends on where they were produced and where they were shipped. The following table gives the accounting department estimates of the dollar profit per unit. (Shipment will be made in lots of 1,000.) SHIPPED TO PRODUCED AT Boulder. NEW YORK FORT WORTH 10. 8 Macon Gary 20 12 SAN DIEGO 14 MINNEAPOLIS 18 7 19 FITTI 10 26 12 16 Given profit maximization as a criterion, Bindley would like to determine how many motors should be produced at each plant and how many motors should be shipped from each plant to each destination. a. Develop a transportation grid for this problem. From/To New York Fort Worth San Diego Minneapolis Supply Boulder 10 8 14 18 90,000 Macon 20 10 12 7 95,000 Gary 12 26 16 19 120,000 Requirements 40,000 70,000 75,000 60,000 b. Find the optimal solution using Microsoft Excel. (Leave no cells blank - be certain to enter "O" wherever required.) Candidate Solution Total Shipped 0 95,000 120,000 Boulder 0 0 Macon Gary 0 0 Total supplied 40,000 70,000 75,000 60,000 Boulder Profit 0 0 0 0 Macon Gary 0 0 Total profit

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started