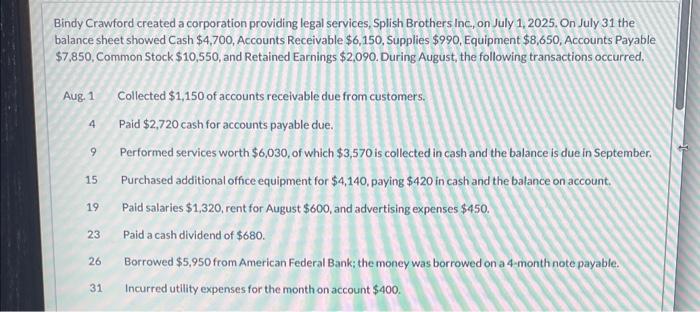

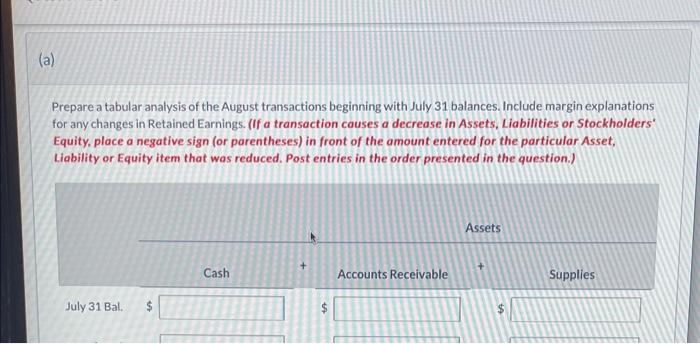

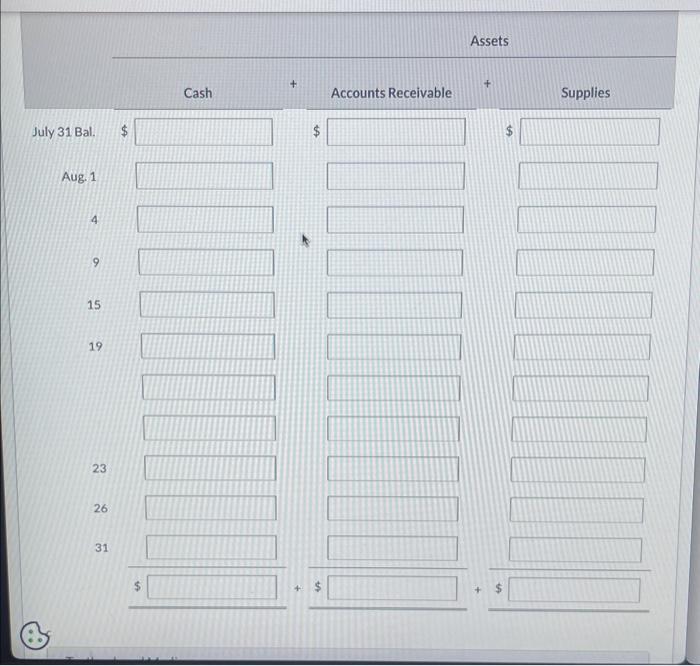

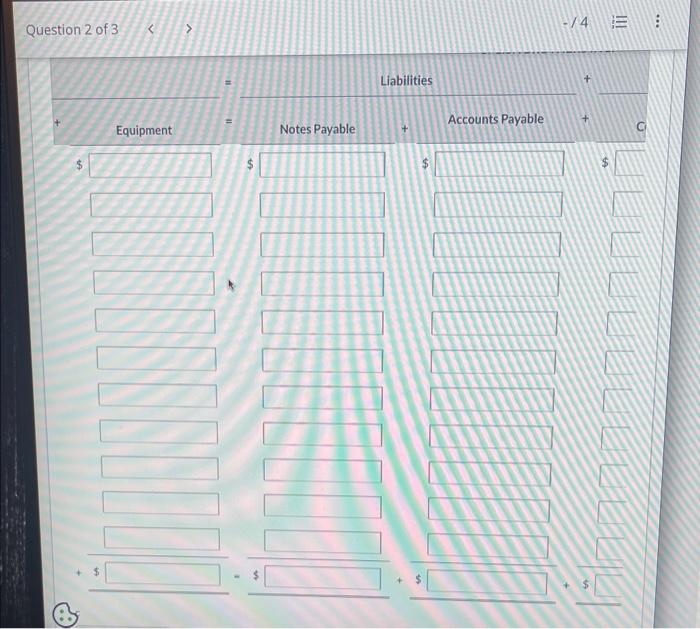

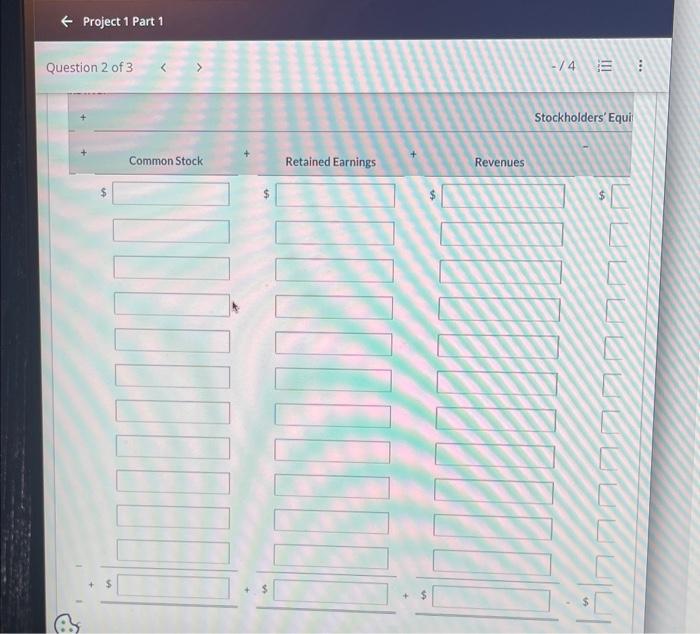

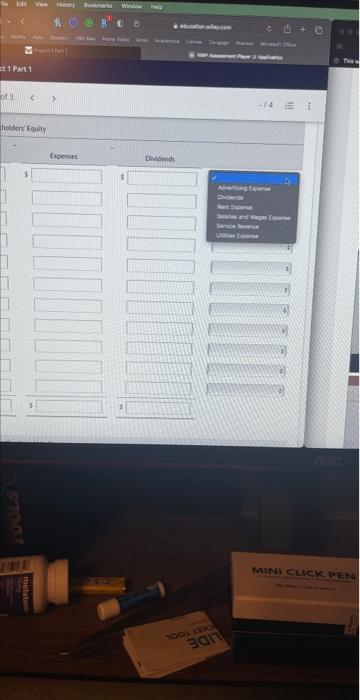

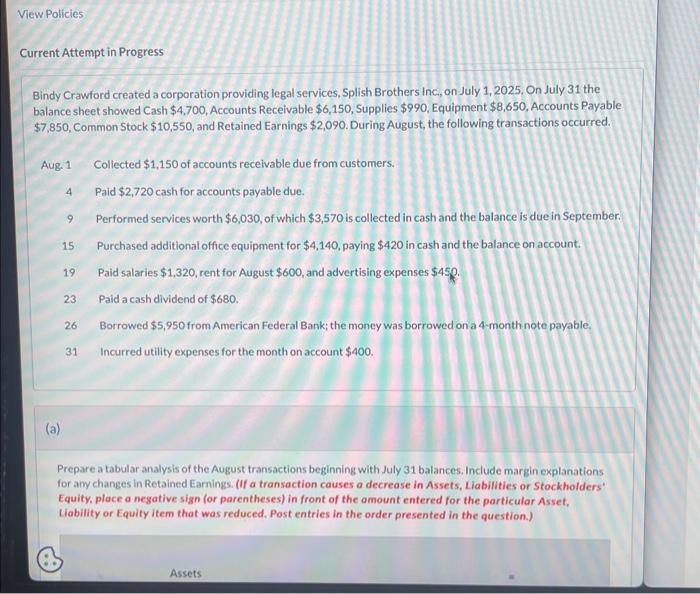

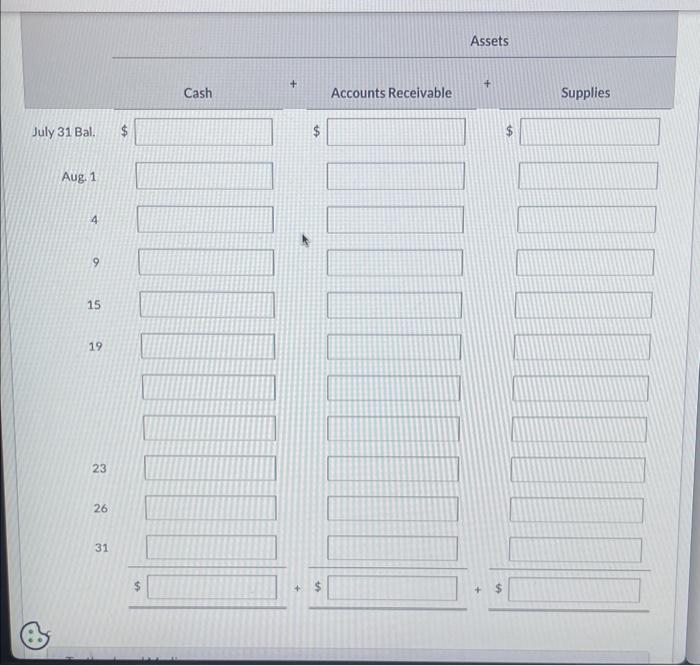

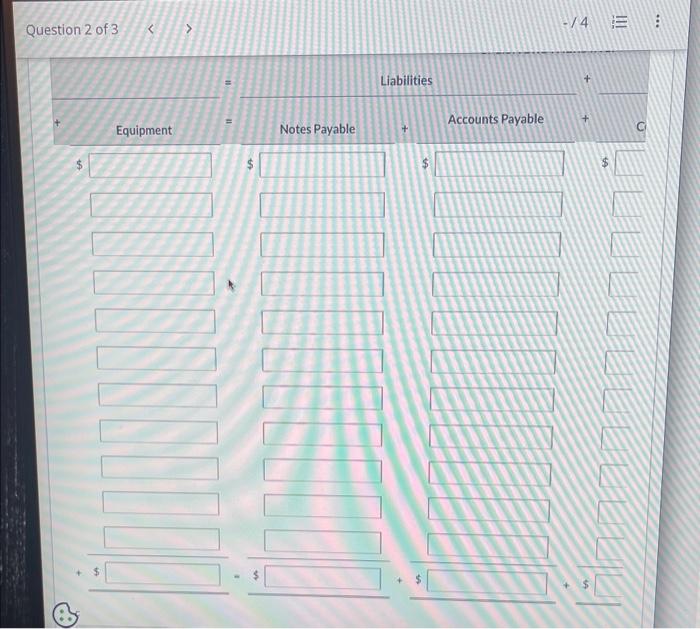

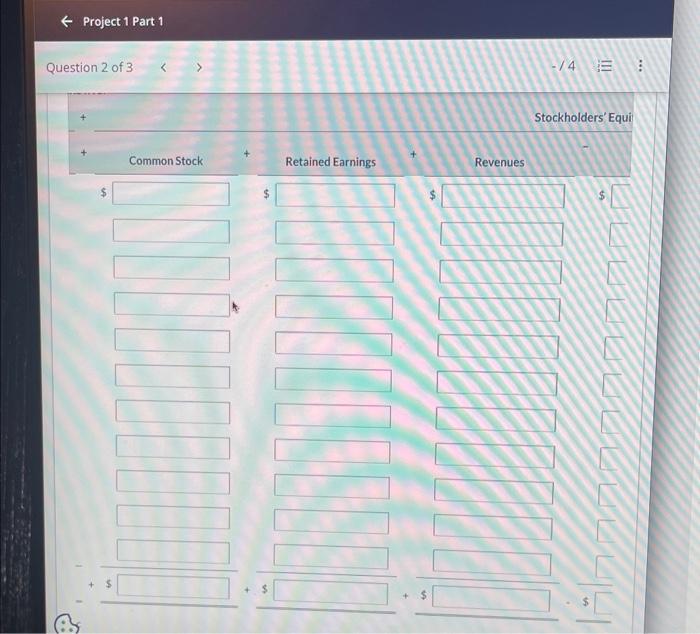

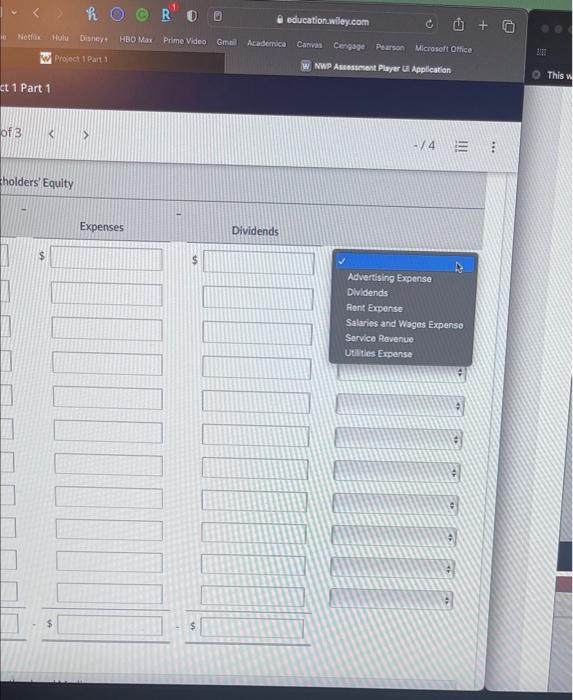

Bindy Crawford created a corporation providing legal services, Splish Brothers Inc, on July 1, 2025, On July 31 the balance sheet showed Cash $4,700, Accounts Receivable $6,150, Supplies $990, Equipment $8,650, Accounts Payable \$7,850, Common Stock $10,550, and Retained Earnings $2,090. During August, the following transactions occurred. Aug. 1 Collected $1,150 of accounts receivable due from customers. 4 Paid $2,720 cash for accounts payable due. 9 Performed services worth $6,030, of which $3,570 is collected in cash and the balance is due in September. 15 Purchased additional office equipment for $4,140, paying $420 in cash and the balance on account. 19 Paid salaries $1,320, rent for August $600, and advertising expenses $450. 23 Paid a cash dividend of $680. 26 Borrowed $5,950 from American Federal Bank; the money was borrowed on a 4-month note payable. 31. Incurred utility expenses for the month on account $400. Prepare a tabular analysis of the August transactions beginning with July 31 balances. Include margin explanations for any changes in Retained Earnings. (If a transaction couses a decrease in Assets, Liabilities or Stockholders" Equity, place a negative sign (or parentheses) in front of the amount entered for the particular Asset, Liability or Equity item that was reduced. Post entries in the order presented in the question.) Assets July 31 Bal. Aug. 1 4 9 15 19 23 26 31 Question 2 of 3 Project 1 Part 1 Question 2 of 3 . Stockholders' Equi /4; (1). Bindy Crawford created a corporation providing legal services, Splish Brothers Inc., on July 1, 2025, On July 31 the balance sheet showed Cash $4,700, Accounts Receivable $6,150, Supplies $990, Equipment $8,650, Accounts Payable $7,850, Common Stock $10,550, and Retained Earnings $2,090. During August, the following transactions occurred. Aug. 1 Collected $1,150 of accounts receivable due from customers. 4 Paid $2,720 cash for accounts payable due. 9 Performed services worth $6,030, of which $3,570 is collected in cash and the balance is due in September. 15 Purchased additional office equipment for $4,140, paying $420 in cash and the balance on account. 19 Paid salaries $1,320, rent for August $600, and advertising expenses $450. 23 Paid a cash dividend of $680. 26 Borrowed \$5,950 from American Federal Bank; the money was borrowed on a 4-month note payable. 31 Incurred utility expenses for the month on account $400. (a) Prepare a tabular analysis of the August transactions beginning with July 31 balances. Include margin explanations for any changes in Retained Earnings. (If a transaction causes a decrease in Assets, Liabilities or Stockholders' Equity, place a negative sign (or parentheses) in front of the amount entered for the particular Asset, Liability or Equity item that was reduced. Post entries in the order presented in the question.) Assets July 31 Bal. Aug. 1 4 9 15 19 23 26 31 Question 2 of 3 Project 1 Part 1 Question 2 of 3 Stockholders' Equi Revenues h C) R10 (1) e colucationwiloxcom at 1 Part 1 14 tholders' Equity Dividends Advertising Expense DWldends Rent Exponse Saluries and Wages Expense Service Rovenue Utilies Experse