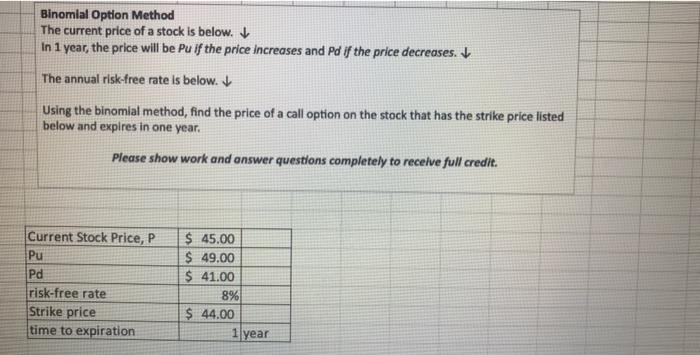

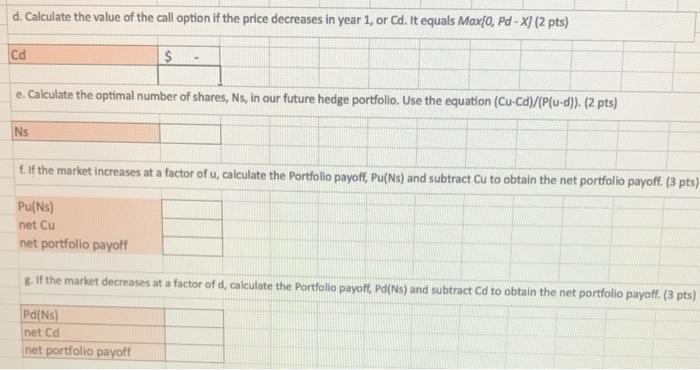

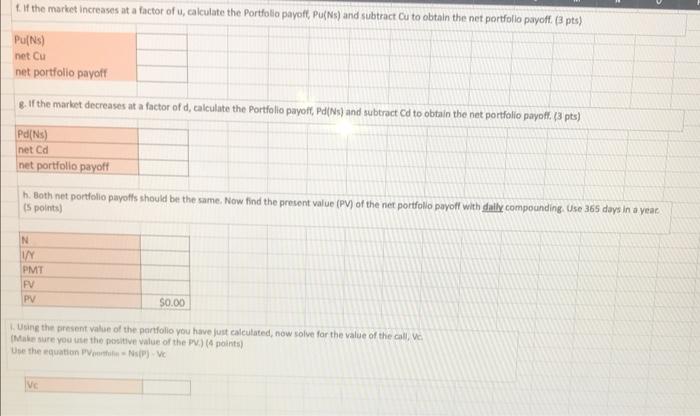

Binomial Option Method The current price of a stock is below. In 1 year, the price will be Pu if the price increases and Pd if the price decreases. The annual risk-free rate is below. Using the binomial method, find the price of a call option on the stock that has the strike price listed below and expires in one year. Please show work and answer questions completely to receive full credit. Current Stock Price, P Pu Pd risk-free rate Strike price time to expiration $ 45.00 $ 49.00 $ 41.00 8% $ 44.00 1 year d. Calculate the value of the call option if the price decreases in year 1, or Cd. It equals Max[0, Pd - XI (2 pts) Cd $ e. Calculate the optimal number of shares, Ns, in our future hedge portfolio. Use the equation (Cu-Cd)/(P/u-d)). (2 pts) Ns f. If the market increases at a factor of u, calculate the Portfolio payoff, Pu(Ns) and subtract Cu to obtain the net portfolio payoff. (3 pts) Pu(N) net Cu net portfolio payoff g. If the market decreases at a factor of d, calculate the Portfolio payoff, Pdins) and subtract Cd to obtain the net portfolio payoff. (3 pts) Pd(N) net Cd net portfolio payoft If the market increases at a factor ofu, calculate the Portfolio payoft, Pu(s) and subtract Cu to obtain the net portfolio payoff. (8 pts) Puis) net Cu net portfolio payoff 8. If the market decreases at a factor of d, calculate the Portfolio payoft Pads) and subtract Cd to obtain the net portfolio payoff (3 pts) Pd Ns) net Cd net portfolio payoff h. Both net portfolio payoffs should be the same. Now find the present value (PV) of the net portfolio payoff with daily compounding. Use 365 days in a year Spolnts N WY PMT FV PV $0.00 Using the present value of the portfolio you have just calculated, now solve for the value of the callVc Make sure you the positive value of the P.) 4 points) Use the equation NP VC Ive Binomial Option Method The current price of a stock is below. In 1 year, the price will be Pu if the price increases and Pd if the price decreases. The annual risk-free rate is below. Using the binomial method, find the price of a call option on the stock that has the strike price listed below and expires in one year. Please show work and answer questions completely to receive full credit. Current Stock Price, P Pu Pd risk-free rate Strike price time to expiration $ 45.00 $ 49.00 $ 41.00 8% $ 44.00 1 year d. Calculate the value of the call option if the price decreases in year 1, or Cd. It equals Max[0, Pd - XI (2 pts) Cd $ e. Calculate the optimal number of shares, Ns, in our future hedge portfolio. Use the equation (Cu-Cd)/(P/u-d)). (2 pts) Ns f. If the market increases at a factor of u, calculate the Portfolio payoff, Pu(Ns) and subtract Cu to obtain the net portfolio payoff. (3 pts) Pu(N) net Cu net portfolio payoff g. If the market decreases at a factor of d, calculate the Portfolio payoff, Pdins) and subtract Cd to obtain the net portfolio payoff. (3 pts) Pd(N) net Cd net portfolio payoft If the market increases at a factor ofu, calculate the Portfolio payoft, Pu(s) and subtract Cu to obtain the net portfolio payoff. (8 pts) Puis) net Cu net portfolio payoff 8. If the market decreases at a factor of d, calculate the Portfolio payoft Pads) and subtract Cd to obtain the net portfolio payoff (3 pts) Pd Ns) net Cd net portfolio payoff h. Both net portfolio payoffs should be the same. Now find the present value (PV) of the net portfolio payoff with daily compounding. Use 365 days in a year Spolnts N WY PMT FV PV $0.00 Using the present value of the portfolio you have just calculated, now solve for the value of the callVc Make sure you the positive value of the P.) 4 points) Use the equation NP VC Ive