Question

Binomial Solutions Inc (BSI) is a financial software company. Its asset has a current market value of $100 million (year 0). The asset value can

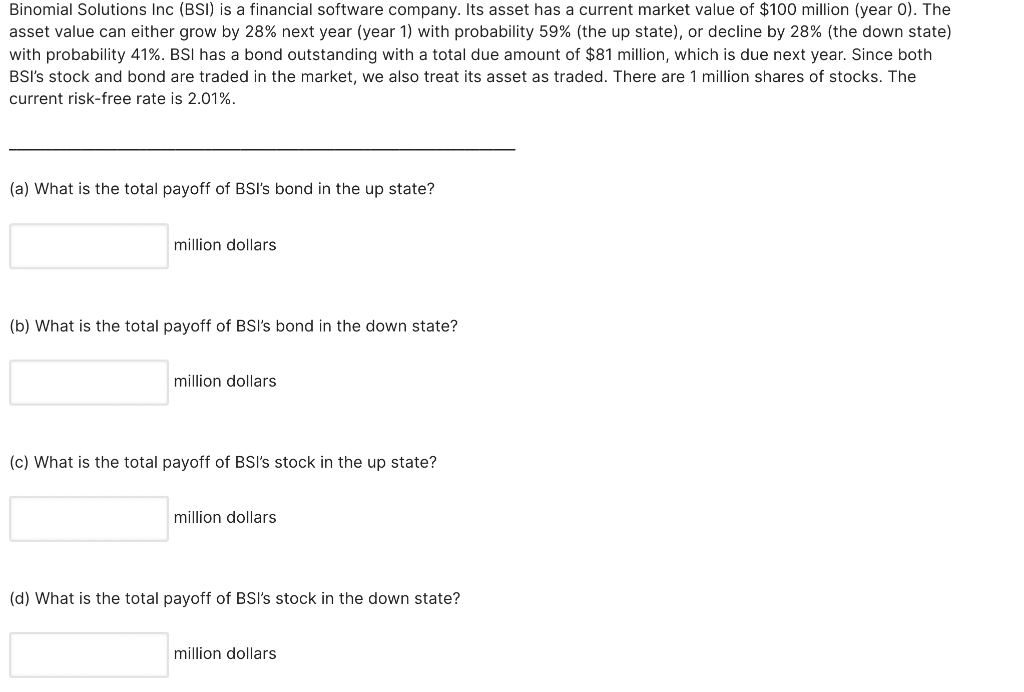

Binomial Solutions Inc (BSI) is a financial software company. Its asset has a current market value of $100 million (year 0). The asset value can either grow by 28% next year (year 1) with probability 59% (the up state), or decline by 28% (the down state) with probability 41%. BSI has a bond outstanding with a total due amount of $81 million, which is due next year. Since both BSIs stock and bond are traded in the market, we also treat its asset as traded. There are 1 million shares of stocks. The current risk-free rate is 2.01%.

(a) What is the total payoff of BSIs bond in the up state?

(b) What is the total payoff of BSIs bond in the down state?

(c) What is the total payoff of BSIs stock in the up state? (d) What is the total payoff of BSIs stock in the down state?

(e) What is the current price of BSIs bond?

(f) What is BSIs current stock price?

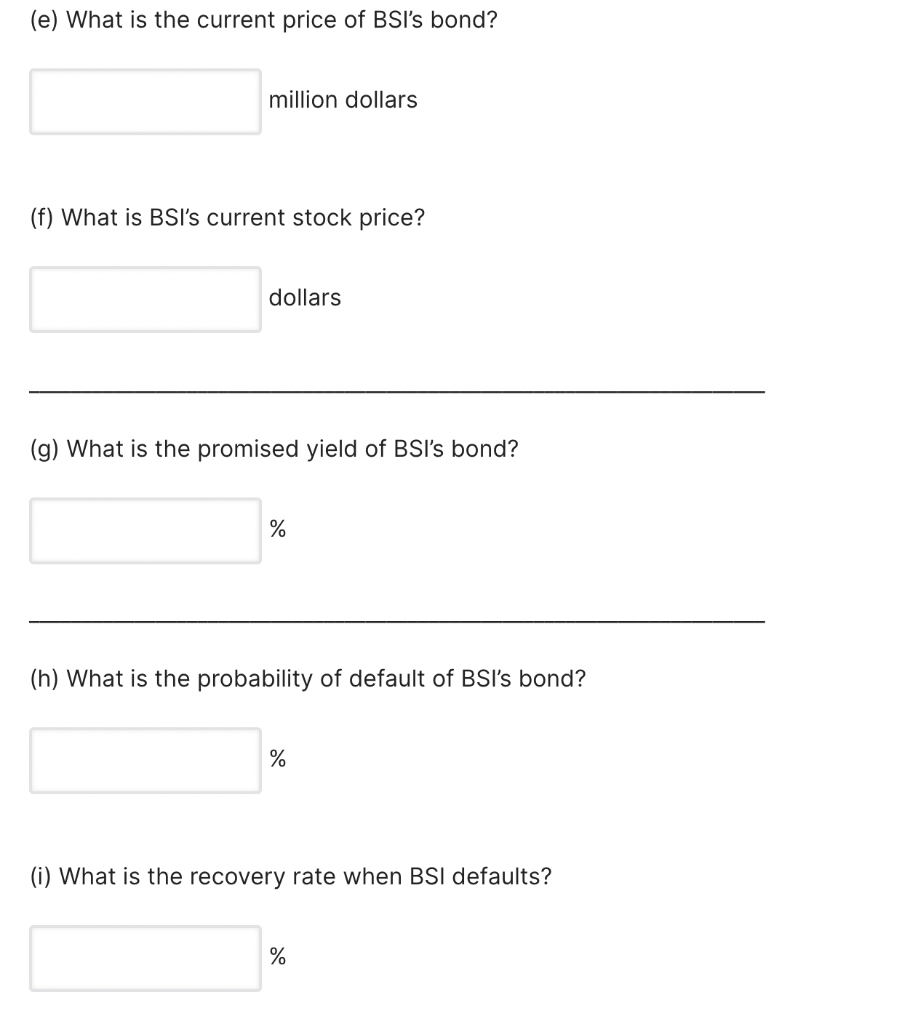

(g) What is the promised yield of BSIs bond?

(h) What is the probability of default of BSIs bond?

(i) What is the recovery rate when BSI defaults?

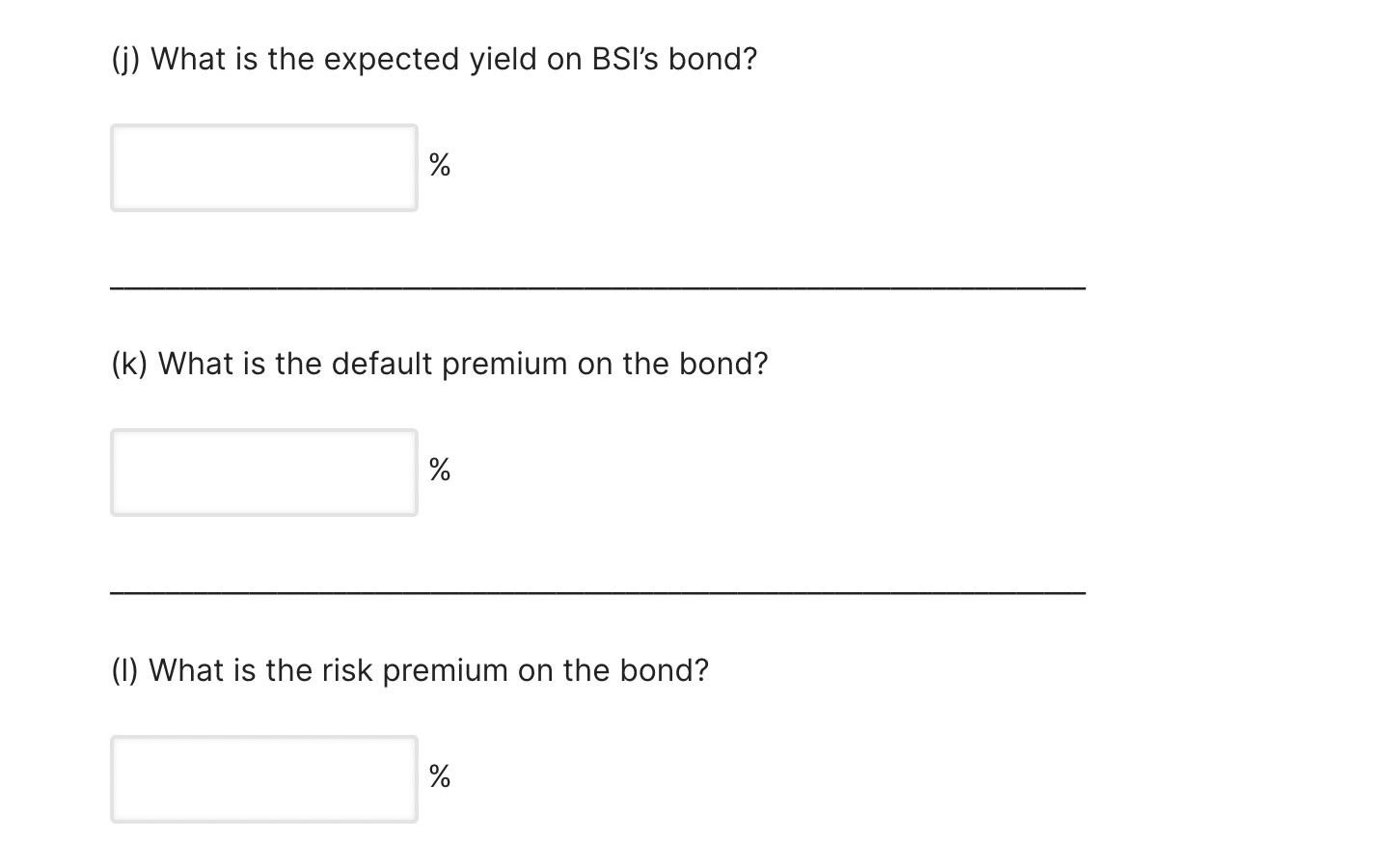

(j) What is the expected yield on BSIs bond?

(k) What is the default premium on the bond?

(l) What is the risk premium on the bond?

Binomial Solutions Inc (BSI) is a financial software company. Its asset has a current market value of $100 million (year O). The asset value can either grow by 28% next year (year 1) with probability 59% (the up state), or decline by 28% (the down state) with probability 41%. BSI has a bond outstanding with a total due amount of $81 million, which is due next year. Since both BSi's stock and bond are traded in the market, we also treat its asset as traded. There are 1 million shares of stocks. The current risk-free rate is 2.01%. (a) What is the total payoff of BSI's bond in the up state? million dollars (b) What is the total payoff of BSi's bond in the down state? million dollars (c) What is the ayoff of BSI's stock in the up ate? million dollars (d) What is the total payoff of BSI's stock in the down state? million dollars (e) What is the current price of BSI's bond? million dollars (f) What is BSi's current stock price? dollars (g) What is the promised yield of BSIs bond? % (h) What is the probability of default of BSI's bond? % (i) What is the recovery rate when BSI defaults? % (j) What is the expected yield on BSls bond? % (k) What is the default premium on the bond? % (1) What is the risk premium on the bond? % Binomial Solutions Inc (BSI) is a financial software company. Its asset has a current market value of $100 million (year O). The asset value can either grow by 28% next year (year 1) with probability 59% (the up state), or decline by 28% (the down state) with probability 41%. BSI has a bond outstanding with a total due amount of $81 million, which is due next year. Since both BSi's stock and bond are traded in the market, we also treat its asset as traded. There are 1 million shares of stocks. The current risk-free rate is 2.01%. (a) What is the total payoff of BSI's bond in the up state? million dollars (b) What is the total payoff of BSi's bond in the down state? million dollars (c) What is the ayoff of BSI's stock in the up ate? million dollars (d) What is the total payoff of BSI's stock in the down state? million dollars (e) What is the current price of BSI's bond? million dollars (f) What is BSi's current stock price? dollars (g) What is the promised yield of BSIs bond? % (h) What is the probability of default of BSI's bond? % (i) What is the recovery rate when BSI defaults? % (j) What is the expected yield on BSls bond? % (k) What is the default premium on the bond? % (1) What is the risk premium on the bond? %Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started