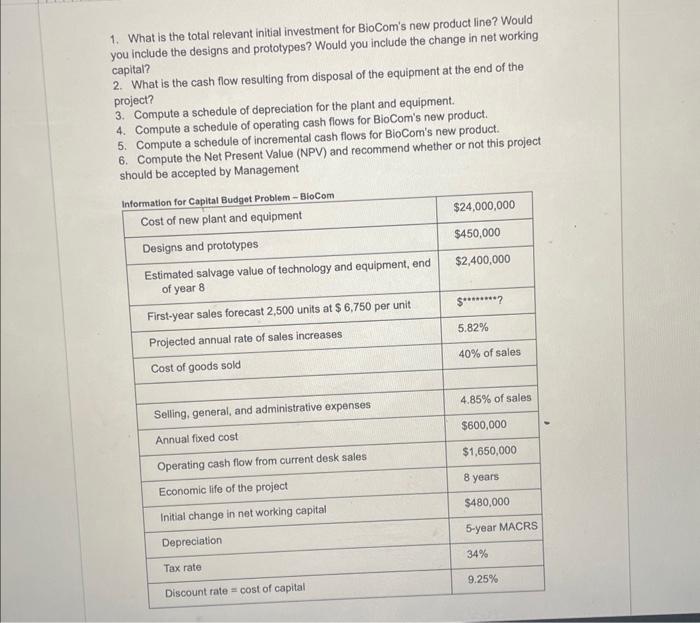

BioCom, Inc. is w state weighing a proposal to manufacture and market a fiber-optic device that will continuously monitor blood pressure during cardiovascular surgery and other medical procedures in which precise, real-time measurements are critical. The device will continuously transmit information to a computer via a thin fiber-optic cable and display measurements on several large monitors in view of operating room personnel. It will also store the data and display it graphically for review during or after procedures. BioCom would market various versions of the device, but manufacture all of them in the same facility using the same equipment. They would have similar markups and cost structures. If management decides to bring this device to market, BioCom will stop selling an earlier, less sophisticated version of the monitor. The product that BioCom will discontinue now contributes about $1,650,000 per year to operating cash flow, and projected sales are flat. BioCom focuses exclusively on cutting-edge applications, so it expects to discontinue the new monitor after Eight (8) years. At that time, it will sell the technology and used manufacturing equipment to a foreign company for an estimated $2,400,000. BioCom submitted this information to the treasurer's office for additional study and a final decision on whether to proceed. You, as assistant to the treasurer, must compute and evaluate the basic capital budgeting criteria. The project will initially increase working capital by $480,000, which the company will recover at the end of the project when it sells remaining inventory and collects accounts receivable. The analysts are not quite sure if they should include $450,000 that the company already spent on research and development for the new product. They also disagree about whether the effect of the discontinued monitor on the company's overall operating cash flows is relevant to the decision on the new product line, so you must decide how to deal with these two items. Using the data table in the next page, answer the questions that follow. You must present your answers in MS-Word and your calculations must in a Spreadsheet attached in Blackboard. 1. What is the total relevant initial investment for BioCom's new product line? Would you include the designs and prototypes? Would you include the change in net working 2. What is the cash flow resulting from disposal of the equipment at the end of the capital? project? 3. Compute a schedule of depreciation for the plant and equipment. 4. Compute a schedule of operating cash flows for BioCom's new product. 5. Compute a schedule of incremental cash flows for BioCom's new product. 6. Compute the Net Present Value (NPV) and recommend whether or not this project should be accepted by Management