Answered step by step

Verified Expert Solution

Question

1 Approved Answer

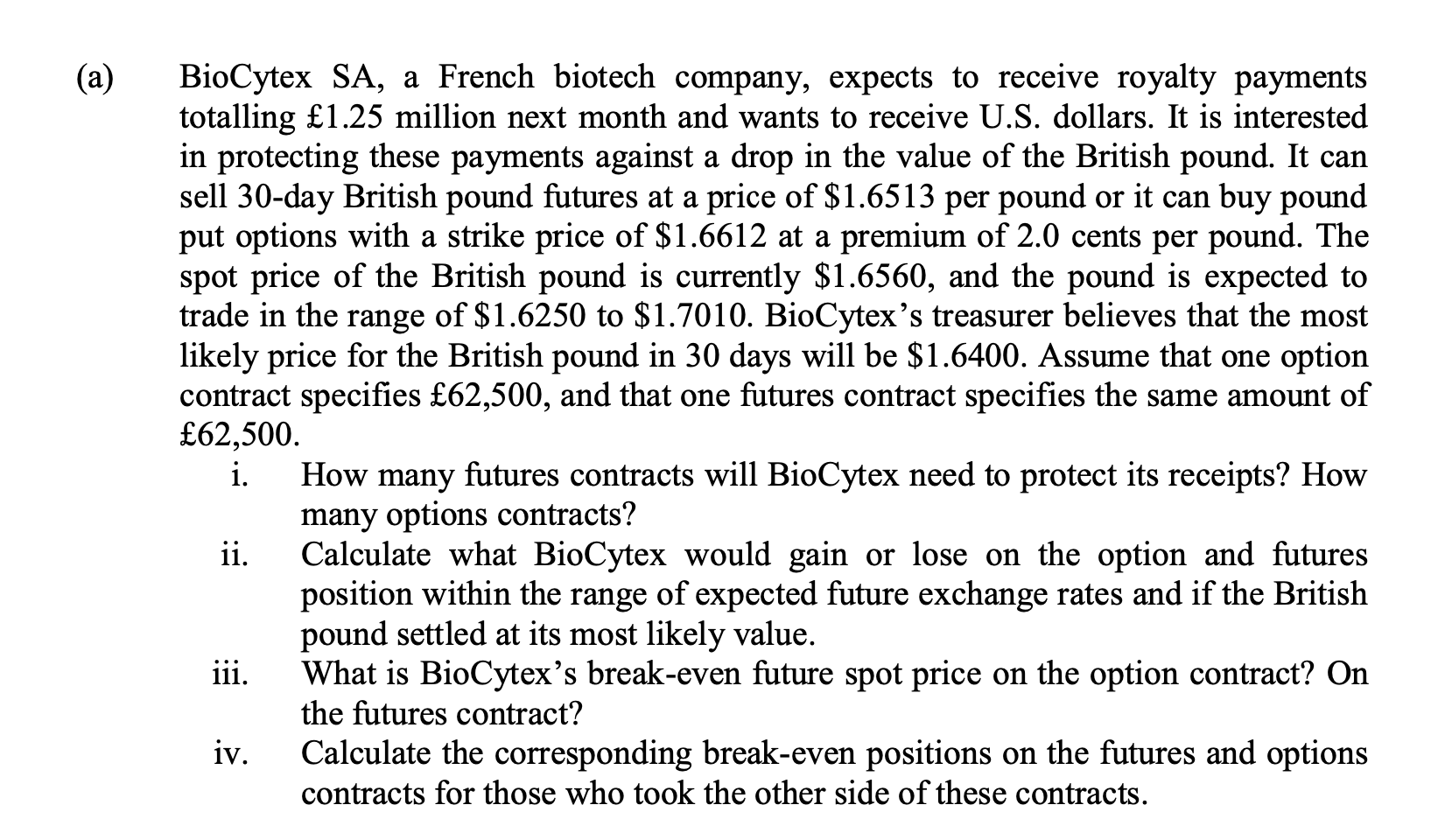

BioCytex SA , a French biotech company, expects to receive royalty payments totalling 1 . 2 5 million next month and wants to receive U

BioCytex SA a French biotech company, expects to receive royalty payments

totalling million next month and wants to receive US dollars. It is interested

in protecting these payments against a drop in the value of the British pound. It can

sell day British pound futures at a price of $ per pound or it can buy pound

put options with a strike price of $ at a premium of cents per pound. The

spot price of the British pound is currently $ and the pound is expected to

trade in the range of $ to $ BioCytex's treasurer believes that the most

likely price for the British pound in days will be $ Assume that one option

contract specifies and that one futures contract specifies the same amount of

i How many futures contracts will BioCytex need to protect its receipts? How

many options contracts?

ii Calculate what BioCytex would gain or lose on the option and futures

position within the range of expected future exchange rates and if the British

pound settled at its most likely value.

iii. What is BioCytex's breakeven future spot price on the option contract? On

the futures contract?

iv Calculate the corresponding breakeven positions on the futures and options

contracts for those who took the other side of these contracts.

I need help for questions I will rate you.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started