Question

Biogen expects to receive royalty payments totaling 5 million next month. It is interested in protecting these receipts against a drop in the value of

Biogen expects to receive royalty payments totaling 5 million next month. It is interested in protecting these receipts against a drop in the value of the pound. It can sell 30-day pound futures (futures contract size of 62,500 ) at a price of $1.6500 per pound or it can buy pound put options with a strike price of $1.6700 at a premium of 4.0 cents per pound. The spot price of the pound is currently $1.6500, and the pound is expected to trade in the range of $1.6250 to $1.7500. Biogen's treasurer believes that the most likely price of the pound in 30 days will be $1.6650. a. How many futures contracts will Biogen need to protect its receipts? How many options contracts?

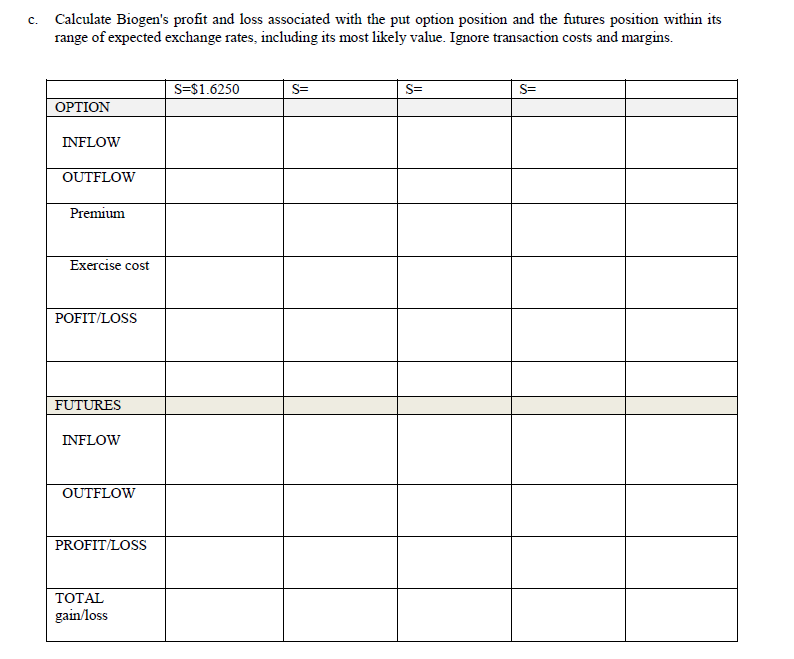

b. Diagram Biogen's profit and loss associated with the put option position and the futures position within its range of expected exchange rates. Ignore transaction costs and margins. Label all axes, and all S($/ 1) prices.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started