Answered step by step

Verified Expert Solution

Question

1 Approved Answer

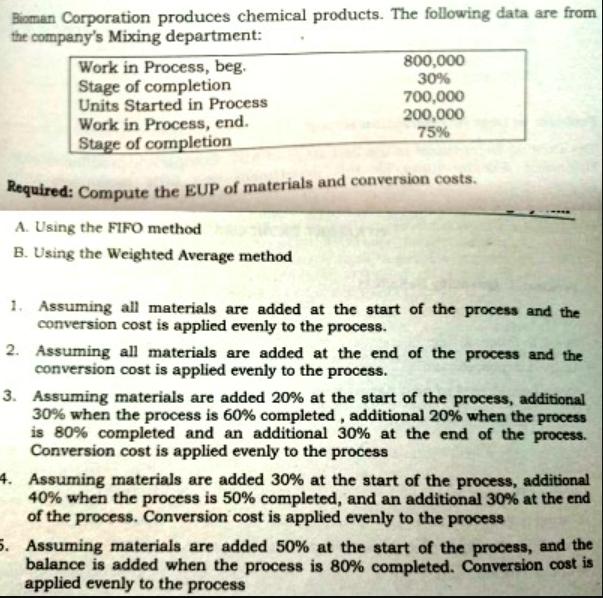

Bioman Corporation produces chemical products. The following data are from the company's Mixing department: Work in Process, beg. Stage of completion Units Started in

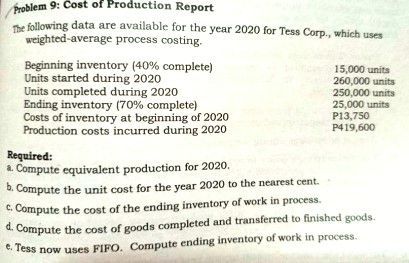

Bioman Corporation produces chemical products. The following data are from the company's Mixing department: Work in Process, beg. Stage of completion Units Started in Process Work in Process, end. Stage of completion 800,000 30% 700,000 200,000 75% Required: Compute the EUP of materials and conversion costs. A. Using the FIFO method B. Using the Weighted Average method 1. Assuming all materials are added at the start of the process and the conversion cost is applied evenly to the process. 2. Assuming all materials are added at the end of the process and the conversion cost is applied evenly to the process. 3. Assuming materials are added 20% at the start of the process, additional 30% when the process is 60% completed, additional 20% when the process is 80% completed and an additional 30% at the end of the process. Conversion cost is applied evenly to the process 4. Assuming materials are added 30% at the start of the process, additional 40% when the process is 50% completed, and an additional 30% at the end of the process. Conversion cost is applied evenly to the process 5. Assuming materials are added 50% at the start of the process, and the balance is added when the process is 80% completed. Conversion cost is applied evenly to the process Problem 9: Cost of Production Report The following data are available for the year 2020 for Tess Corp., which uses weighted-average process costing. Beginning inventory (40% complete) Units started during 2020 Units completed during 2020 Ending inventory (70% complete) Costs of inventory at beginning of 2020 Production costs incurred during 2020 Required: a. Compute equivalent production for 2020. b. Compute the unit cost for the year 2020 to the nearest cent. c. Compute the cost of the ending inventory of work in process. 15,000 units 260,000 units 250,000 units 25,000 units P13,750 P419,600 d. Compute the cost of goods completed and transferred to finished goods. e. Tess now uses FIFO. Compute ending inventory of work in process.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started