Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Biotechnics Engineering has developed two mutually exclusive plans for investing in new capital equipment with the expectation of increased revenue from its medical diagnostic

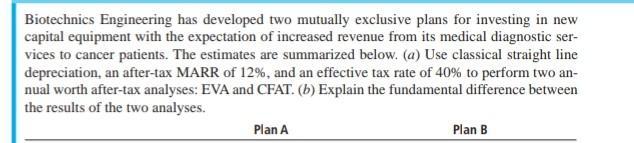

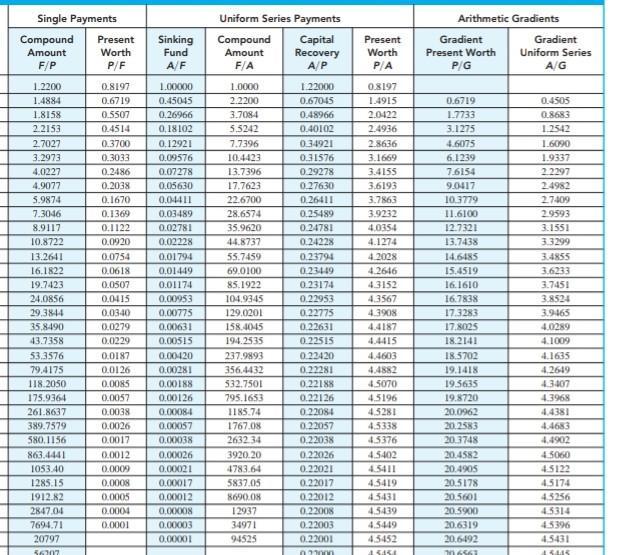

Biotechnics Engineering has developed two mutually exclusive plans for investing in new capital equipment with the expectation of increased revenue from its medical diagnostic ser- vices to cancer patients. The estimates are summarized below. (a) Use classical straight line depreciation, an after-tax MARR of 12%, and an effective tax rate of 40% to perform two an- nual worth after-tax analyses: EVA and CFAT. (b) Explain the fundamental difference between the results of the two analyses. Plan A Plan B Single Payments Uniform Series Payments Arithmetic Gradients Capital Recovery A/P Present Worth Compound Present Sinking Fund Compound Gradient Gradient Amount Worth Amount Present Worth Uniform Series F/P P/F A/F F/A P/A P/G A/G 1.2200 0.8197 1.00000 1.0000 1 22000 0.8197 1.4884 0.6719 0.45045 2.2200 0.67045 1.4915 0.6719 0.4505 1.8158 0.5507 0.26966 3.7084 0.48966 2.0422 1.7733 0.8683 2.2153 0.4514 0,18102 5.5242 0.40102 2.4936 3.1275 1.2542 2.7027 0.3700 0.12921 7.7396 034921 2.8636 4.6075 1.6090 1.9337 3.1669 3.4155 3.2973 0.3033 0.09576 10.4423 0.31576 6.1239 4.0227 0.2486 0.07278 13.7396 0.29278 7.6154 2.2297 4.9077 0.2038 0.05630 17.7623 0.27630 3.6193 9.0417 24982 5.9874 0.1670 0.04411 22.6700 0.26411 3.7863 10.3779 2.7409 7.3046 0.1369 0.03489 28.6574 0.25489 3.9232 I1.6100 2.9593 8.9117 0.1122 0.02781 35.9620 0.24781 4.0354 12.7321 3.1551 10.8722 0.0920 0.02228 44.8737 0.24228 4.1274 13.7438 3.3299 13.2641 0.0754 0.01794 55.7459 0.23794 4.2028 14.6485 3.4855 16.1822 0.0618 0.01449 69.0100 0.23449 4.2646 15.4519 3.6233 19.7423 0.0507 0.01174 85.1922 0.23174 4.3152 16.1610 3.7451 24.0856 0.0415 0.00953 104.9345 0.22953 4.3567 16.7838 3.8524 29.3844 0.0340 0.00775 129.0201 0.22775 4.3908 17.3283 3.9465 35.8490 0.0279 0.00631 158.4045 0.22631 4.4187 17.8025 4.0289 43.7358 0.0229 0.00515 194.2535 0.22515 4.4415 18.2141 4.1009 53.3576 0.0187 0.00420 237.9893 0.22420 4.4603 18.5702 4.1635 79.4175 0.0126 0.00281 356.4432 0.22281 4.4882 19.1418 19.5635 4.2649 118.2050 0.0085 0.00188 532.7501 0.22188 4.5070 43407 175.9364 0.0057 0.00126 795.1653 0.22126 4.5196 19.8720 4.3968 261.8637 0.0038 0.00084 1185.74 0.22084 4.5281 20.0962 4.4381 1767.08 2632.34 3920.20 389.7579 0.0026 0.00057 0.22057 4.5338 20.2583 4.4683 580,1156 0.0017 0.00038 20.3748 0.22038 0.22026 0.22021 4.5376 4.4902 863.4441 0.0012 0.00026 20.4582 4.5402 4.5411 4.5060 1053.40 0.0009 0.00021 4783.64 20.4905 45122 1285.15 0.0008 0.00017 5837.05 0.22017 4.5419 20.5178 4.5174 1912.82 0.0005 0,00012 8690.08 0.22012 4.5431 20.5601 4.5256 2847.04 0.0004 0,00008 12937 0.22008 4.5439 20.5900 4.5314 7694.71 0.0001 0.00003 34971 0.22003 4.5449 20.6319 4.5396 20797 0.00001 94525 0.22001 4.5452 20.6492 4.5431 36707 02000 45454 06561 1S445

Step by Step Solution

★★★★★

3.44 Rating (170 Votes )

There are 3 Steps involved in it

Step: 1

Answer Plan A CFo Depriciation 5000004 500000 12500...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started