Question

Bipasha is a good looking, intelligent and smart lady with a pleasant personality in her 20s. She always wanted to do something of her own.

Bipasha is a good looking, intelligent and smart lady with a pleasant personality in her 20s. She always wanted to do something of her own. Every year she visits places endowed with natural beauty and places of historical interest. Immediately after graduating from IIM-A , she identified tourism as her passion and started the tourism business on 1st January 2018. Under the name and style Bipasha and Co. ( BC) . She arranged a bank loan of Rs 10 lacs under special scheme to support young entrepreneurs. This was 50% of the total capital required by the firm and Bipasha contributed the balance 50%. The rate of interest is 10% p.a to be compounded annually. Interest for years 2018 and 2019 are payable on 1st January 2020. The loan is to repaid 50 equal installment starting from 1st January 2020.

Bipasha works with corporate clients only. Her business model is quite simple. She arranges groups tours for employees of her clients. She has entered into MOU with tourism departments of different state governments. Tourism department allows 20% discount over published rates to Bipasha. She pays 50% in advance for all bookings. The advance is non-refundable in case of cancellation of a trip. Bipasha allows group discount, which varies between 5% and 15% depending upon the size of the group, and collects 50% of the estimated cost at the commencement of the tour. She directly arranges visits to places not covered in tour package.

In addition Bipasha arranges conducted tours jointly with Modern Transport company (MTC) which operate inter-state bus services.

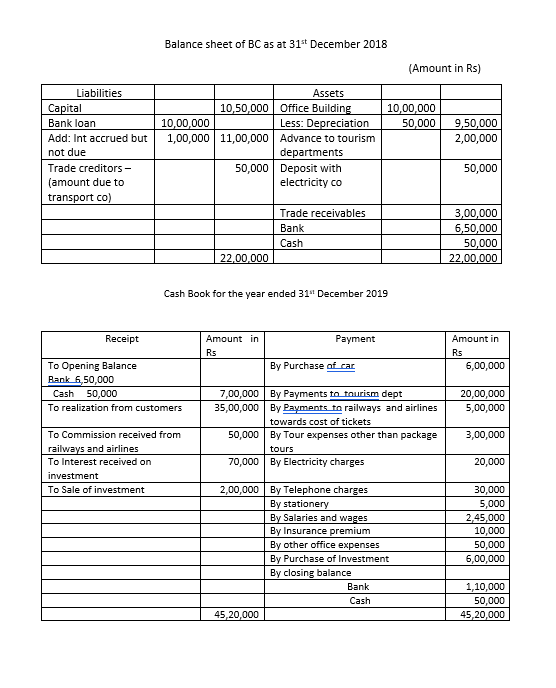

The year 2018 was good year for Bipasha. She earned a modest profit in the first year of operation. She submitted the following Balance sheet as at 31st December 2018 to the bank from which she borrowed money.

Bipasha provides you the following information

- BC purchased car on 1st July 2019

- BC uses straight line method of depreciation at 5% on Building and 25% p.a on Car

- Payments to tourism department include payment of advances for booking cancelled subsequently amounting to Rs 50,000

- Insurance premium was paid on 1st July 2019 to cover risk for one year.

- Advance with state tourism department on 31st December 2019 was Rs 1,50,000

- Trade receivable as on 31st December 2019 was Rs 2,00,000

- The cost of investment sold was Rs 1,50,000

Please prepare a Profit and Loss account ( No trading account required) for the year ended 31st December 2019 and Balance of BC as at that date in the HORIZNTAL FORMAT

Balance sheet of BC as at 31st December 2018 (Amount in Rs) 10,00,000 50,000 Liabilities Capital Bank loan Add: Int accrued but not due Trade creditors - (amount due to transport co) Assets 10,50,000 Office Building 10,00,000 Less: Depreciation 1,00,000 11,00,000 Advance to tourism departments 50,000 Deposit with electricity Co 9,50,000 2,00,000 50,000 Trade receivables Bank Cash 3,00,000 6,50,000 50,000 22,00,000 22,00,000 Cash Book for the year ended 31" December 2019 Receipt Payment Amount in Rs Amount in Rs 6,00,000 By Purchase of car To Opening Balance Rank 6,50,000 Cash 50,000 To realization from customers 20,00,000 5,00,000 7,00,000 By Payments to tourism dept 35,00,000 By Payments to railways and airlines towards cost of tickets 50,000 By Tour expenses other than package tours 70,000 By Electricity charges To Commission received from railways and airlines To Interest received on investment To Sale of investment 3,00,000 20,000 2,00,000 By Telephone charges By stationery By Salaries and wages By Insurance premium By other office expenses By Purchase of Investment By closing balance Bank Cash 45,20,000 30,000 5,000 2,45,000 10,000 50,000 6,00,000 1,10,000 50,000 45,20,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started