Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Birch Company owns a piece of equipment that cost $95,000. Currently, the equipment's book value is $43,000 and its expected remaining useful life is

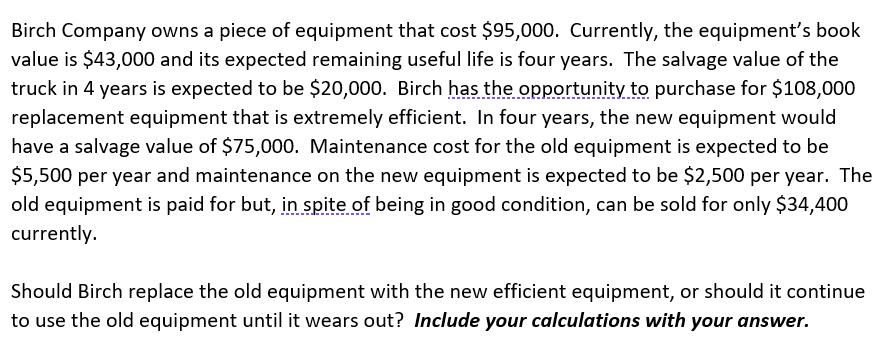

Birch Company owns a piece of equipment that cost $95,000. Currently, the equipment's book value is $43,000 and its expected remaining useful life is four years. The salvage value of the truck in 4 years is expected to be $20,000. Birch has the opportunity to purchase for $108,000 replacement equipment that is extremely efficient. In four years, the new equipment would have a salvage value of $75,000. Maintenance cost for the old equipment is expected to be $5,500 per year and maintenance on the new equipment is expected to be $2,500 per year. The old equipment is paid for but, in spite of being in good condition, can be sold for only $34,400 currently. Should Birch replace the old equipment with the new efficient equipment, or should it continue to use the old equipment until it wears out? Include your calculations with your answer. Birch Company owns a piece of equipment that cost $95,000. Currently, the equipment's book value is $43,000 and its expected remaining useful life is four years. The salvage value of the truck in 4 years is expected to be $20,000. Birch has the opportunity to purchase for $108,000 replacement equipment that is extremely efficient. In four years, the new equipment would have a salvage value of $75,000. Maintenance cost for the old equipment is expected to be $5,500 per year and maintenance on the new equipment is expected to be $2,500 per year. The old equipment is paid for but, in spite of being in good condition, can be sold for only $34,400 currently. Should Birch replace the old equipment with the new efficient equipment, or should it continue to use the old equipment until it wears out? Include your calculations with your answer. Birch Company owns a piece of equipment that cost $95,000. Currently, the equipment's book value is $43,000 and its expected remaining useful life is four years. The salvage value of the truck in 4 years is expected to be $20,000. Birch has the opportunity to purchase for $108,000 replacement equipment that is extremely efficient. In four years, the new equipment would have a salvage value of $75,000. Maintenance cost for the old equipment is expected to be $5,500 per year and maintenance on the new equipment is expected to be $2,500 per year. The old equipment is paid for but, in spite of being in good condition, can be sold for only $34,400 currently. Should Birch replace the old equipment with the new efficient equipment, or should it continue to use the old equipment until it wears out? Include your calculations with your answer. Birch Company owns a piece of equipment that cost $95,000. Currently, the equipment's book value is $43,000 and its expected remaining useful life is four years. The salvage value of the truck in 4 years is expected to be $20,000. Birch has the opportunity to purchase for $108,000 replacement equipment that is extremely efficient. In four years, the new equipment would have a salvage value of $75,000. Maintenance cost for the old equipment is expected to be $5,500 per year and maintenance on the new equipment is expected to be $2,500 per year. The old equipment is paid for but, in spite of being in good condition, can be sold for only $34,400 currently. Should Birch replace the old equipment with the new efficient equipment, or should it continue to use the old equipment until it wears out? Include your calculations with your answer. Birch Company owns a piece of equipment that cost $95,000. Currently, the equipment's book value is $43,000 and its expected remaining useful life is four years. The salvage value of the truck in 4 years is expected to be $20,000. Birch has the opportunity to purchase for $108,000 replacement equipment that is extremely efficient. In four years, the new equipment would have a salvage value of $75,000. Maintenance cost for the old equipment is expected to be $5,500 per year and maintenance on the new equipment is expected to be $2,500 per year. The old equipment is paid for but, in spite of being in good condition, can be sold for only $34,400 currently. Should Birch replace the old equipment with the new efficient equipment, or should it continue to use the old equipment until it wears out? Include your calculations with your answer. Birch Company owns a piece of equipment that cost $95,000. Currently, the equipment's book value is $43,000 and its expected remaining useful life is four years. The salvage value of the truck in 4 years is expected to be $20,000. Birch has the opportunity to purchase for $108,000 replacement equipment that is extremely efficient. In four years, the new equipment would have a salvage value of $75,000. Maintenance cost for the old equipment is expected to be $5,500 per year and maintenance on the new equipment is expected to be $2,500 per year. The old equipment is paid for but, in spite of being in good condition, can be sold for only $34,400 currently. Should Birch replace the old equipment with the new efficient equipment, or should it continue to use the old equipment until it wears out? Include your calculations with your answer. Birch Company owns a piece of equipment that cost $95,000. Currently, the equipment's book value is $43,000 and its expected remaining useful life is four years. The salvage value of the truck in 4 years is expected to be $20,000. Birch has the opportunity to purchase for $108,000 replacement equipment that is extremely efficient. In four years, the new equipment would have a salvage value of $75,000. Maintenance cost for the old equipment is expected to be $5,500 per year and maintenance on the new equipment is expected to be $2,500 per year. The old equipment is paid for but, in spite of being in good condition, can be sold for only $34,400 currently. Should Birch replace the old equipment with the new efficient equipment, or should it continue to use the old equipment until it wears out? Include your calculations with your answer.

Step by Step Solution

★★★★★

3.48 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

Answer It should continue with the old equipment as new equipment leads to disadv...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started