Answered step by step

Verified Expert Solution

Question

1 Approved Answer

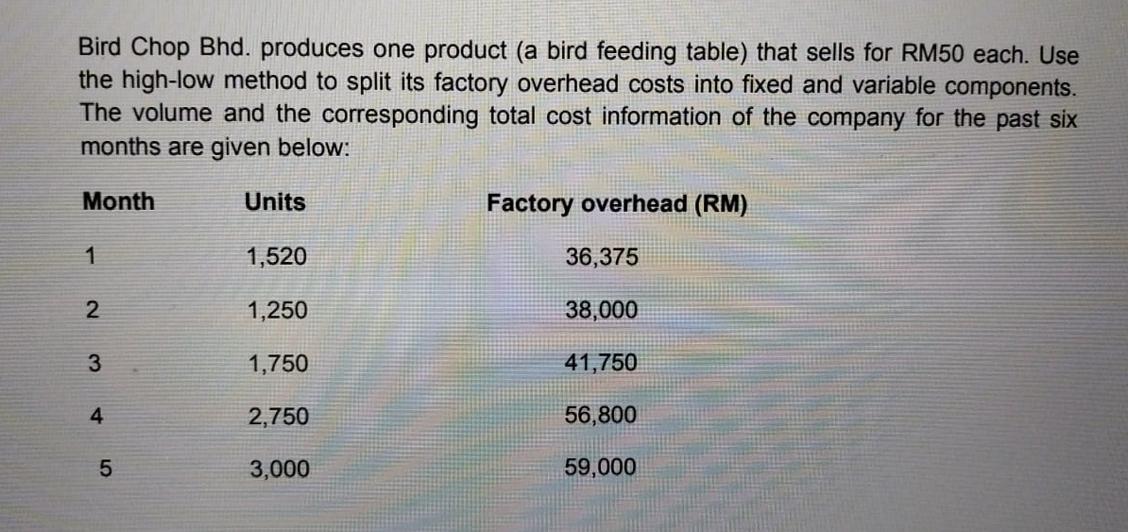

Bird Chop Bhd. produces one product (a bird feeding table) that sells for RM50 each. Use the high-low method to split its factory overhead

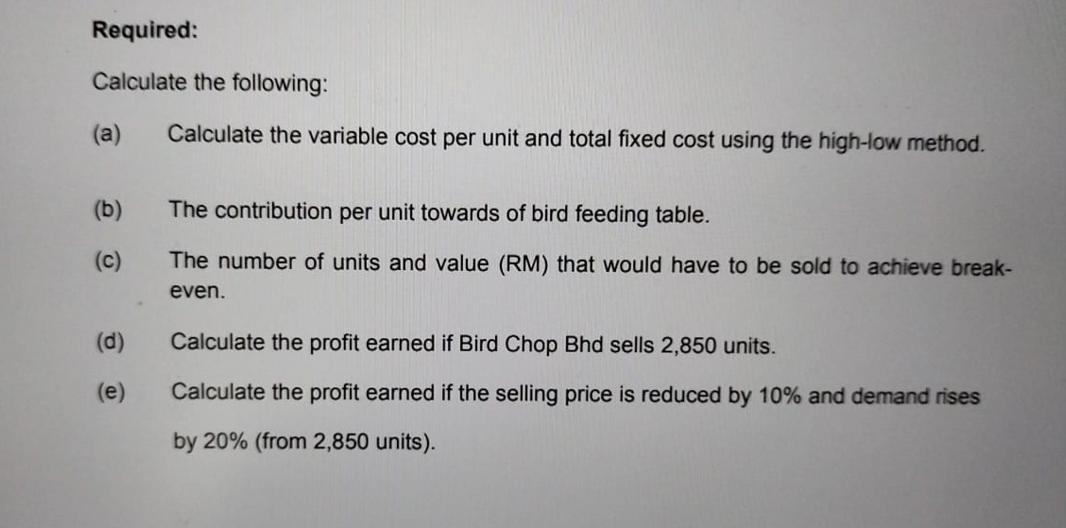

Bird Chop Bhd. produces one product (a bird feeding table) that sells for RM50 each. Use the high-low method to split its factory overhead costs into fixed and variable components. The volume and the corresponding total cost information of the company for the past six months are given below: Month 1 2 3 4 5 Units 1,520 1,250 1,750 2,750 3,000 Factory overhead (RM) 36,375 38,000 41,750 56,800 59,000 Required: Calculate the following: (a) Calculate the variable cost per unit and total fixed cost using the high-low method. (b) (c) (d) (e) The contribution per unit towards of bird feeding table. The number of units and value (RM) that would have to be sold to achieve break- even. Calculate the profit earned if Bird Chop Bhd sells 2,850 units. Calculate the profit earned if the selling price is reduced by 10% and demand rises by 20% (from 2,850 units).

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Lets use the highlow method to calculate the variable cost per unit and total fixed cost a Calculate the variable cost per unit and total fixed cost S...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started