Answered step by step

Verified Expert Solution

Question

1 Approved Answer

xbas y1,2 mber Owin bjec bje b. 12. In 2022, Mr. Francis, a dealer of car, disposed a brand new sports utility vehicle (SUV)

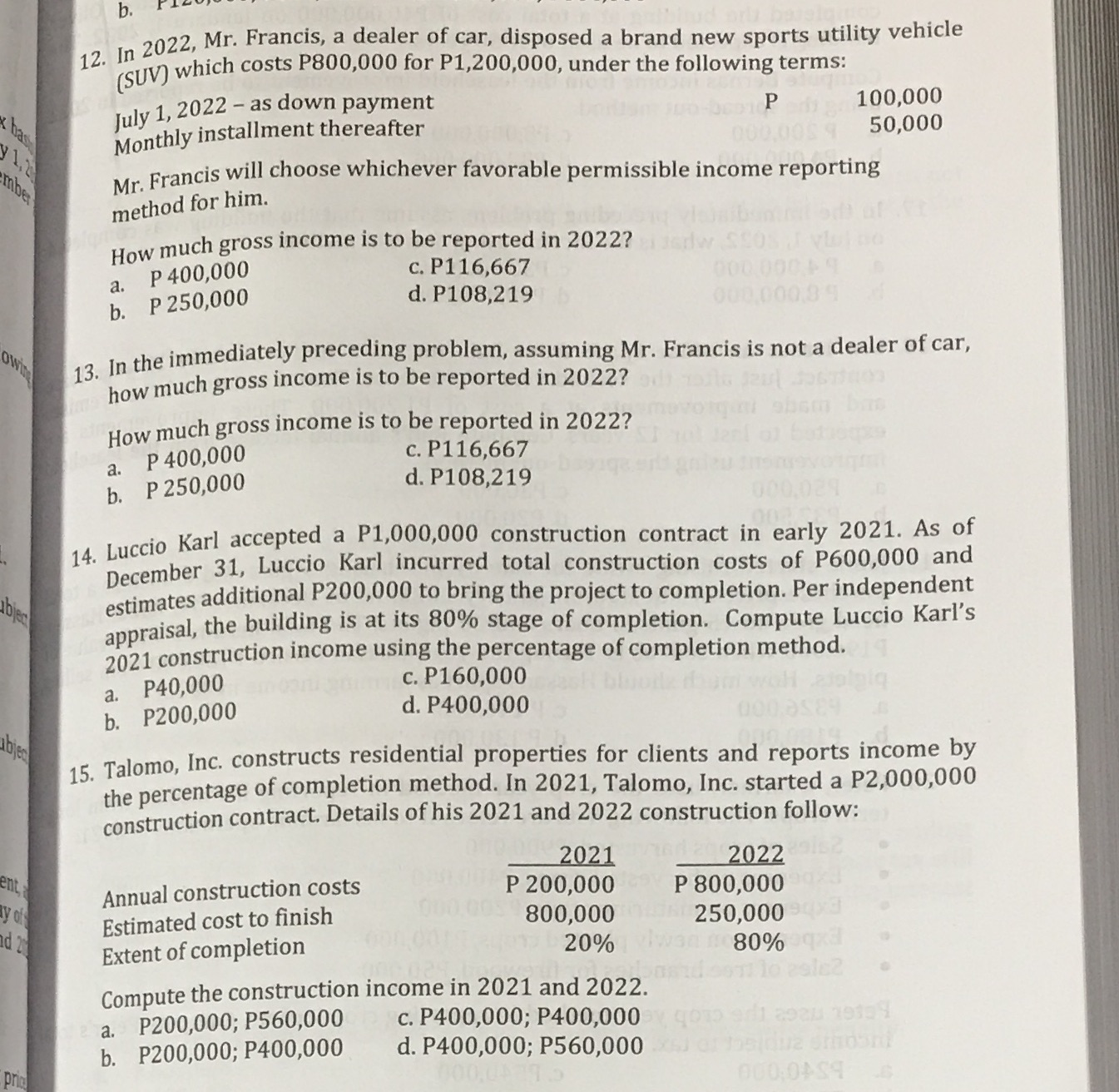

xbas y1,2 mber Owin bjec bje b. 12. In 2022, Mr. Francis, a dealer of car, disposed a brand new sports utility vehicle (SUV) which costs P800,000 for P1,200,000, under the following terms: July 1, 2022 - as down payment Monthly installment thereafter 100,000 50,000 Mr. Francis will choose whichever favorable permissible income reporting method for him. How much gross income is to be reported in 2022? a. P 400,000 b. P 250,000 c. P116,667 d. P108,219 000.000+9 000,000,89 13. In the immediately preceding problem, assuming Mr. Francis is not a dealer of car, how much gross income is to be reported in 2022? How much gross income is to be reported in 2022? a. P 400,000 b. P 250,000 c. P116,667 d. P108,219 bas 14. Luccio Karl accepted a P1,000,000 construction contract in early 2021. As of December 31, Luccio Karl incurred total construction costs of P600,000 and estimates additional P200,000 to bring the project to completion. Per independent appraisal, the building is at its 80% stage of completion. Compute Luccio Karl's 2021 construction income using the percentage of completion method. a. P40,000 b. P200,000 c. P160,000 d. P400,000 000.0819 15. Talomo, Inc. constructs residential properties for clients and reports income by the percentage of completion method. In 2021, Talomo, Inc. started a P2,000,000 construction contract. Details of his 2021 and 2022 construction follow: ent y of Estimated cost to finish Annual construction costs nd 2 Extent of completion 2021 P 200,000 800,000 20% 202022 P 800,000 250,000 80% b. P200,000; P400,000 a. P200,000; P560,000 Compute the construction income in 2021 and 2022. c. P400,000; P400,000 d. P400,000; P560,000 000,0+$9 pri

Step by Step Solution

There are 3 Steps involved in it

Step: 1

12 To determine the gross income to be reported in 2022 we need to calculate the gain on the sale of ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started