Answered step by step

Verified Expert Solution

Question

1 Approved Answer

BK2U is a mobile bike service that services and repairs bikes at customers' homes. It is geared to bicyclists who have invested in expensive

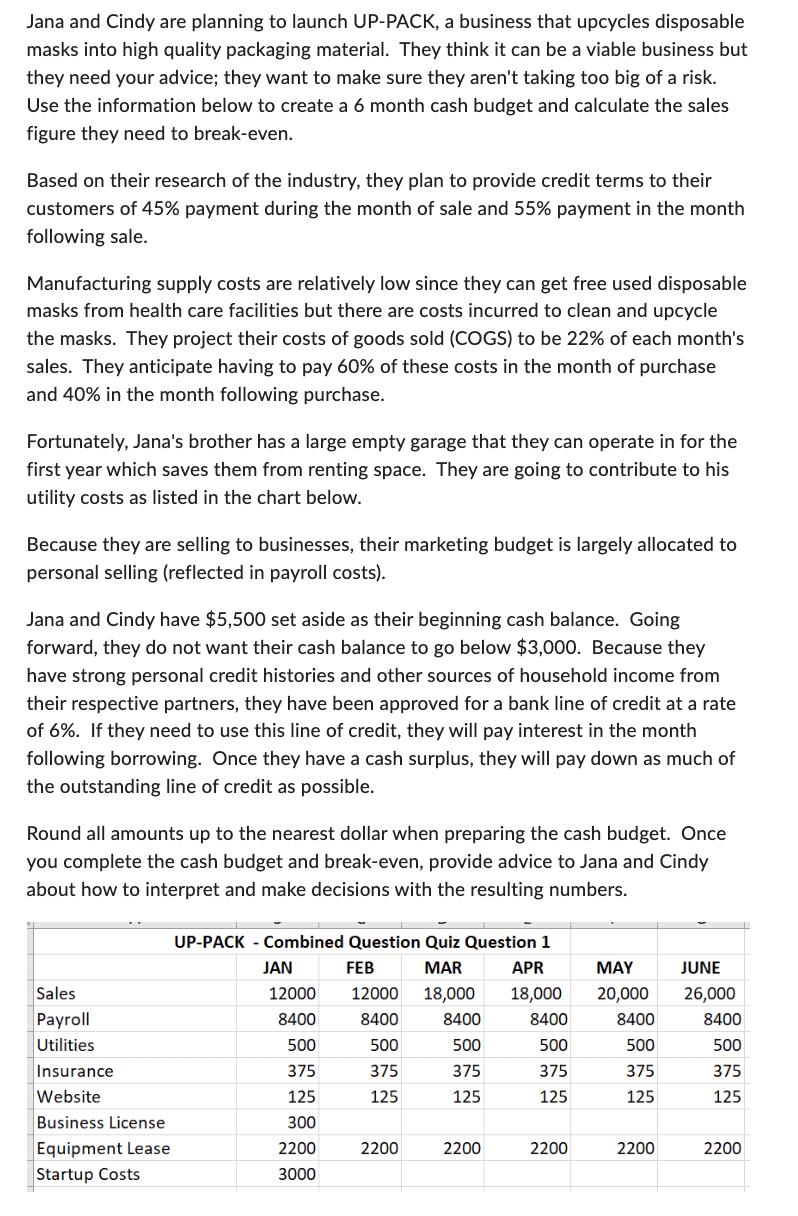

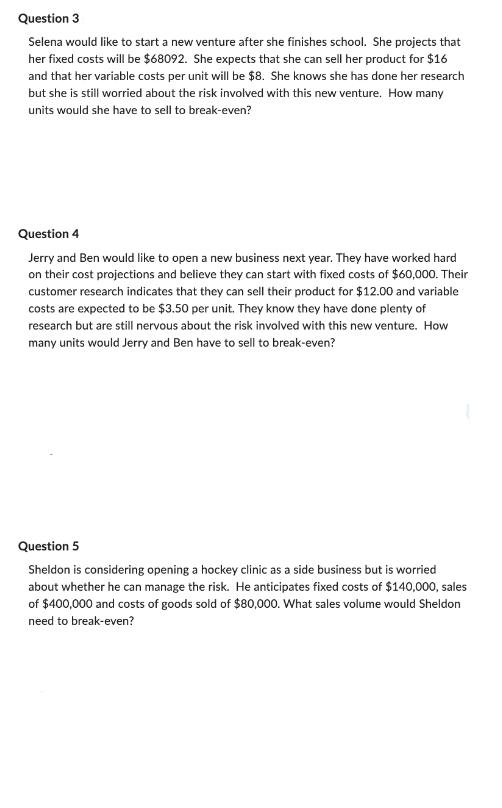

BK2U is a mobile bike service that services and repairs bikes at customers' homes. It is geared to bicyclists who have invested in expensive bikes and are willing to pay for the convenience of a mobile service. The company is planning to launch the product in Toronto and the surrounding Greater Toronto suburbs. a) List at least five data points you would use to create a top-down forecast (you do not need to do any calculations - focus instead on the process and logic). b) Specify what constraints and data points you would use to create a bottom-up forecast. Jana and Cindy are planning to launch UP-PACK, a business that upcycles disposable masks into high quality packaging material. They think it can be a viable business but they need your advice; they want to make sure they aren't taking too big of a risk. Use the information below to create a 6 month cash budget and calculate the sales figure they need to break-even. Based on their research of the industry, they plan to provide credit terms to their customers of 45% payment during the month of sale and 55% payment in the month following sale. Manufacturing supply costs are relatively low since they can get free used disposable masks from health care facilities but there are costs incurred to clean and upcycle the masks. They project their costs of goods sold (COGS) to be 22% of each month's sales. They anticipate having to pay 60% of these costs in the month of purchase and 40% in the month following purchase. Fortunately, Jana's brother has a large empty garage that they can operate in for the first year which saves them from renting space. They are going to contribute to his utility costs as listed in the chart below. Because they are selling to businesses, their marketing budget is largely allocated to personal selling (reflected in payroll costs). Jana and Cindy have $5,500 set aside as their beginning cash balance. Going forward, they do not want their cash balance to go below $3,000. Because they have strong personal credit histories and other sources of household income from their respective partners, they have been approved for a bank line of credit at a rate of 6%. If they need to use this line of credit, they will pay interest in the month following borrowing. Once they have a cash surplus, they will pay down as much of the outstanding line of credit as possible. Round all amounts up to the nearest dollar when preparing the cash budget. Once you complete the cash budget and break-even, provide advice to Jana and Cindy about how to interpret and make decisions with the resulting numbers. Sales Payroll Utilities Insurance Website Business License Equipment Lease Startup Costs UP-PACK - Combined Question Quiz Question 1 MAR JAN 12000 8400 500 375 125 300 2200 3000 FEB 12000 18,000 8400 8400 500 375 125 500 375 125 2200 2200 APR 18,000 8400 500 375 125 2200 MAY 20,000 8400 500 375 125 2200 JUNE 26,000 8400 500 375 125 2200 Question 3 Selena would like to start a new venture after she finishes school. She projects that her fixed costs will be $68092. She expects that she can sell her product for $16 and that her variable costs per unit will be $8. She knows she has done her research but she is still worried about the risk involved with this new venture. How many units would she have to sell to break-even? Question 4 Jerry and Ben would like to open a new business next year. They have worked hard on their cost projections and believe they can start with fixed costs of $60,000. Their customer research indicates that they can sell their product for $12.00 and variable costs are expected to be $3.50 per unit. They know they have done plenty of research but are still nervous about the risk involved with this new venture. How many units would Jerry and Ben have to sell to break-even? Question 5 Sheldon is considering opening a hockey clinic as a side business but is worried about whether he can manage the risk. He anticipates fixed costs of $140,000, sales of $400,000 and costs of goods sold of $80,000. What sales volume would Sheldon need to break-even?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Budget for Upcycling Business Jana and Cindy are planning to launch UPPACK a business that upcycles disposable masks into high quality packaging material They think it can be a viable business but the...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started