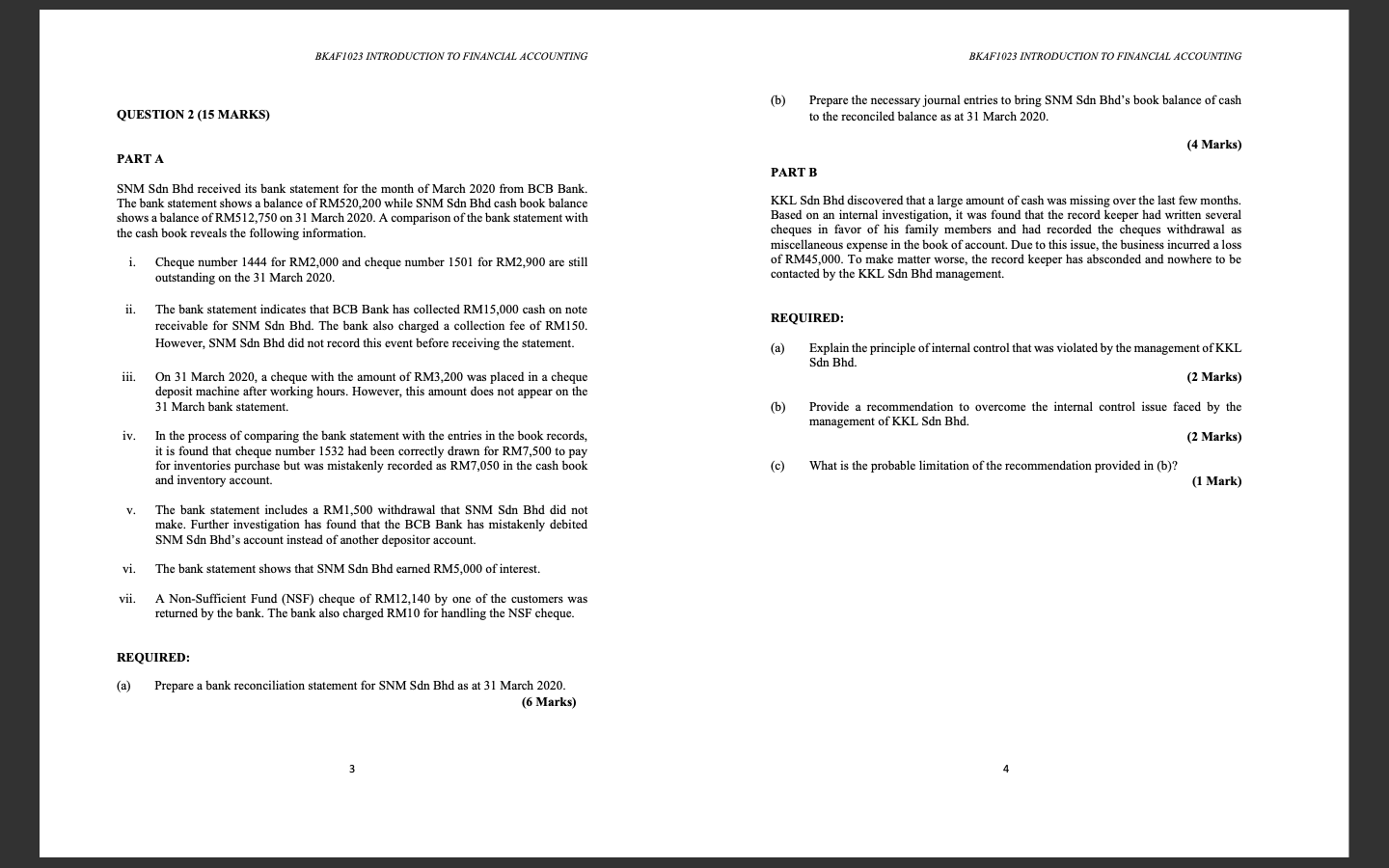

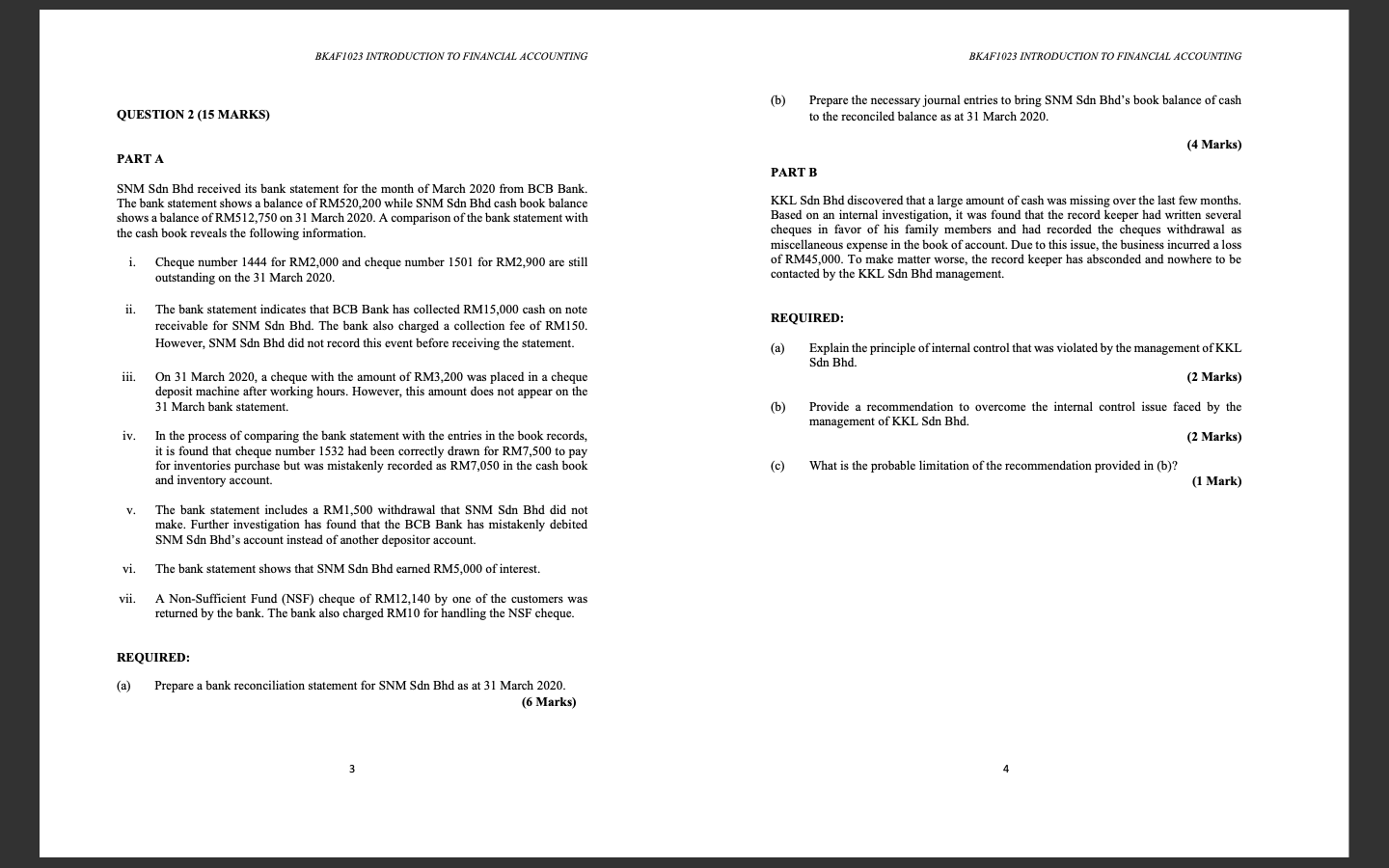

BKAF1023 INTRODUCTION TO FINANCIAL ACCOUNTING BKAF1023 INTRODUCTION TO FINANCIAL ACCOUNTING (b) QUESTION 2 (15 MARKS) Prepare the necessary journal entries to bring SNM Sdn Bhd's book balance of cash to the reconciled balance as at 31 March 2020. (4 Marks) PART A PART B SNM Sdn Bhd received its bank statement for the month of March 2020 from BCB Bank. The bank statement shows a balance of RM520,200 while SNM Sdn Bhd cash book balance shows a balance of RM512,750 on 31 March 2020. A comparison of the bank statement with the cash book reveals the following information. KKL Sdn Bhd discovered that a large amount of cash was missing over the last few months. Based on an internal investigation, it was found that the record keeper had written several cheques in favor of his family members and had recorded the cheques withdrawal as miscellaneous expense in the book of account. Due to this issue, the business incurred a loss of RM45,000. To make matter worse, the record keeper has absconded and nowhere to be contacted by the KKL Sdn Bhd management. i. Cheque number 1444 for RM2,000 and cheque number 1501 for RM2,900 are still outstanding on the 31 March 2020. ii. REQUIRED: The bank statement indicates that BCB Bank has collected RM15,000 cash on note receivable for SNM Sdn Bhd. The bank also charged a collection fee of RM150. However, SNM Sdn Bhd did not record this event before receiving the statement. (a) Explain the principle of internal control that was violated by the management of KKL Sdn Bhd. (2 Marks) iii. On 31 March 2020, a cheque with the amount of RM3,200 was placed in a cheque deposit machine after working hours. However, this amount does not appear on the 31 March bank statement. (b) Provide a recommendation to overcome the internal control issue faced by the management of KKL Sdn Bhd. (2 Marks) iv. In the process of comparing the bank statement with the entries in the book records, it is found that cheque number 1532 had been correctly drawn for RM7,500 to pay for inventories purchase but was mistakenly recorded as RM7,050 in the cash book and inventory account. What is the probable limitation of the recommendation provided in (b)? (1 Mark) V. The bank statement includes a RM1,500 withdrawal that SNM Sdn Bhd did not make. Further investigation has found that the BCB Bank has mistakenly debited SNM Sdn Bhd's account instead of another depositor account. vi. The bank statement shows that SNM Sdn Bhd earned RM5,000 of interest. vii. A Non-Sufficient Fund (NSF) cheque of RM12,140 by one of the customers was returned by the bank. The bank also charged RM10 for handling the NSF cheque. REQUIRED: Prepare a bank reconciliation statement for SNM Sdn Bhd as at 31 March 2020. (6 Marks)