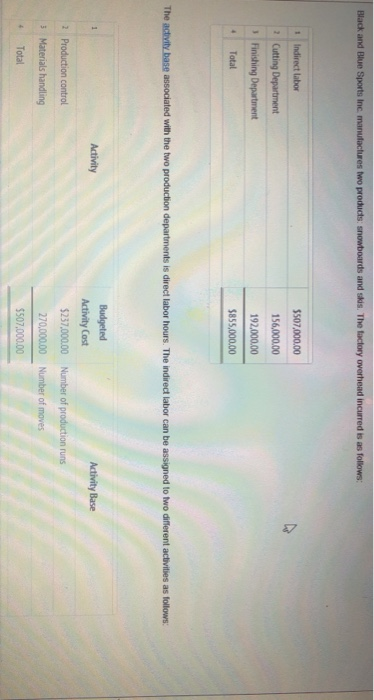

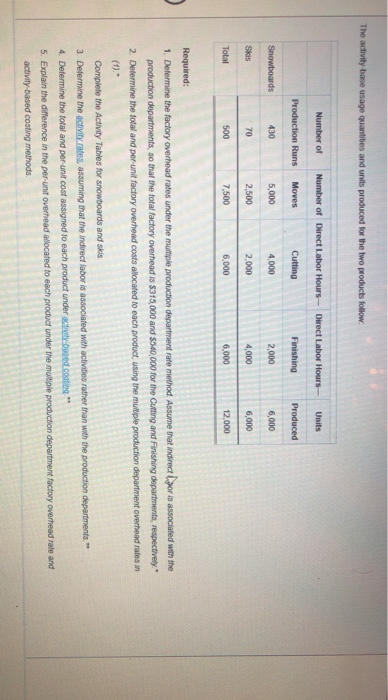

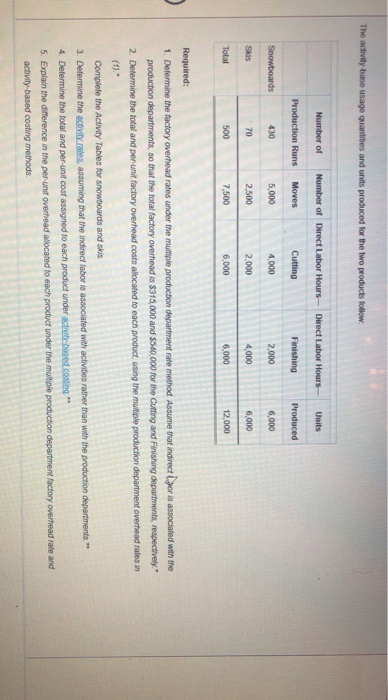

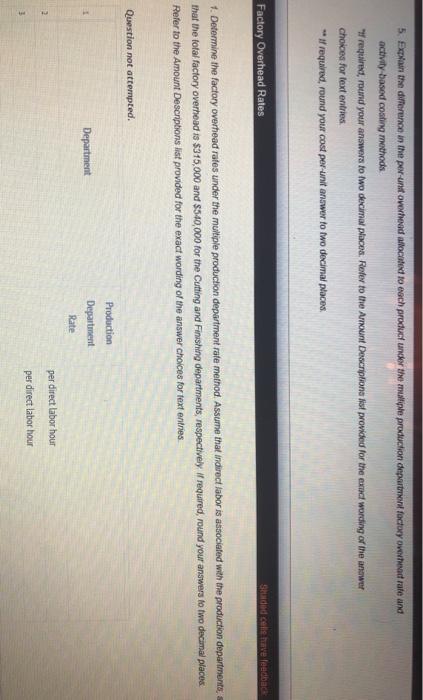

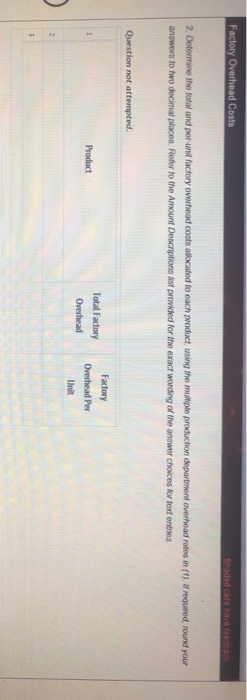

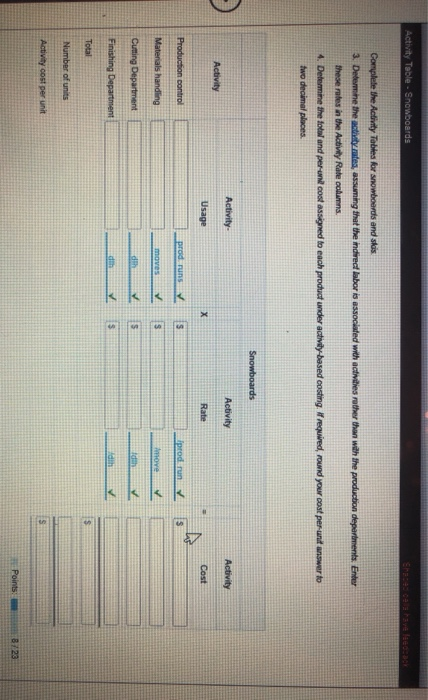

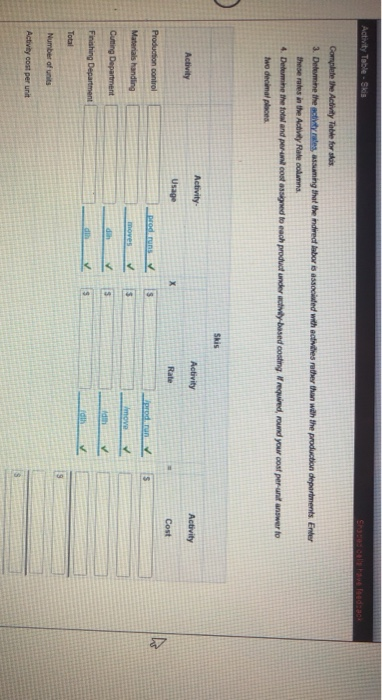

Black and Blue Sports Inc. manufactures two products: snowboards and skis. The factory overhead incurred is as follows: 1 Indirect labor 5507,000.00 2 Cutting Department 156,000.00 Finishing Department 192,000,00 Total $855,000.00 The activity base associated with the two production departments is direct labor hours. The indirect labor can be assigned to two different activities as follows: Activity Budgeted Activity Cost Activity Base 2 Production control $237.000,00 Number of production runs 3 Materials handling 270,000.00 Number of moves Total $507,000.00 The activity base usage quantities and units produced for the two products follow Number of Number of Direct Labor Hours - Direct Labor Hours- Units Production Runs Moves Cutting Finishing Produced Snowboards 430 5,000 4000 2,000 6.000 2,500 2.000 4,000 6,000 Total 500 7.500 6,000 6.000 12.000 Required: 1. Determine the factory overhead rates under the multiple production department rate method. Assume that indirector is associated with the production departments, so that the total factory overhead is $315,000 and $500,000 for the Cutting and Finishing departments, respectively 2. Determine the total and per-unit factory overhead coats allocated to each product, using the multiple production department overhead rates in " Complete the Activity Tables for snowboards and skis 3. Determine the activity rates, assuming that the Indirector is associated with activities rather than with the production departments** 4. Determine the foal and per-unit cost assigned to each product under l ed cost 5. Explain the difference in the per unit overhead allocated to each product under the multiple production department factory overhead rate and activity-based costing methods The activity base usage quantities and units produced for the two products follow Number of Number of Direct Labor Hours - Direct Labor Hours- Units Production Runs Moves Cutting Finishing Produced Snowboards 430 5,000 4000 2.000 6.000 2,500 2.000 4,000 6,000 Total 500 7.500 6,000 6.000 12.000 Required: 1. Determine the factory overhead rates under the multiple production department rate method. Assume that indirector is associated with the production departments so that the total factory overhead is $315,000 and $500,000 for the Cutting and Finishing departments, respectively." 2. Determine the total and perunt factory overhead costs allocated to each product, using the multiple production department overhead rates in Complete the Activity Tables for snowboards and skis 3. Determine the activitats assuming that the indirect laboris cated with activities rather than with the production departments** 4. Determine the total and per-unit cost assigned to each product under h e d cost 5. Explain the difference in the per unit overhead allocated to each product under the multiple production department factory overhead rate and activity-based costing methods 5. Expon the difference in the per unifovahend allocated to each product under the multiple production department factory owerhead rate and activity-based costing methods. "Wrequired, round your answers to two decimal places. Refer to the Amount Descriptions is provided for the exact wording of the answer choices for text entries. *If required, round your cost per-unit answer to two decimal places Factory Overhead Rates Shaded cells have feedback 1. Determine the factory overhead rates under the multiple production department rate method. Assume that indirect labor is associated with the production departments, that the total factory overhead is $315,000 and $540,000 for the Cutting and Finishing departments, respectively. If required, round your answers to two decimal places. Refer to the Amount Descriptions list provided for the exact wording of the answer choices for text entries. Question not attempted. Production Department Department Rate per direct labor hour per direct labor hour Factory Overhead Costs Sradd c ave et 2. Determine the total and per un factory overhead coats allocated to each product, using the multiple production department overhead roles in (1). If required, round your answers to two decimal places. Refer to the Amount Descriptions is provided for the exact wording of the answer choices for text entries Question not attempted. Factory Overhead Per Total Factory Overhead Product Unit Activity Table - Snowboards Complete the Activity Tables for snowboards and skis 3. Determine the activity mates, assuming that the indirect laboris associated with activities rather than with the production departments Enter these rates in the Activity Rate columns 4. Determine the folland per-ww.cost assigned to each product under activity-based costing. If required, round your cost per unit answer to two decimal places Snowboards Activity Activity Activity Usage Production control prod runs Materials handling Cutting Department Finishing Departhen Total Number of units Activity cost per unit Activity Table - Sk e bor e d with the other than with the production departments Enter Complete the Activity Table for skis D e t There in the Activity Rule D e the co two decimal places s d ech product under based costing round you could er Activity Activity Activity Activity Rate Cost Production control Material handling CD Fishing Departe Number of its Activity cost per unit Black and Blue Sports Inc. manufactures two products: snowboards and skis. The factory overhead incurred is as follows: 1 Indirect labor 5507,000.00 2 Cutting Department 156,000.00 Finishing Department 192,000,00 Total $855,000.00 The activity base associated with the two production departments is direct labor hours. The indirect labor can be assigned to two different activities as follows: Activity Budgeted Activity Cost Activity Base 2 Production control $237.000,00 Number of production runs 3 Materials handling 270,000.00 Number of moves Total $507,000.00 The activity base usage quantities and units produced for the two products follow Number of Number of Direct Labor Hours - Direct Labor Hours- Units Production Runs Moves Cutting Finishing Produced Snowboards 430 5,000 4000 2,000 6.000 2,500 2.000 4,000 6,000 Total 500 7.500 6,000 6.000 12.000 Required: 1. Determine the factory overhead rates under the multiple production department rate method. Assume that indirector is associated with the production departments, so that the total factory overhead is $315,000 and $500,000 for the Cutting and Finishing departments, respectively 2. Determine the total and per-unit factory overhead coats allocated to each product, using the multiple production department overhead rates in " Complete the Activity Tables for snowboards and skis 3. Determine the activity rates, assuming that the Indirector is associated with activities rather than with the production departments** 4. Determine the foal and per-unit cost assigned to each product under l ed cost 5. Explain the difference in the per unit overhead allocated to each product under the multiple production department factory overhead rate and activity-based costing methods The activity base usage quantities and units produced for the two products follow Number of Number of Direct Labor Hours - Direct Labor Hours- Units Production Runs Moves Cutting Finishing Produced Snowboards 430 5,000 4000 2.000 6.000 2,500 2.000 4,000 6,000 Total 500 7.500 6,000 6.000 12.000 Required: 1. Determine the factory overhead rates under the multiple production department rate method. Assume that indirector is associated with the production departments so that the total factory overhead is $315,000 and $500,000 for the Cutting and Finishing departments, respectively." 2. Determine the total and perunt factory overhead costs allocated to each product, using the multiple production department overhead rates in Complete the Activity Tables for snowboards and skis 3. Determine the activitats assuming that the indirect laboris cated with activities rather than with the production departments** 4. Determine the total and per-unit cost assigned to each product under h e d cost 5. Explain the difference in the per unit overhead allocated to each product under the multiple production department factory overhead rate and activity-based costing methods 5. Expon the difference in the per unifovahend allocated to each product under the multiple production department factory owerhead rate and activity-based costing methods. "Wrequired, round your answers to two decimal places. Refer to the Amount Descriptions is provided for the exact wording of the answer choices for text entries. *If required, round your cost per-unit answer to two decimal places Factory Overhead Rates Shaded cells have feedback 1. Determine the factory overhead rates under the multiple production department rate method. Assume that indirect labor is associated with the production departments, that the total factory overhead is $315,000 and $540,000 for the Cutting and Finishing departments, respectively. If required, round your answers to two decimal places. Refer to the Amount Descriptions list provided for the exact wording of the answer choices for text entries. Question not attempted. Production Department Department Rate per direct labor hour per direct labor hour Factory Overhead Costs Sradd c ave et 2. Determine the total and per un factory overhead coats allocated to each product, using the multiple production department overhead roles in (1). If required, round your answers to two decimal places. Refer to the Amount Descriptions is provided for the exact wording of the answer choices for text entries Question not attempted. Factory Overhead Per Total Factory Overhead Product Unit Activity Table - Snowboards Complete the Activity Tables for snowboards and skis 3. Determine the activity mates, assuming that the indirect laboris associated with activities rather than with the production departments Enter these rates in the Activity Rate columns 4. Determine the folland per-ww.cost assigned to each product under activity-based costing. If required, round your cost per unit answer to two decimal places Snowboards Activity Activity Activity Usage Production control prod runs Materials handling Cutting Department Finishing Departhen Total Number of units Activity cost per unit Activity Table - Sk e bor e d with the other than with the production departments Enter Complete the Activity Table for skis D e t There in the Activity Rule D e the co two decimal places s d ech product under based costing round you could er Activity Activity Activity Activity Rate Cost Production control Material handling CD Fishing Departe Number of its Activity cost per unit