Question

Black Co. acquired 100% of Blue, Inc. on January 2023. On that date, Blue had land with a book value of $38,000 and a

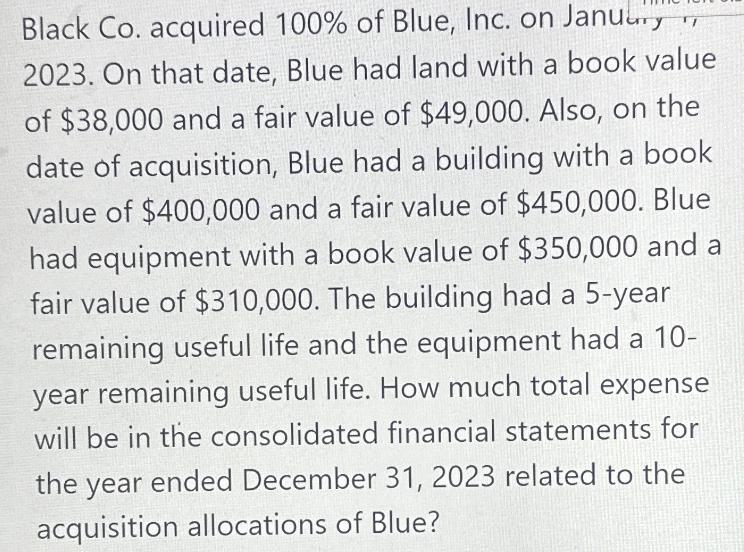

Black Co. acquired 100% of Blue, Inc. on January 2023. On that date, Blue had land with a book value of $38,000 and a fair value of $49,000. Also, on the date of acquisition, Blue had a building with a book value of $400,000 and a fair value of $450,000. Blue had equipment with a book value of $350,000 and a fair value of $310,000. The building had a 5-year remaining useful life and the equipment had a 10- year remaining useful life. How much total expense will be in the consolidated financial statements for the year ended December 31, 2023 related to the acquisition allocations of Blue?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To determine the total expense related to the acquisition allocations of Blue we need to consider th...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Intermediate Accounting

Authors: J. David Spiceland, James Sepe, Mark Nelson

6th edition

978-0077328894, 71313974, 9780077395810, 77328892, 9780071313971, 77395816, 978-0077400163

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App