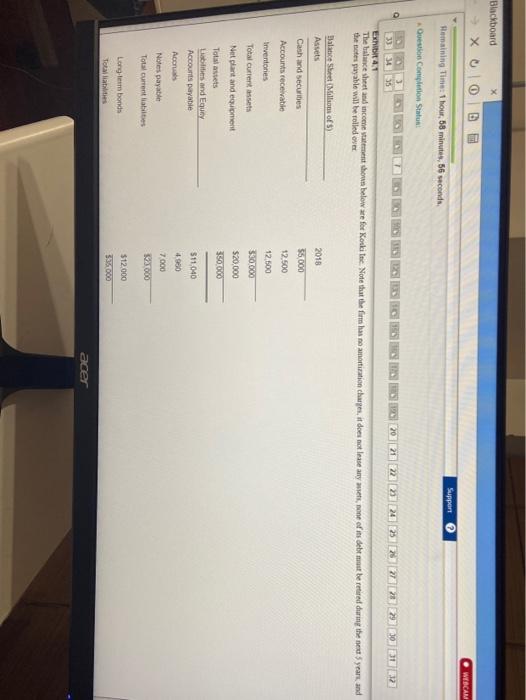

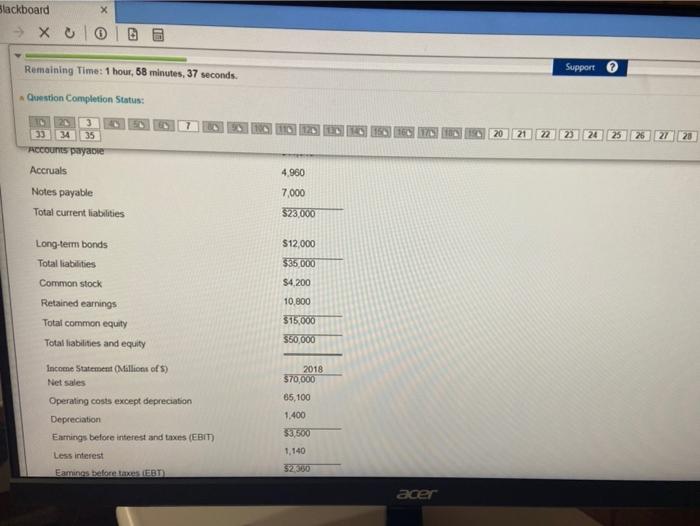

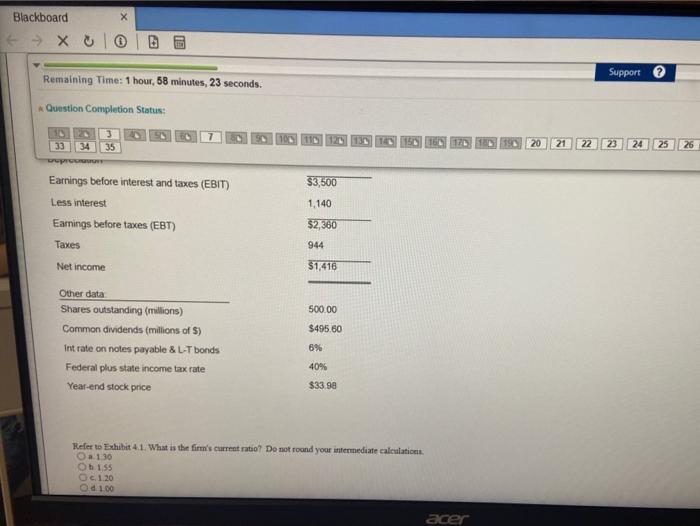

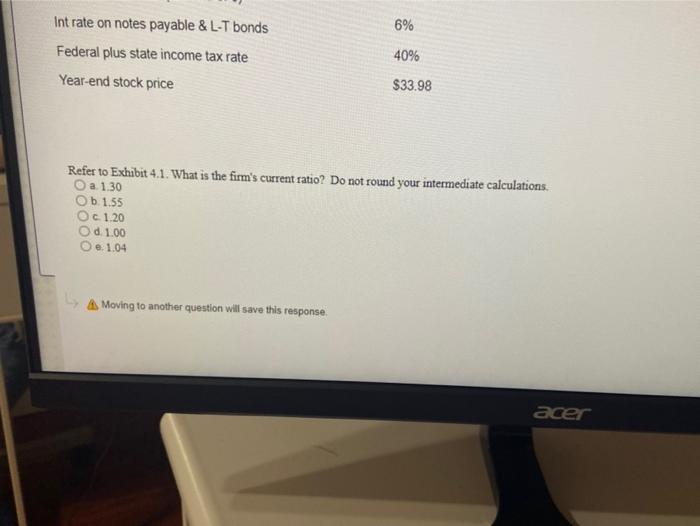

Blackboard xo WEBCAM Hemaining Time: 1 hour, 58 minutes, 55 .conds Support Questions Comption Status 1300 133 134 135 EX 1 The balance sheet and incentie statement shown below are for Korki tee. Note that the firm has no anotturation charge, it does not lease any meets, none of its debt muuan be retired during the next 5 years, and be rolled over Balance Sheet (Mallomos) Assets 2018 $5.000 12.500 12.500 Cash and Securities Accounts receivable Inventories Total current assets Net plant and equipment Total stets Liabilities and Equy Accounts payable Acon Notes payable Total current liabilities $20.000 3507000 $11.040 4950 7.000 3000 Long term bonds Totallaties $12.000 3351000 acer Slackboard x & lo Remaining Time: 1 hour, 58 minutes, 37 seconds. Support Question Completion Status: 020 121 22 23 24 25 26 27 28 20 3 33 34 35 Accounts payable Accruals Notes payable Total current liabilities 4,960 7.000 $23.000 $12,000 $35 000 $4,200 Long-term bonds Total liabilities Common stock Retained earnings Total common equity Total liabilities and equity 10.800 $15.000 $50 000 2018 $70,000 85,100 Income Statement (Millions of S) Net sales Operating costs except depreciation Depreciation Earrings before interest and taxes (EBIT) Less interest Eamings before taxes (EBT) 1.400 $3,500 1.140 52350 acer Blackboard Xo Support Remaining Time: 1 hour, 58 minutes, 23 seconds. Question Completion Status: 10 33 3 35 34 150 OTTO 20 21 22 23 24 25 26 $3,500 Earnings before interest and taxes (EBIT) Less interest Earnings before taxes (EBT) 1.140 $2,360 Taxes 944 Net income $1,416 500.00 $495.60 Other data Shares outstanding (millions) Common dividends (millions of S) Intrate on notes payable & L-T bonds Federal plus state income tax rate Year-end stock price 6% 40% $33.98 Refer to Exhibit 41. What is the firm's current ratio? Do not round your intermediate calculation O 130 Ob 1.55 c. 1.20 Od 1.00 acer 6% Intrate on notes payable & L-T bonds Federal plus state income tax rate Year-end stock price 40% $33.98 Refer to Exhibit 4.1. What is the firm's current ratio? Do not round your intermediate calculations. O a. 1.30 O b. 1.55 Oc1.20 Od 1.00 Oe. 1.04 A Moving to another question will save this response acer