Answered step by step

Verified Expert Solution

Question

1 Approved Answer

blackboard.towson.edu / ultra / calendar / assessment / _ 1 1 4 8 1 4 0 1 _ 1 / overview / attempt / _

blackboard.towson.eduultracalendarassessmentoverviewattempt

minutes remaining

OF QUESTIONS REMAINING

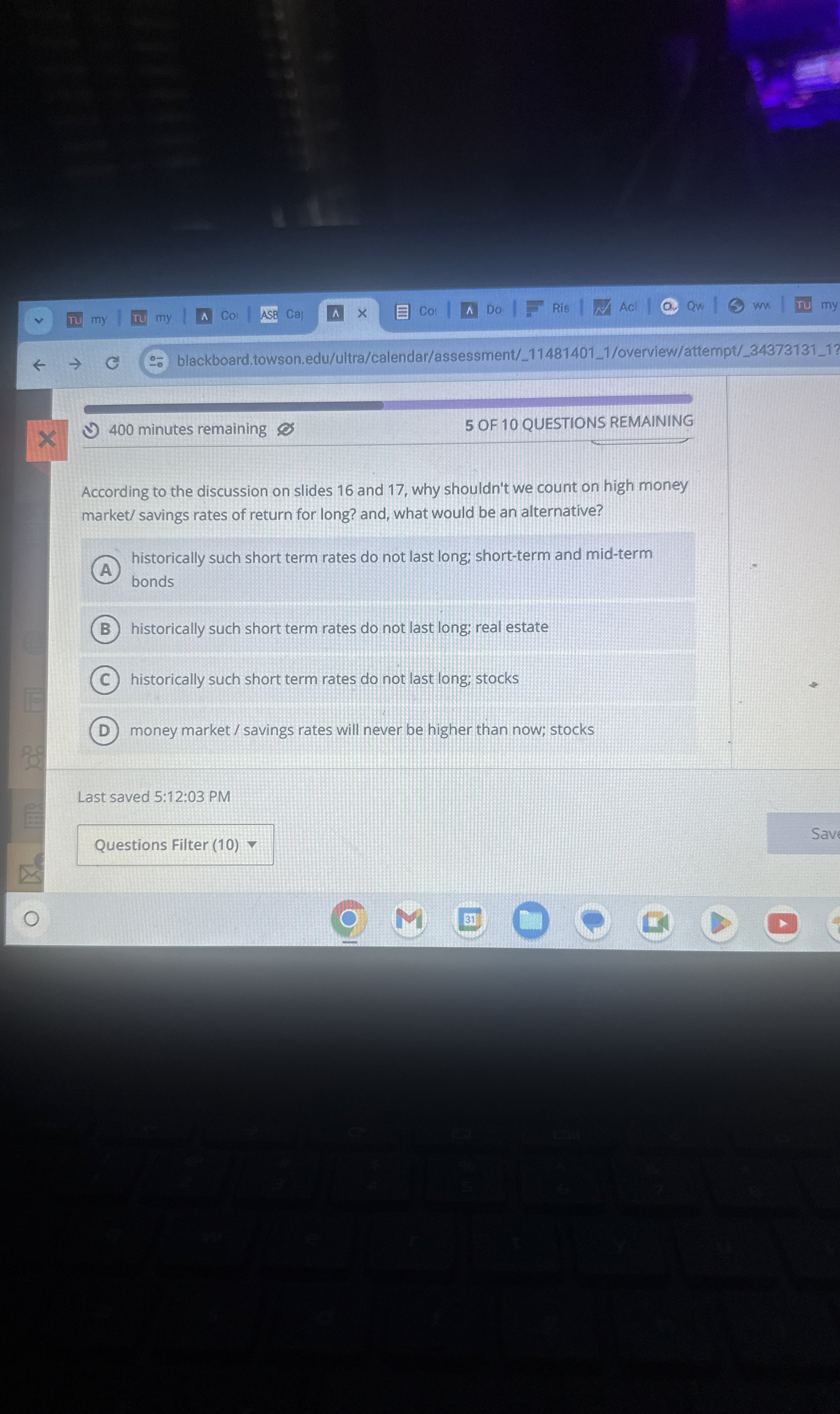

According to the discussion on slides and why shouldn't we count on high money market savings rates of return for long? and, what would be an alternative?

historically such short term rates do not last long; shortterm and midterm bonds

historically such short term rates do not last long; real estate

historically such short term rates do not last long; stocks

money market savings rates will never be higher than now; stocks

Last saved :: PM

Questions Filter

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started