Answered step by step

Verified Expert Solution

Question

1 Approved Answer

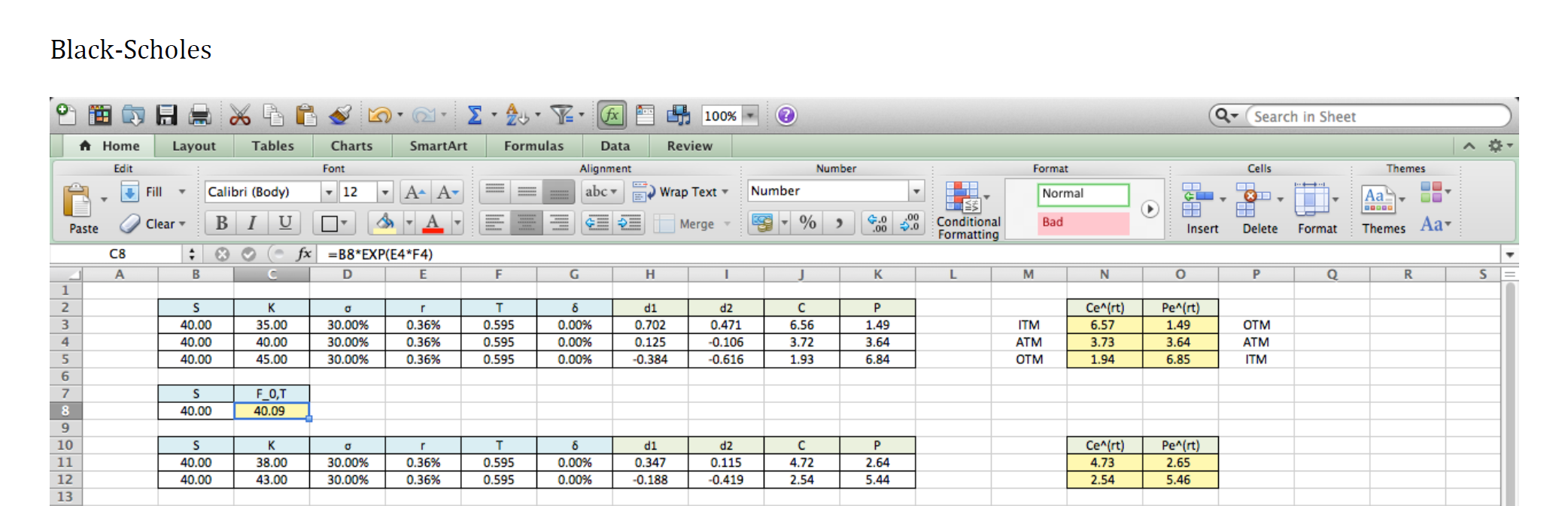

Black-Scholes 1. C8: Provide a formula for the forward price based on the stock price S, the risk-free rate r and the time to expiration

Black-Scholes

1. C8: Provide a formula for the forward price based on the stock price S, the risk-free rate r and the time to expiration T.

2. Columns N, O: Provide formulas for the future value (at expiration) value of the option premiums using the BlackScholes option prices C(K,T) and P(K,T), the risk free rate r and the time to expiration T.

Black-Scholes 2.45-Y 100% Q- Search in Sheet Home Layout Tables Charts SmartArt Formulas Data Review Edit Font Number Format Cells Themes Alignment abc Fill Calibri (Body) 12 A A Wrap Text Number Normal XD Aa Clear B 1 U Les % Merge 4.0 .00 .00 >.0 Paste Bad Conditional Formatting Insert Delete Format Aa Themes C8 fx =B8*EXP(E4F4) E B C F H 1 J K L M N O Q R S d1 OTM S 40.00 40.00 40.00 35.00 40.00 45.00 0 30.00% 30.00% 30.00% r 0.36% 0.36% 0.36% T 0.595 0.595 0.595 6 0.00% 0.00% 0.00% 0.702 0.125 -0.384 d2 0.471 -0.106 -0.616 6.56 3.72 1.93 P 1.49 3.64 6.84 ITM ATM OTM Ce^irt) 6.57 3.73 1.94 Pert) 1.49 3.64 6.85 ATM ITM S 40.00 F_O,T 40.09 7 8 9 10 11 12 13 r S 40.00 40.00 38.00 43.00 30.00% 30.00% 0.36% 0.36% T 0.595 0.595 6 0.00% 0.00% d1 0.347 -0.188 d2 0.115 -0.419 4.72 2.54 P 2.64 5.44 Ce^(rt) 4.73 2.54 Pe^(rt) 2.65 5.46Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started