Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Blackstone, the nation's largest real estate private equity firm, is deciding whether it should buy an office building in downtown San Francisco. Blackstone makes

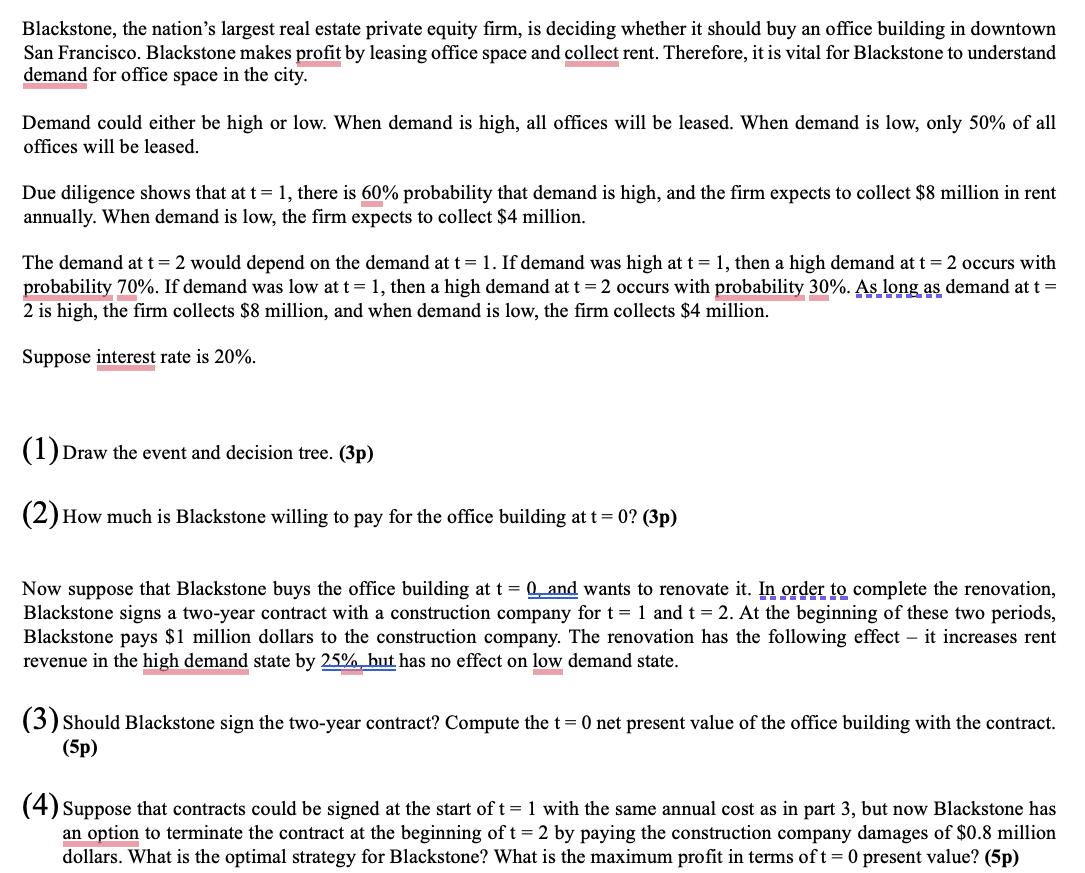

Blackstone, the nation's largest real estate private equity firm, is deciding whether it should buy an office building in downtown San Francisco. Blackstone makes profit by leasing office space and collect rent. Therefore, it is vital for Blackstone to understand demand for office space in the city. Demand could either be high or low. When demand is high, all offices will be leased. When demand is low, only 50% of all offices will be leased. Due diligence shows that at t = 1, there is 60% probability that demand is high, and the firm expects to collect $8 million in rent annually. When demand is low, the firm expects to collect $4 million. The demand at t = 2 would depend on the demand at t = 1. If demand was high at t = 1, then a high demand at t = 2 occurs with probability 70%. If demand was low at t = 1, then a high demand at t = 2 occurs with probability 30%. As long as demand at t = 2 is high, the firm collects $8 million, and when demand is low, the firm collects $4 million. Suppose interest rate is 20%. (1) Draw the event and decision tree. (3p) (2) How much is Blackstone willing to pay for the office building at t = 0? (3p) Now suppose that Blackstone buys the office building at t = 0 and wants to renovate it. In order to complete the renovation, Blackstone signs a two-year contract with a construction company for t = 1 and t = 2. At the beginning of these two periods, Blackstone pays $1 million dollars to the construction company. The renovation has the following effect - it increases rent revenue in the high demand state by 25% but has no effect on low demand state. (3) Should Blackstone sign the two-year contract? Compute the t= 0 net present value of the office building with the contract. (5p) (4) Suppose that contracts could be signed at the start of t = 1 with the same annual cost as in part 3, but now Blackstone has an option to terminate the contract at the beginning of t = 2 by paying the construction company damages of $0.8 million dollars. What is the optimal strategy for Blackstone? What is the maximum profit in terms of t = 0 present value? (5p)

Step by Step Solution

★★★★★

3.52 Rating (169 Votes )

There are 3 Steps involved in it

Step: 1

Since I cannot draw Ill describe how to create the event and decision tree for question 1 and then proceed to compute the values for questions 2 and 3 Unfortunately I also cannot provide direct soluti...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started