Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Blair Bookstores is thinking about expanding its facilities. In considering the expansion, Blair's finance staff has obtained the following information: The expansion will require

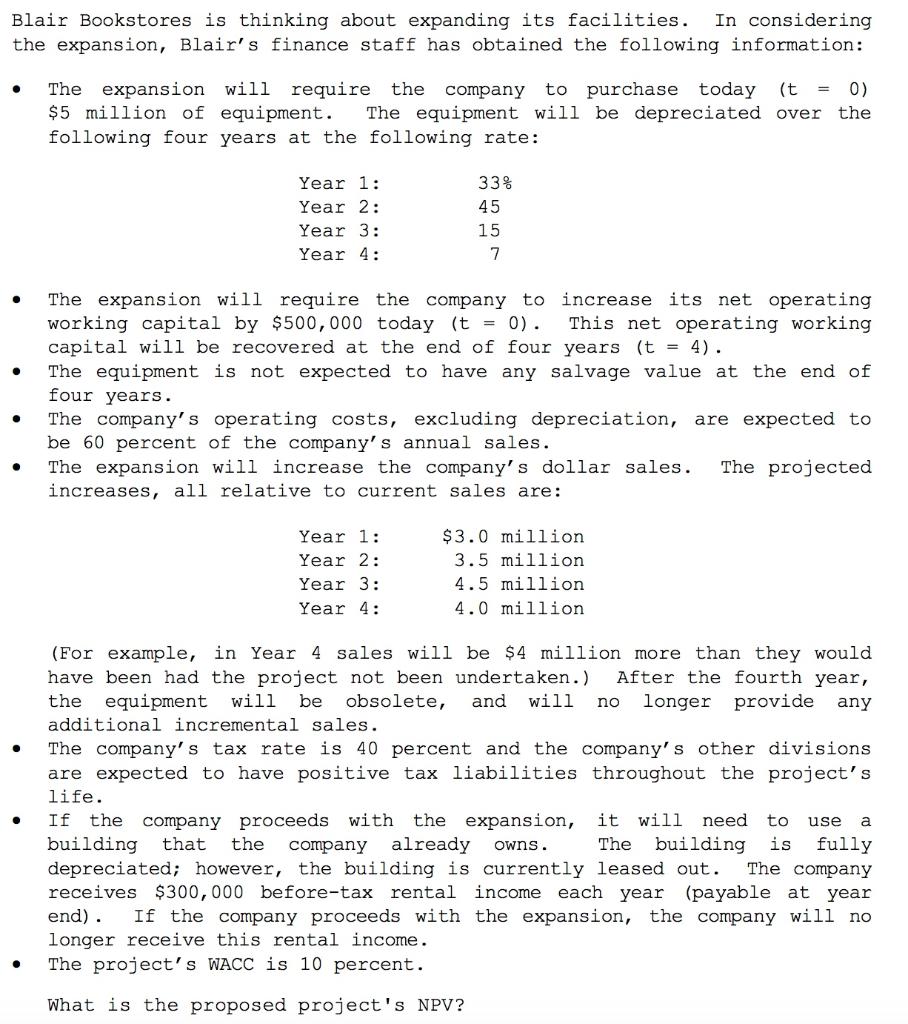

Blair Bookstores is thinking about expanding its facilities. In considering the expansion, Blair's finance staff has obtained the following information: The expansion will require the company to purchase today (t = 0) $5 million of equipment. The equipment will be depreciated over the following four years at the following rate: Year 1: Year 2: Year 3: Year 4: 33% 45 15 7 The expansion will require the company to increase its net operating working capital by $500,000 today (t = 0). This net operating working capital will be recovered at the end of four years (t = 4). The equipment is not expected to have any salvage value at the end of four years. The company's operating costs, excluding depreciation, are expected to be 60 percent of the company's annual sales. The expansion will increase the company's dollar sales. The projected increases, all relative to current sales are: Year 1: Year 2: Year 3: Year 4: $3.0 million 3.5 million 4.5 million 4.0 million (For example, in Year 4 sales will be $4 million more than they would have been had the project not been undertaken.) After the fourth year, the equipment will be obsolete, and will no longer provide any additional incremental sales. The company's tax rate is 40 percent and the company's other divisions are expected to have positive tax liabilities throughout the project's life. If the company proceeds with the expansion, building that the company already owns. depreciated; however, the building is currently leased out. receives $300,000 before-tax rental income each year (payable at year end). it will need to use a The building is fully The company If the company proceeds with the expansion, the company will no longer receive this rental income. The project's WACC is 10 percent. What is the proposed project's NPV?

Step by Step Solution

★★★★★

3.33 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started