Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Blake is currently planning for his retirement. Blake earns a salary of $50,000 every month, and starting from the beginning of next month for

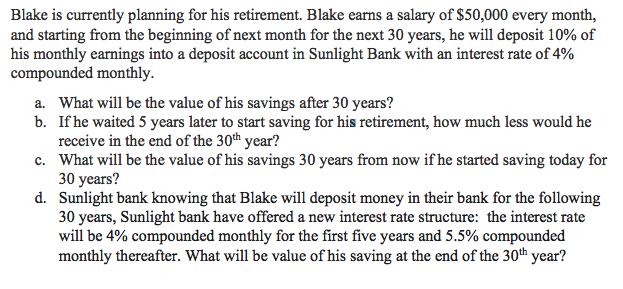

Blake is currently planning for his retirement. Blake earns a salary of $50,000 every month, and starting from the beginning of next month for the next 30 years, he will deposit 10% of his monthly earnings into a deposit account in Sunlight Bank with an interest rate of 4% compounded monthly. a. What will be the value of his savings after 30 years? b. If he waited 5 years later to start saving for his retirement, how much less would he receive in the end of the 30th year? c. What will be the value of his savings 30 years from now if he started saving today for 30 years? d. Sunlight bank knowing that Blake will deposit money in their bank for the following 30 years, Sunlight bank have offered a new interest rate structure: the interest rate will be 4% compounded monthly for the first five years and 5.5% compounded monthly thereafter. What will be value of his saving at the end of the 30th year?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Monthly Savings Blakes monthly saving is 10 of his salary which is 50000 x 10 5000 a Value of Savings after 30 years Constant Interest Rate We can use ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started