Question

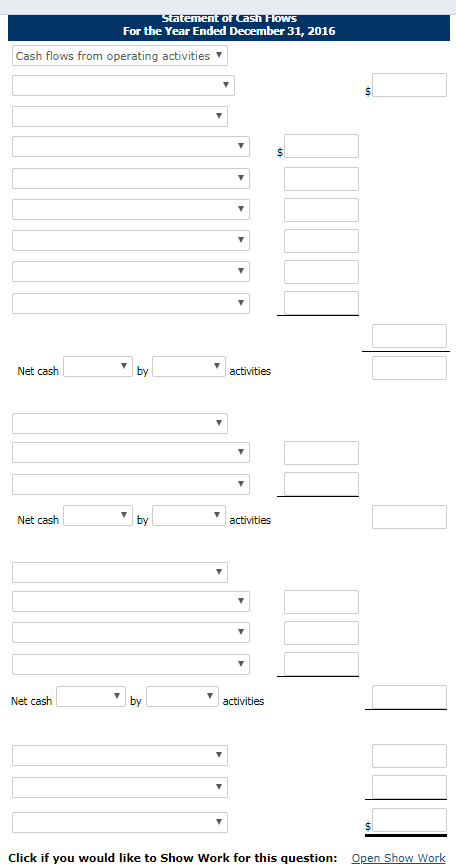

Blake Weaver, Sheridan Enterprises controller, is preparing the financial statements for 2016. He has completed the comparative balance sheets and income statement, which follow, and

Blake Weaver, Sheridan Enterprises controller, is preparing the financial statements for 2016. He has completed the comparative balance sheets and income statement, which follow, and has gathered this additional information:

On December 31, 2016, Sheridan sold a piece of equipment with an original cost of $25,030 for $30,630 cash. The equipment had a book value of $13,880.

On February 1, 2016, Sheridan issued $110,770 of common stock to raise cash in anticipation of the purchase of a new building later in the year.

On February 2, 2016, Sheridan took out a ten-year $76,310 long-term loan to provide the remaining funds needed to purchase the building.

On May 15, 2016, Sheridan paid $155,480 for the new building.

The company repaid $4,780 of the long-term debt before the end of the year.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started