Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Blank 1 Answer choices : Yes or No Blank 4 Answer choices : Indexed Bonds or Income Bonds Thank you!!!! 4. Convertible bonds, warrants, and

Blank 1 Answer choices : Yes or No

Blank 4 Answer choices : Indexed Bonds or Income Bonds

Thank you!!!!

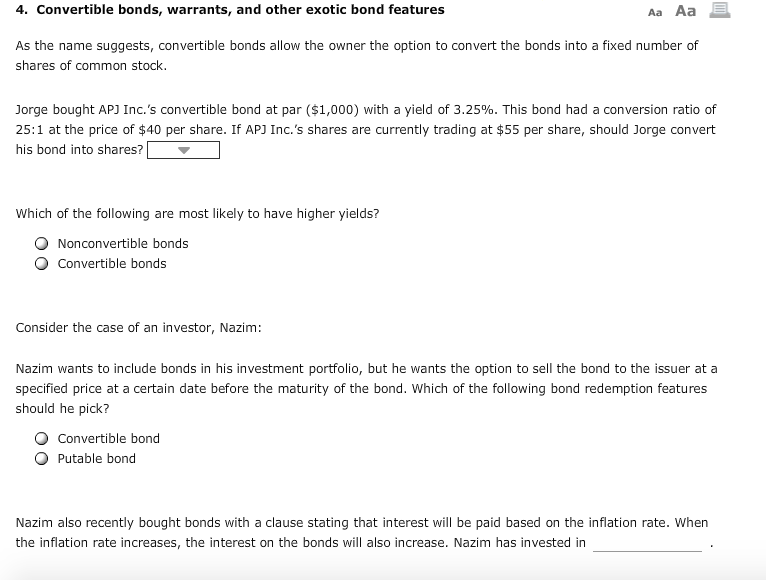

4. Convertible bonds, warrants, and other exotic bond features Aa Aa As the name suggests, convertible bonds allow the owner the option to convert the bonds into a fixed number of shares of common stock. Jorge bought AP Inc.'s convertible bond at par ($1,000) with a yield of 3.25%. This bond had a conversion ratio of 25:1 at the price of $40 per share. If AP) Inc.'s shares are currently trading at $55 per share, should Jorge convert his bond into shares? Which of the following are most likely to have higher yields? Nonconvertible bonds O Convertible bonds Consider the case of an investor, Nazim: Nazim wants to include bonds in his investment portfolio, but he wants the option to sell the bond to the issuer at a specified price at a certain date before the maturity of the bond. Which of the following bond redemption features should he pick? Convertible bond Putable bond Nazim also recently bought bonds with a clause stating that interest will be paid based on the inflation rate. When the inflation rate increases, the interest on the bonds will also increase. Nazim has invested inStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started