Answered step by step

Verified Expert Solution

Question

1 Approved Answer

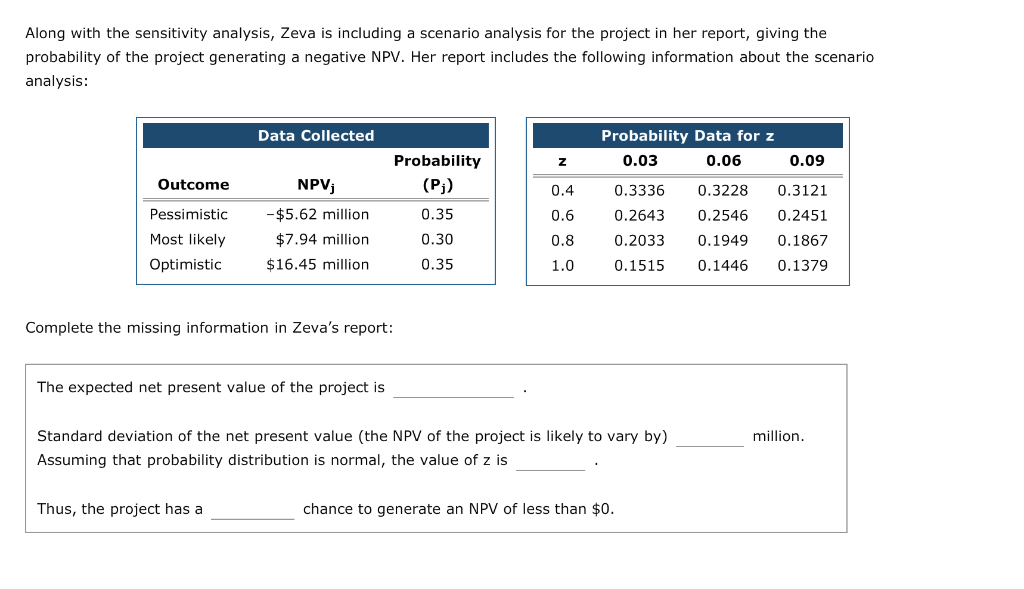

Blank 2: 5% or 10% Blank 3: $0.93 Million $6.17 Million $2.06 Million $6.85 Million Blank 4: 10.17 9.30 10.68 9.33 Blank 5 1.03 -.46

Blank 2:

Blank 2:

5% or 10%

Blank 3:

$0.93 Million

$6.17 Million

$2.06 Million

$6.85 Million

Blank 4:

10.17

9.30

10.68

9.33

Blank 5

1.03

-.46

-.66

-.83

Blank 6:

31.21%

26.43%

25.46%

32.28%

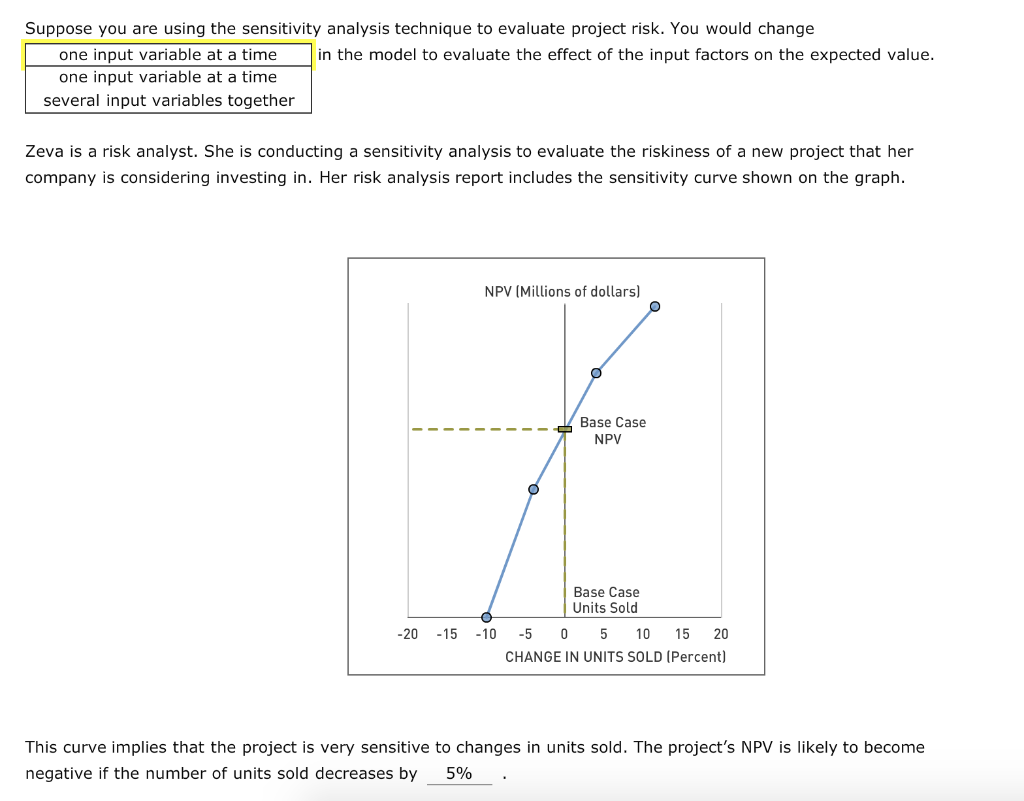

Suppose you are using the sensitivity analysis technique to evaluate project risk. You would change in the model to evaluate the effect of the input factors on the expected value. one input variable at a time one input variable at a time several input variables together Zeva is a risk analyst. She is conducting a sensitivity analysis to evaluate the riskiness of a new project that her company is considering investing in. Her risk analysis report includes the sensitivity curve shown on the graph NPV (Millions of dollars) C Base Case NPV Base Case Units Sold 20 -15 10 -5 0 5 10 15 20 CHANGE IN UNITS SOLD (Percent) This curve implies that the project is very sensitive to changes in units sold. The project's NPV is likely to become negative if the number of units sold decreases by 5% Along with the sensitivity analysis, Zeva is including a scenario analysis for the project in her report, giving the probability of the project generating a negative NPV. Her report includes the following information about the scenario analysis Probability Data for z Data Collected Probability 0.03 0.06 0.09 (Pj) Outcome NPV 0.4 0.3336 0.3228 0.3121 Pessimistic -$5.62 million 0.35 0.6 0.2643 0.2546 0.2451 Most likely $7.94 million 0.30 0.8 0.1949 0.2033 0.1867 $16.45 million 0.35 Optimistic 1.0 0.1515 0.1446 0.1379 Complete the missing information in Zeva's report: The expected net present value of the project is Standard deviation of the net present value (the NPV of the project is likely to vary by) million. Assuming that probability distribution is normal, the value of z is chance to generate an NPV of less than $0 Thus, the project has aStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started