Answered step by step

Verified Expert Solution

Question

1 Approved Answer

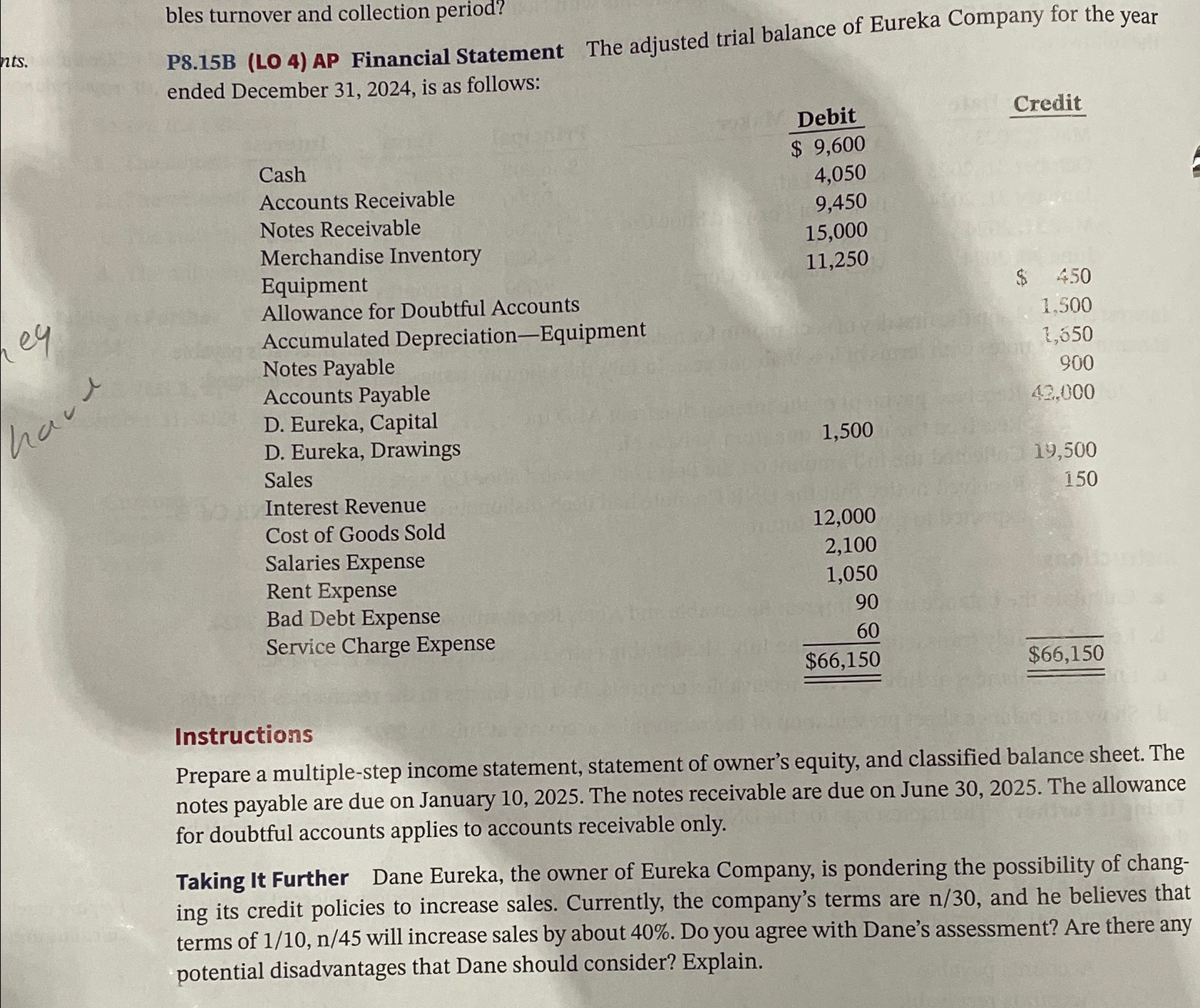

bles turnover and collection period? P 8 . 1 5 B ( LO 4 ) AP Financial Statement The adjusted trial balance of Eureka Company

bles turnover and collection period?

PB LO AP Financial Statement The adjusted trial balance of Eureka Company for the year ended December is as follows:

tableDebit,CreditCash$Accounts Receivable,Notes Receivable,Merchandise Inventory,EquipmentAllowance for Doubtful Accounts,,Accumulated DepreciationEquipment,,Notes Payable,,Accounts Payable,D Eureka, Capital,,D Eureka, Drawings,SalesInterest Revenue,Cost of Goods Sold,Salaries Expense,Rent Expense,$Bad Debt Expense,,Service Charge Expense,,

Instructions

Prepare a multiplestep income statement, statement of owner's equity, and classified balance sheet. The notes payable are due on January The notes receivable are due on June The allowance for doubtful accounts applies to accounts receivable only.

Taking It Further Dane Eureka, the owner of Eureka Company, is pondering the possibility of changing its credit policies to increase sales. Currently, the company's terms are and he believes that terms of will increase sales by about Do you agree with Dane's assessment? Are there any potential disadvantages that Dane should consider? Explain.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started