Answered step by step

Verified Expert Solution

Question

1 Approved Answer

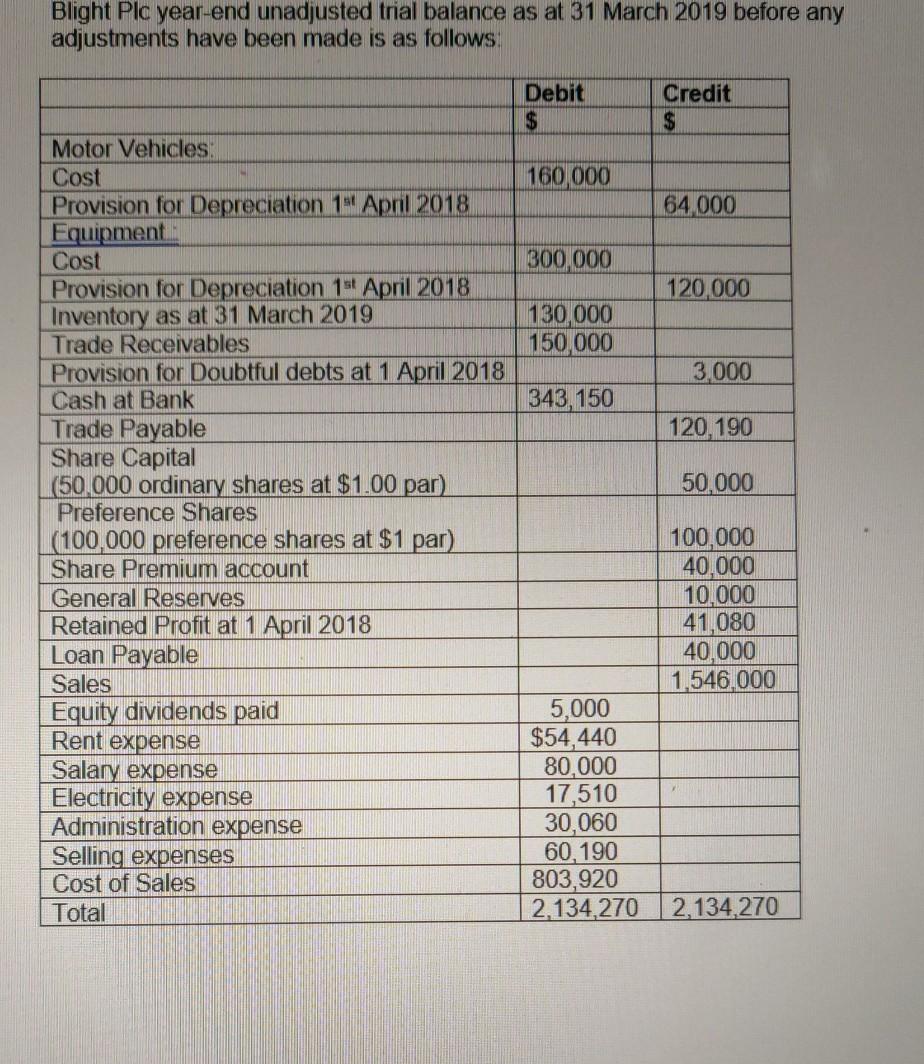

Blight Plc year-end unadjusted trial balance as at 31 March 2019 before any adjustments have been made is as follows: Debit $ Credit $ 160,000

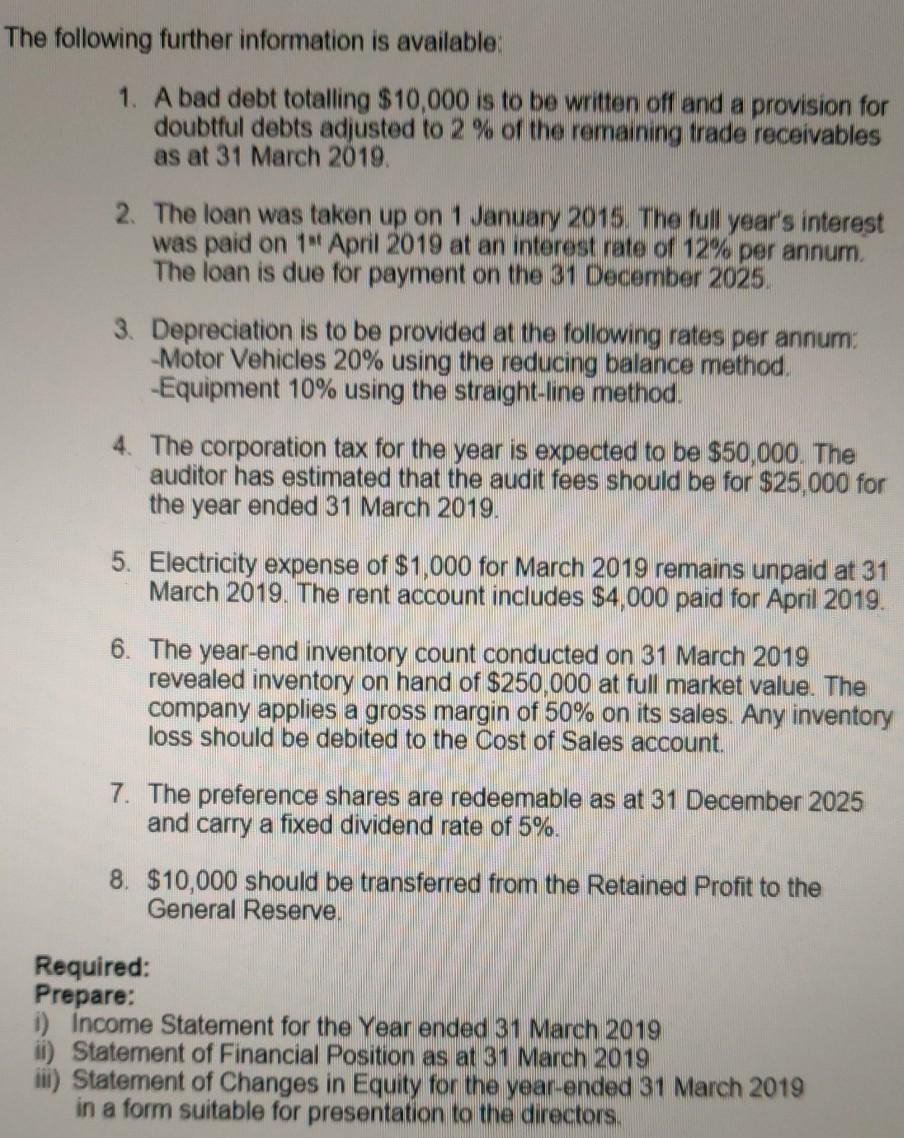

Blight Plc year-end unadjusted trial balance as at 31 March 2019 before any adjustments have been made is as follows: Debit $ Credit $ 160,000 64 000 300,000 120,000 130,000 150,000 3,000 343,150 120.190 50,000 Motor Vehicles Cost Provision for Depreciation 1 Apnl 2018 Equipment Cost Provision for Depreciation 1 April 2018 Inventory as at 31 March 2019 Trade Receivables Provision for Doubtful debts at 1 April 2018 Cash at Bank Trade Payable Share Capital (50,000 ordinary shares at $1.00 par) Preference Shares (100,000 preference shares at $1 par) Share Premium account General Reserves Retained Profit at 1 April 2018 Loan Payable Sales Equity dividends paid Rent expense Salary expense Electricity expense Administration expense Selling expenses Cost of Sales Total 100,000 40,000 10,000 41,080 40,000 1,546,000 5,000 $54,440 80,000 17,510 30,060 60,190 803,920 2,134,270 2,134,270 The following further information is available: 1. A bad debt totalling $10,000 is to be written off and a provision for doubtful debts adjusted to 2% of the remaining trade receivables as at 31 March 2019. 2. The loan was taken up on 1 January 2015 The full year's interest was paid on 1 April 2019 at an interest rate of 12% per annum. The loan is due for payment on the 31 December 2025. 3. Depreciation is to be provided at the following rates per annum: -Motor Vehicles 20% using the reducing balance method. -Equipment 10% using the straight-line method. 4. The corporation tax for the year is expected to be $50,000. The auditor has estimated that the audit fees should be for $25,000 for the year ended 31 March 2019. 5. Electricity expense of $1,000 for March 2019 remains unpaid at 31 March 2019. The rent account includes $4,000 paid for April 2019. 6. The year-end inventory count conducted on 31 March 2019 revealed inventory on hand of $250,000 at full market value. The company applies a gross margin of 50% on its sales. Any inventory loss should be debited to the Cost of Sales account. 7. The preference shares are redeemable as at 31 December 2025 and carry a fixed dividend rate of 5%. 8. $10,000 should be transferred from the Retained Profit to the General Reserve Required: Prepare: i) Income Statement for the Year ended 31 March 2019 il) Statement of Financial Position as at 31 March 2019 ill) Statement of Changes in Equity for the year-ended 31 March 2019 in a form suitable for presentation to the directors

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started