Answered step by step

Verified Expert Solution

Question

1 Approved Answer

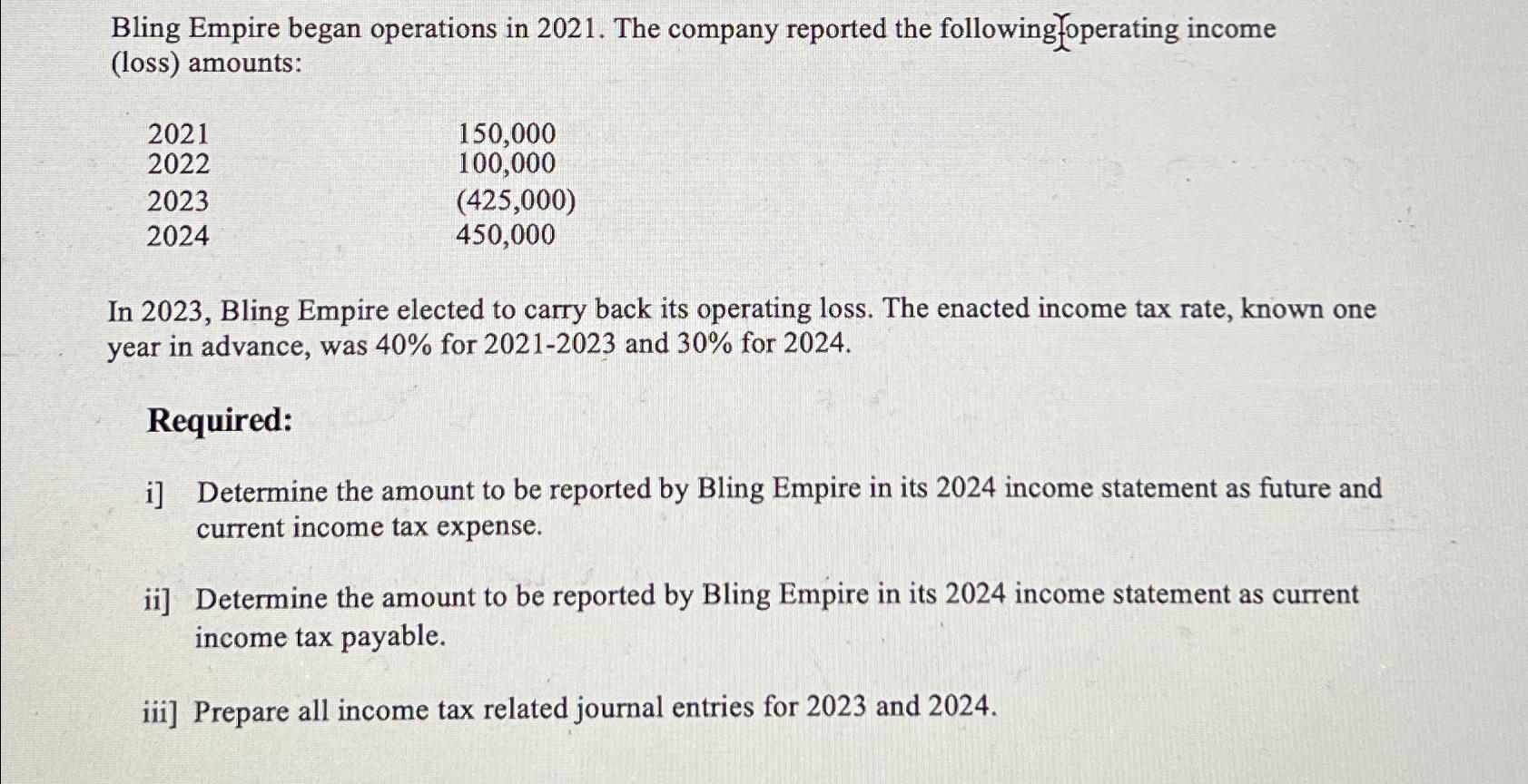

Bling Empire began operations in 2021. The company reported the following operating income (loss) amounts: 2021 2022 2023 2024 150,000 100,000 (425,000) 450,000 In

Bling Empire began operations in 2021. The company reported the following operating income (loss) amounts: 2021 2022 2023 2024 150,000 100,000 (425,000) 450,000 In 2023, Bling Empire elected to carry back its operating loss. The enacted income tax rate, known one year in advance, was 40% for 2021-2023 and 30% for 2024. Required: i] Determine the amount to be reported by Bling Empire in its 2024 income statement as future and current income tax expense. ii] Determine the amount to be reported by Bling Empire in its 2024 income statement as current income tax payable. iii] Prepare all income tax related journal entries for 2023 and 2024.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a Amount to be Reported in 2024 Income Statement as Future and Current Income Tax Expense 1 For 2021 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

663e621cddcd5_957208.pdf

180 KBs PDF File

663e621cddcd5_957208.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started