Answered step by step

Verified Expert Solution

Question

1 Approved Answer

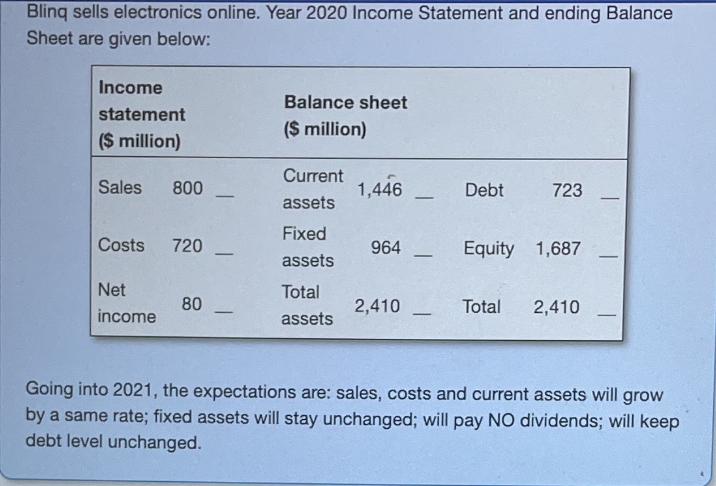

Blinq sells electronics online. Year 2020 Income Statement and ending Balance Sheet are given below: Income statement ($ million) Sales 800 Costs 720 Net

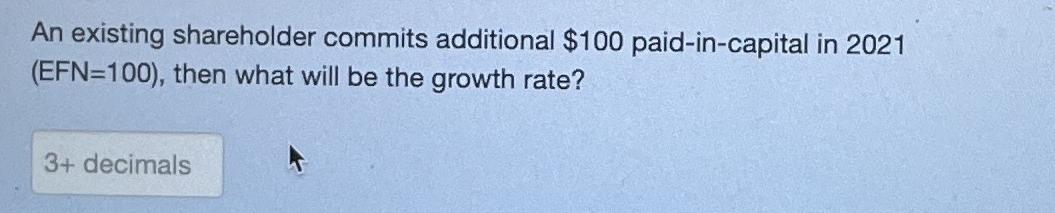

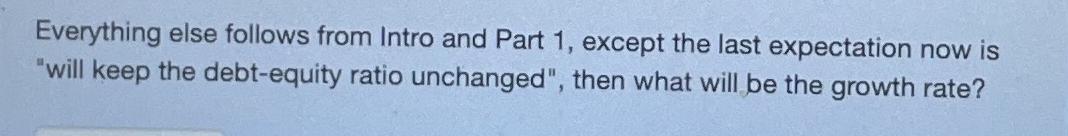

Blinq sells electronics online. Year 2020 Income Statement and ending Balance Sheet are given below: Income statement ($ million) Sales 800 Costs 720 Net income 80 - Balance sheet ($ million) Current assets Fixed assets Total assets 1,446 964 2,410 - - - Debt 723 Equity 1,687 Total 2,410 - Going into 2021, the expectations are: sales, costs and current assets will grow by a same rate; fixed assets will stay unchanged; will pay NO dividends; will keep debt level unchanged. An existing shareholder commits additional $100 paid-in-capital in 2021 (EFN=100), then what will be the growth rate? 3+ decimals Everything else follows from Intro and Part 1, except the last expectation now is "will keep the debt-equity ratio unchanged", then what will be the growth rate?

Step by Step Solution

★★★★★

3.39 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

To determine the growth rate in each scenario we need to use the External Financing Needed EFN equation and consider the given expectations 1 Growth R...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started