Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Freazing Hotel inc (FH) is based in Calgary, Alberta. It can only invest in only one of the following projects. The project that it

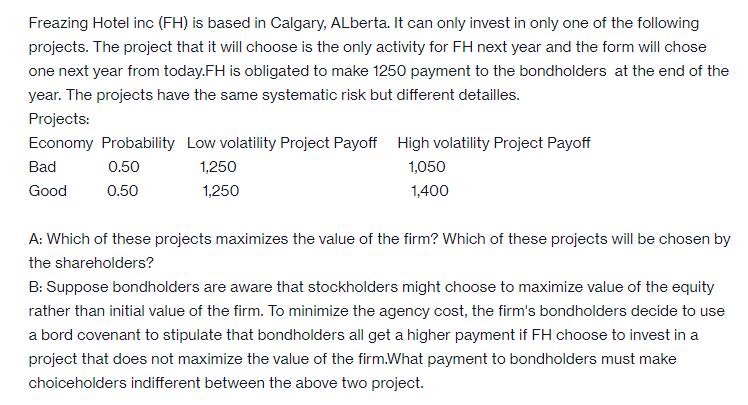

Freazing Hotel inc (FH) is based in Calgary, Alberta. It can only invest in only one of the following projects. The project that it will choose is the only activity for FH next year and the form will chose one next year from today.FH is obligated to make 1250 payment to the bondholders at the end of the year. The projects have the same systematic risk but different detailles. Projects: Economy Probability Low volatility Project Payoff High volatility Project Payoff 0.50 1,050 1,400 0.50 Bad Good 1,250 1,250 A: Which of these projects maximizes the value of the firm? Which of these projects will be chosen by the shareholders? B: Suppose bondholders are aware that stockholders might choose to maximize value of the equity rather than initial value of the firm. To minimize the agency cost, the firm's bondholders decide to use a bord covenant to stipulate that bondholders all get a higher payment if FH choose to invest in a project that does not maximize the value of the firm.What payment to bondholders must make choiceholders indifferent between the above two project.

Step by Step Solution

★★★★★

3.34 Rating (169 Votes )

There are 3 Steps involved in it

Step: 1

Lets analyze the two projects and determine which one maximizes the value of the firm and which one ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started