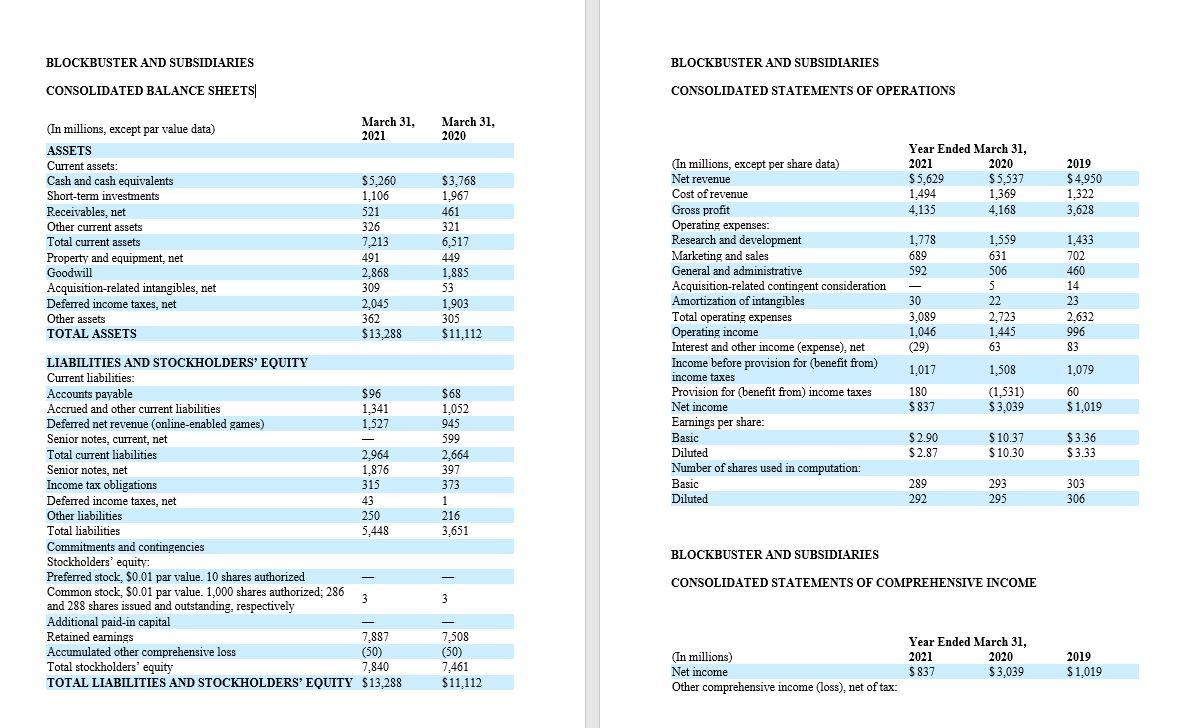

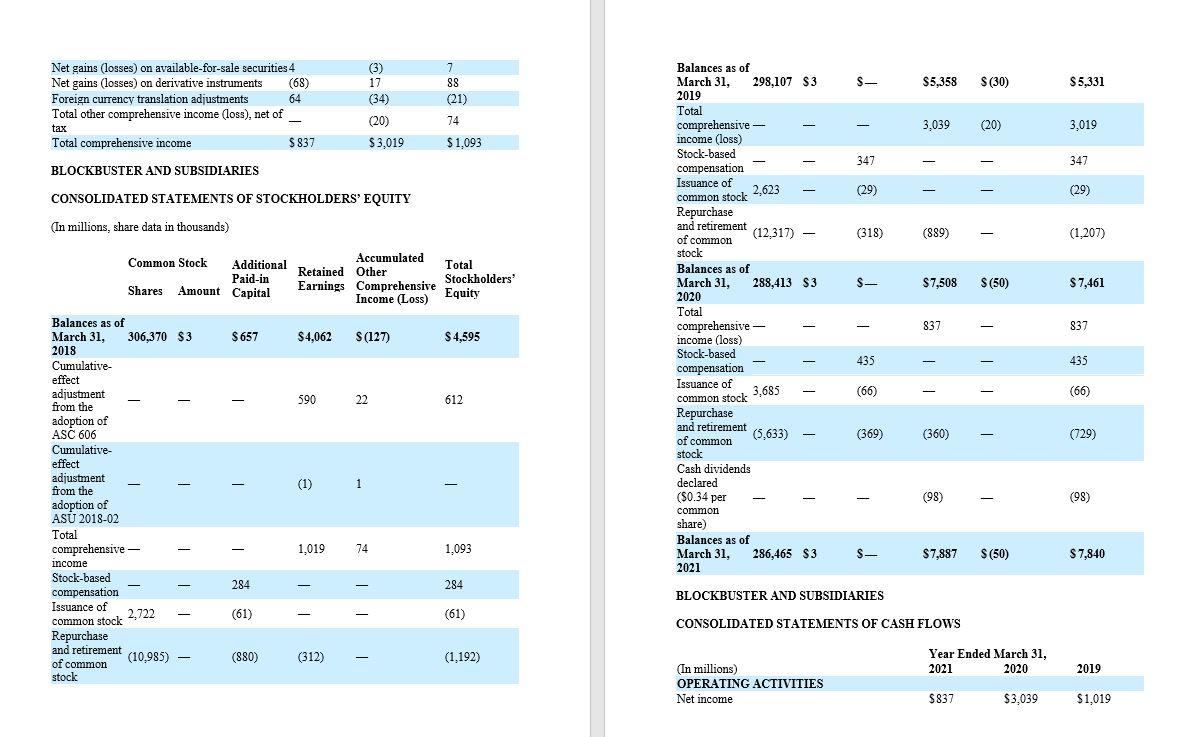

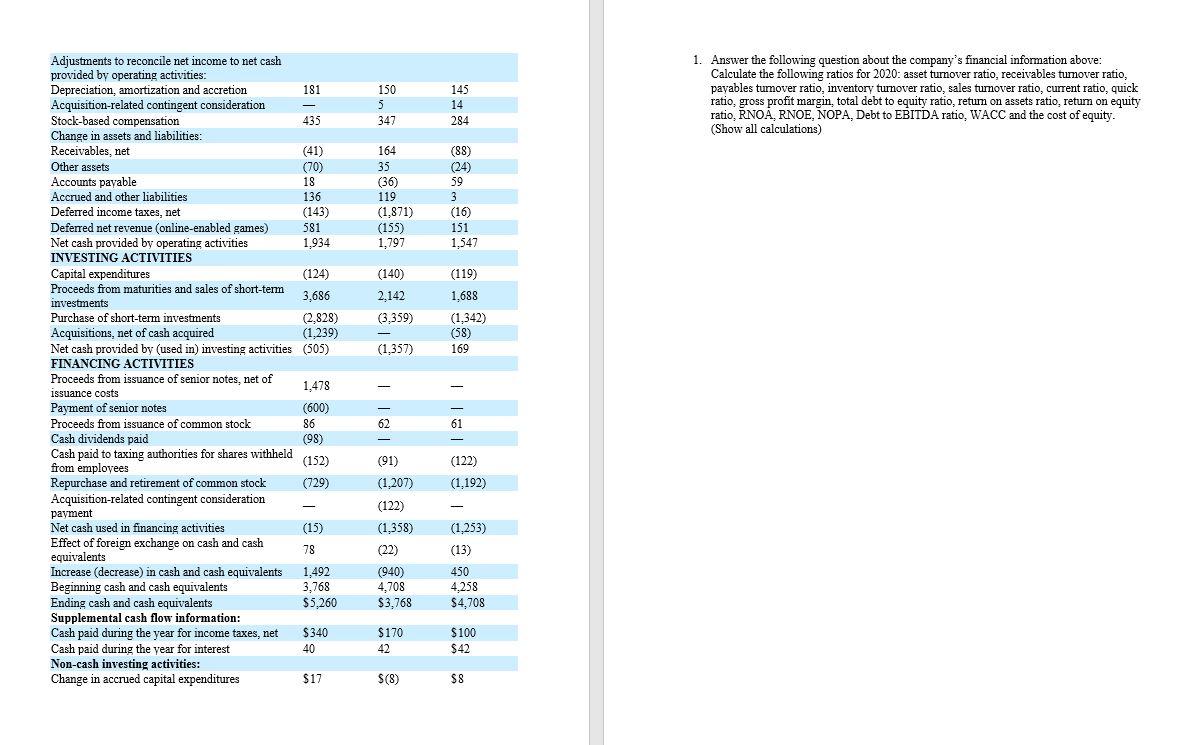

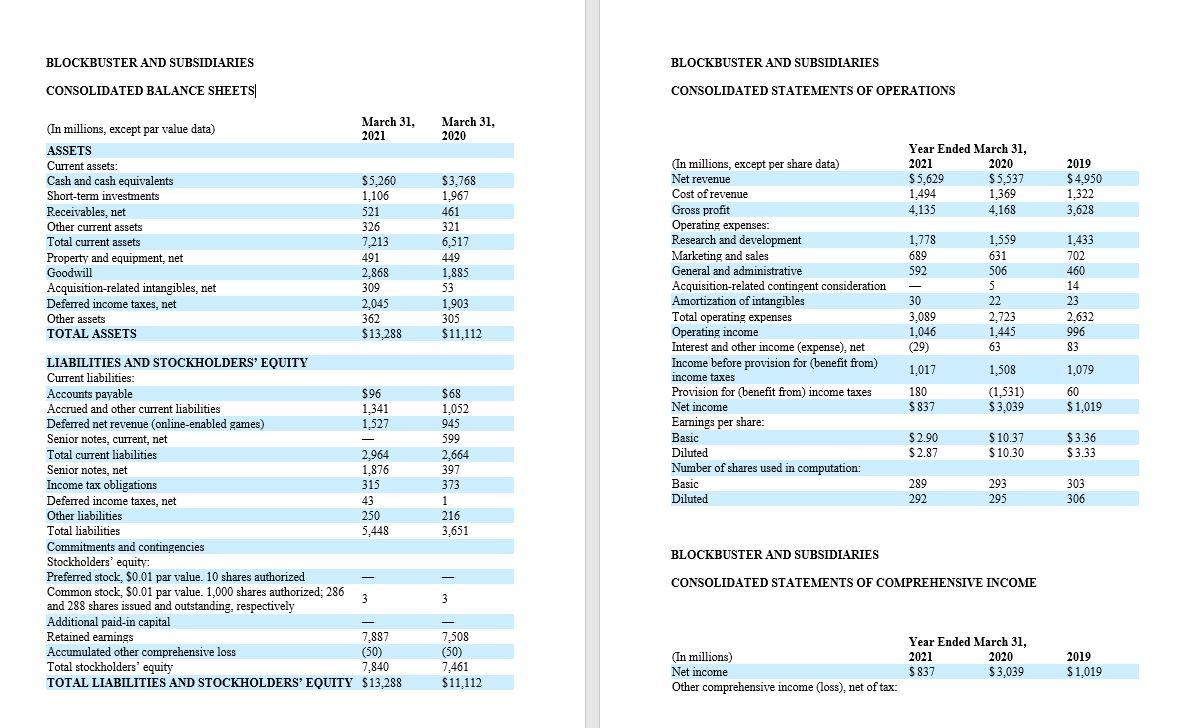

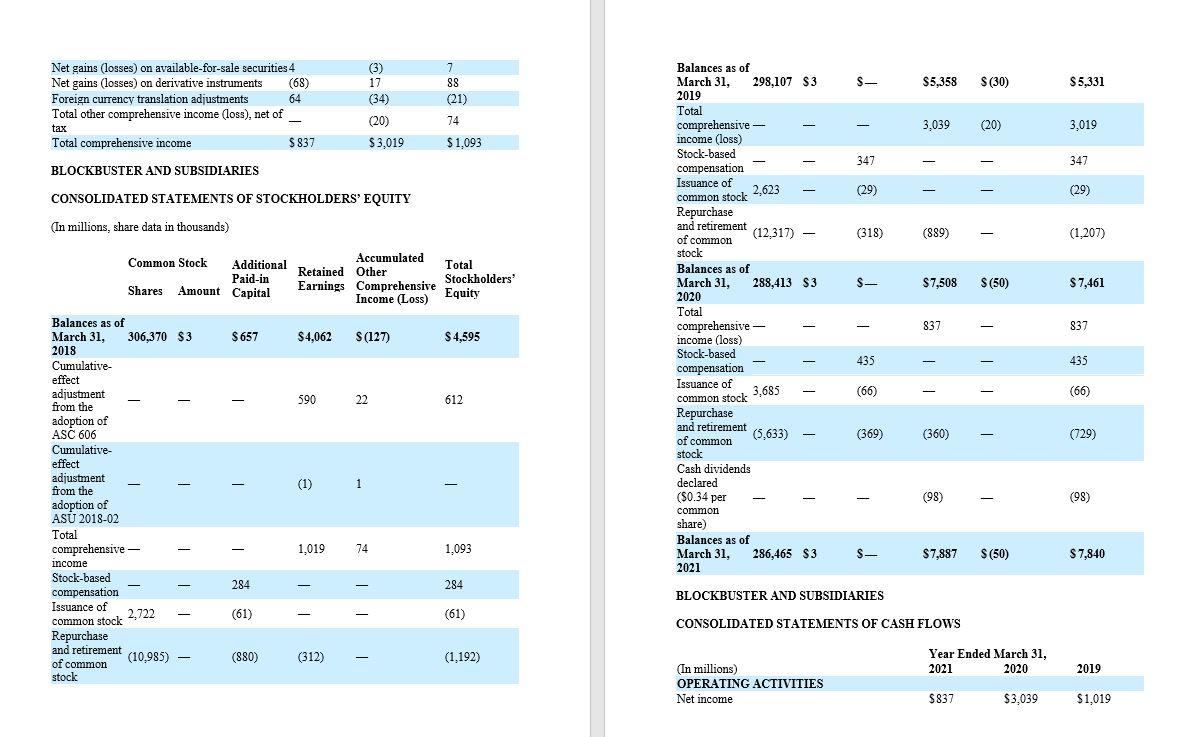

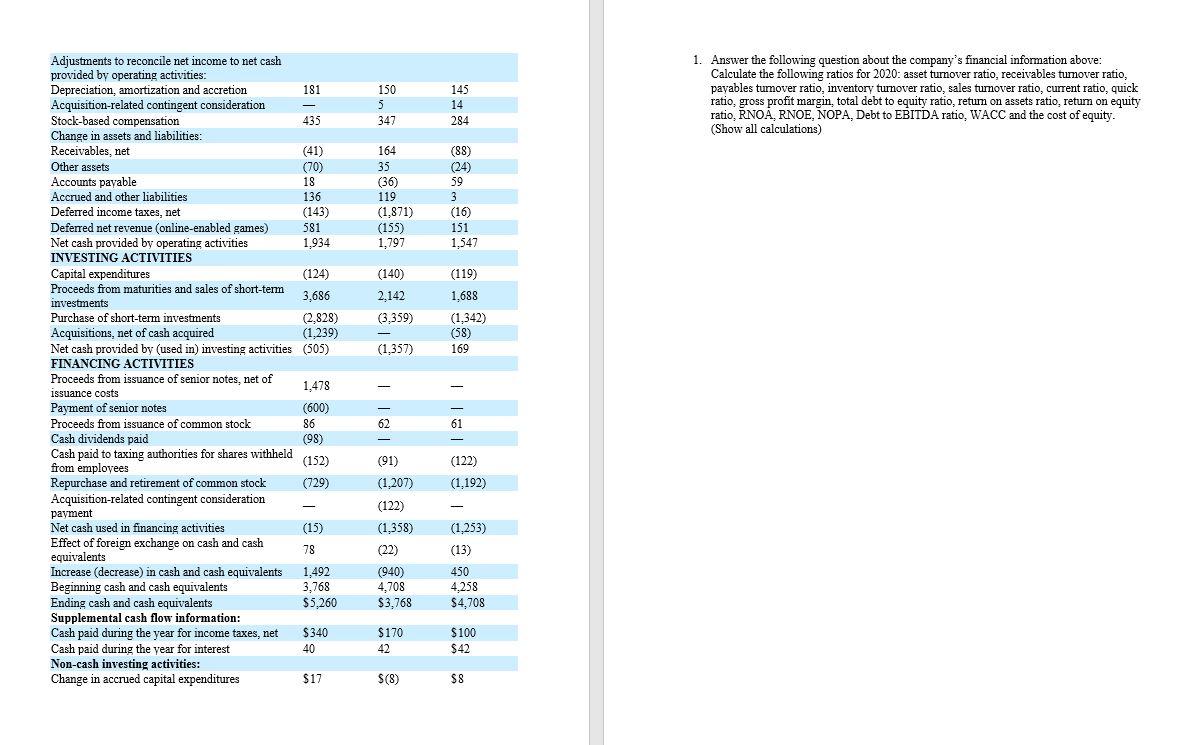

BLOCKBUSTER AND SUBSIDIARIES BLOCKBUSTER AND SUBSIDIARIES CONSOLIDATED BALANCE SHEETS CONSOLIDATED STATEMENTS OF OPERATIONS March 31, 2021 March 31, 2020 In millions, except par value data) ASSETS Current assets: Cash and cash equivalents Short-term investments Receivables, net Other current assets Total current assets Property and equipment, net Goodwill Acquisition-related intangibles, net Deferred income taxes, net Year Ended March 31, 2021 2020 $ 5,629 $5,537 1,494 1,369 4,135 4,168 2019 $4,950 1,322 3,628 $5,260 1.106 521 326 7,213 491 2,868 309 2,045 362 $13,288 $3,768 1,967 461 321 6,517 449 1,885 53 1,903 305 $11,112 1,778 689 592 1.559 631 506 5 22 2.723 1,445 63 (In millions, except per share data) Net revenue Cost of revenue Gross profit Operating expenses: Research and development Marketing and sales General and administrative Acquisition-related contingent consideration Amortization of intangibles Total operating expenses Operating income Interest and other income (expense), net Income before provision for (benefit from) income taxes Provision for (benefit from) income taxes Net income Earnings per share: Basic Diluted Number of shares used in computation: Basic Diluted 1,433 702 460 14 23 2.632 996 83 Other assets 30 3,089 1,046 (29) TOTAL ASSETS 1,017 180 $837 1,508 (1,531) $3,039 1,079 60 $1,019 $ 2.90 $ 2.87 $10.37 S 10.30 $3.36 $3.33 $68 1,052 945 599 2,664 397 373 1 216 3,651 289 292 293 295 LIABILITIES AND STOCKHOLDERS' EQUITY Current liabilities: Accounts payable $96 Accrued and other current liabilities 1,341 Deferred net revenue (online-enabled games) 1,527 Senior notes, current, net Total current liabilities 2,964 Senior notes, net 1,876 Income tax obligations 315 Deferred income taxes, net 43 Other liabilities 250 Total liabilities 5,448 Commitments and contingencies Stockholders' equity: Preferred stock, $0.01 par value. 10 shares authorized Common stock, $0.01 par value. 1,000 shares authorized: 286 3 and 288 shares issued and outstanding, respectively Additional paid-in capital Retained earings 7,887 Accumulated other comprehensive loss (50) Total stockholders' equity 7,840 TOTAL LIABILITIES AND STOCKHOLDERS' EQUITY $13,288 303 306 BLOCKBUSTER AND SUBSIDIARIES - CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME 3 7,508 (50) 7,461 (In millions) Net income Other comprehensive income (loss), net of tax: Year Ended March 31, 2021 2020 $837 $3,039 2019 $ 1,019 $11,112 7 88 (21) $ $5.358 S (30) $5,331 Net gains (losses) on available-for-sale securities 4 Net gains (losses) on derivative instruments (68) Foreign currency translation adjustments 64 Total other comprehensive income (loss), net of tax Total comprehensive income $837 (3) 17 (34) (20) $3.019 - 3.039 (20) 3,019 74 $1,093 347 347 BLOCKBUSTER AND SUBSIDIARIES (29) (29) CONSOLIDATED STATEMENTS OF STOCKHOLDERS' EQUITY (In millions, share data in thousands) (318) (889) (1,207) Common Stock Additional Paid-in Shares Amount Capital Accumulated Retained Other Total Stockholders Earnings Comprehensive Income (Loss) Equity $- $7,508 S (50) $ 7,461 Balances as of March 31, 298,107 $3 2019 Total comprehensive - income (loss) Stock-based compensation Issuance of 2.623 common stock Repurchase and retirement (12,317) - of common stock Balances as of March 31, 288,413 $3 2020 Total comprehensive - income (loss) Stock-based compensation Issuance of 3.685 common stock Repurchase and retirement of common (5.633) stock Cash dividends declared ($0.34 per common share) Balances as of March 31, 286,465 $3 2021 837 837 $ 657 $4,062 S(127) $4,595 435 435 - (66) (66) 590 22 612 - (369) (360) (729) (1) Balances as of March 31, 306,370 $3 2018 Cumulative- effect adjustment from the adoption of ASC 606 Cumulative- effect adjustment from the adoption of ASU 2018-02 Total comprehensive income Stock-based compensation Issuance of common stock 2,722 Repurchase and retirement (10,985) - of common stock 1 (98) (98) 1,019 74 1,093 S- $7.887 S (50) $7,840 284 284 BLOCKBUSTER AND SUBSIDIARIES (61) (61) CONSOLIDATED STATEMENTS OF CASH FLOWS (880) (312) (1,192) Year Ended March 31, 2021 2020 2019 (In millions) OPERATING ACTIVITIES Net income $837 $3,039 $1,019 150 5 347 - 1. Answer the following question about the company's financial information above: Calculate the following ratios for 2020: asset turnover ratio, receivables turnover ratio, payables turnover ratio, inventory tumover ratio, sales tumover ratio, current ratio, quick ratio, gross profit margin, total debt to equity ratio, retum on assets ratio, retum on equity ratio, RNOA, RNOE, NOPA, Debt to EBITDA ratio, WACC and the cost of equity. (Show all calculations) 145 14 284 Other assets 164 35 (36) 119 (1.871) (155) 1,797 (88) (24) 59 3 (16) ( 151 1,547 (140) 2.142 (3,359) (119) 1,688 (1,342) (58) 169 - (1,357) Adjustments to reconcile net income to net cash provided by operating activities: Depreciation, amortization and accretion 181 Acquisition-related contingent consideration Stock-based compensation 435 Change in assets and liabilities: Receivables, net (41) (70) Accounts payable 18 Accrued and other liabilities 136 Deferred income taxes, net (143) Deferred net revenue (online-enabled games) 581 Net cash provided by operating activities 1,934 INVESTING ACTIVITIES Capital expenditures (124) Proceeds from maturities and sales of short-term 3,686 investments Purchase of short-term investments (2.828) Acquisitions, net of cash acquired (1,239) Net cash provided by (used in investing activities (505) FINANCING ACTIVITIES Proceeds from issuance of senior notes, net of issuance costs 1,478 Payment of senior notes (600) Proceeds from issuance of common stock 86 Cash dividends paid (98) Cash paid to taxing authorities for shares withheld (152) from employees Repurchase and retirement of common stock (729) Acquisition-related contingent consideration payment Net cash used in financing activities (15) Effect of foreign exchange on cash and cash 78 equivalents Increase (decrease) in cash and cash equivalents 1,492 Beginning cash and cash equivalents 3,768 Ending cash and cash equivalents $5,260 Supplemental cash flow information: Cash paid during the year for income taxes, net $340 Cash paid during the year for interest 40 Non-cash investing activities: Change in accrued capital expenditures $17 62 61 - (91) (122) (1,192) (1,207) (122) (1,358) (22) (940) 4,708 $3.768 (1,253) (13) 450 4,258 $4,708 $170 42 $100 $42 $(8) $8 BLOCKBUSTER AND SUBSIDIARIES BLOCKBUSTER AND SUBSIDIARIES CONSOLIDATED BALANCE SHEETS CONSOLIDATED STATEMENTS OF OPERATIONS March 31, 2021 March 31, 2020 In millions, except par value data) ASSETS Current assets: Cash and cash equivalents Short-term investments Receivables, net Other current assets Total current assets Property and equipment, net Goodwill Acquisition-related intangibles, net Deferred income taxes, net Year Ended March 31, 2021 2020 $ 5,629 $5,537 1,494 1,369 4,135 4,168 2019 $4,950 1,322 3,628 $5,260 1.106 521 326 7,213 491 2,868 309 2,045 362 $13,288 $3,768 1,967 461 321 6,517 449 1,885 53 1,903 305 $11,112 1,778 689 592 1.559 631 506 5 22 2.723 1,445 63 (In millions, except per share data) Net revenue Cost of revenue Gross profit Operating expenses: Research and development Marketing and sales General and administrative Acquisition-related contingent consideration Amortization of intangibles Total operating expenses Operating income Interest and other income (expense), net Income before provision for (benefit from) income taxes Provision for (benefit from) income taxes Net income Earnings per share: Basic Diluted Number of shares used in computation: Basic Diluted 1,433 702 460 14 23 2.632 996 83 Other assets 30 3,089 1,046 (29) TOTAL ASSETS 1,017 180 $837 1,508 (1,531) $3,039 1,079 60 $1,019 $ 2.90 $ 2.87 $10.37 S 10.30 $3.36 $3.33 $68 1,052 945 599 2,664 397 373 1 216 3,651 289 292 293 295 LIABILITIES AND STOCKHOLDERS' EQUITY Current liabilities: Accounts payable $96 Accrued and other current liabilities 1,341 Deferred net revenue (online-enabled games) 1,527 Senior notes, current, net Total current liabilities 2,964 Senior notes, net 1,876 Income tax obligations 315 Deferred income taxes, net 43 Other liabilities 250 Total liabilities 5,448 Commitments and contingencies Stockholders' equity: Preferred stock, $0.01 par value. 10 shares authorized Common stock, $0.01 par value. 1,000 shares authorized: 286 3 and 288 shares issued and outstanding, respectively Additional paid-in capital Retained earings 7,887 Accumulated other comprehensive loss (50) Total stockholders' equity 7,840 TOTAL LIABILITIES AND STOCKHOLDERS' EQUITY $13,288 303 306 BLOCKBUSTER AND SUBSIDIARIES - CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME 3 7,508 (50) 7,461 (In millions) Net income Other comprehensive income (loss), net of tax: Year Ended March 31, 2021 2020 $837 $3,039 2019 $ 1,019 $11,112 7 88 (21) $ $5.358 S (30) $5,331 Net gains (losses) on available-for-sale securities 4 Net gains (losses) on derivative instruments (68) Foreign currency translation adjustments 64 Total other comprehensive income (loss), net of tax Total comprehensive income $837 (3) 17 (34) (20) $3.019 - 3.039 (20) 3,019 74 $1,093 347 347 BLOCKBUSTER AND SUBSIDIARIES (29) (29) CONSOLIDATED STATEMENTS OF STOCKHOLDERS' EQUITY (In millions, share data in thousands) (318) (889) (1,207) Common Stock Additional Paid-in Shares Amount Capital Accumulated Retained Other Total Stockholders Earnings Comprehensive Income (Loss) Equity $- $7,508 S (50) $ 7,461 Balances as of March 31, 298,107 $3 2019 Total comprehensive - income (loss) Stock-based compensation Issuance of 2.623 common stock Repurchase and retirement (12,317) - of common stock Balances as of March 31, 288,413 $3 2020 Total comprehensive - income (loss) Stock-based compensation Issuance of 3.685 common stock Repurchase and retirement of common (5.633) stock Cash dividends declared ($0.34 per common share) Balances as of March 31, 286,465 $3 2021 837 837 $ 657 $4,062 S(127) $4,595 435 435 - (66) (66) 590 22 612 - (369) (360) (729) (1) Balances as of March 31, 306,370 $3 2018 Cumulative- effect adjustment from the adoption of ASC 606 Cumulative- effect adjustment from the adoption of ASU 2018-02 Total comprehensive income Stock-based compensation Issuance of common stock 2,722 Repurchase and retirement (10,985) - of common stock 1 (98) (98) 1,019 74 1,093 S- $7.887 S (50) $7,840 284 284 BLOCKBUSTER AND SUBSIDIARIES (61) (61) CONSOLIDATED STATEMENTS OF CASH FLOWS (880) (312) (1,192) Year Ended March 31, 2021 2020 2019 (In millions) OPERATING ACTIVITIES Net income $837 $3,039 $1,019 150 5 347 - 1. Answer the following question about the company's financial information above: Calculate the following ratios for 2020: asset turnover ratio, receivables turnover ratio, payables turnover ratio, inventory tumover ratio, sales tumover ratio, current ratio, quick ratio, gross profit margin, total debt to equity ratio, retum on assets ratio, retum on equity ratio, RNOA, RNOE, NOPA, Debt to EBITDA ratio, WACC and the cost of equity. (Show all calculations) 145 14 284 Other assets 164 35 (36) 119 (1.871) (155) 1,797 (88) (24) 59 3 (16) ( 151 1,547 (140) 2.142 (3,359) (119) 1,688 (1,342) (58) 169 - (1,357) Adjustments to reconcile net income to net cash provided by operating activities: Depreciation, amortization and accretion 181 Acquisition-related contingent consideration Stock-based compensation 435 Change in assets and liabilities: Receivables, net (41) (70) Accounts payable 18 Accrued and other liabilities 136 Deferred income taxes, net (143) Deferred net revenue (online-enabled games) 581 Net cash provided by operating activities 1,934 INVESTING ACTIVITIES Capital expenditures (124) Proceeds from maturities and sales of short-term 3,686 investments Purchase of short-term investments (2.828) Acquisitions, net of cash acquired (1,239) Net cash provided by (used in investing activities (505) FINANCING ACTIVITIES Proceeds from issuance of senior notes, net of issuance costs 1,478 Payment of senior notes (600) Proceeds from issuance of common stock 86 Cash dividends paid (98) Cash paid to taxing authorities for shares withheld (152) from employees Repurchase and retirement of common stock (729) Acquisition-related contingent consideration payment Net cash used in financing activities (15) Effect of foreign exchange on cash and cash 78 equivalents Increase (decrease) in cash and cash equivalents 1,492 Beginning cash and cash equivalents 3,768 Ending cash and cash equivalents $5,260 Supplemental cash flow information: Cash paid during the year for income taxes, net $340 Cash paid during the year for interest 40 Non-cash investing activities: Change in accrued capital expenditures $17 62 61 - (91) (122) (1,192) (1,207) (122) (1,358) (22) (940) 4,708 $3.768 (1,253) (13) 450 4,258 $4,708 $170 42 $100 $42 $(8) $8