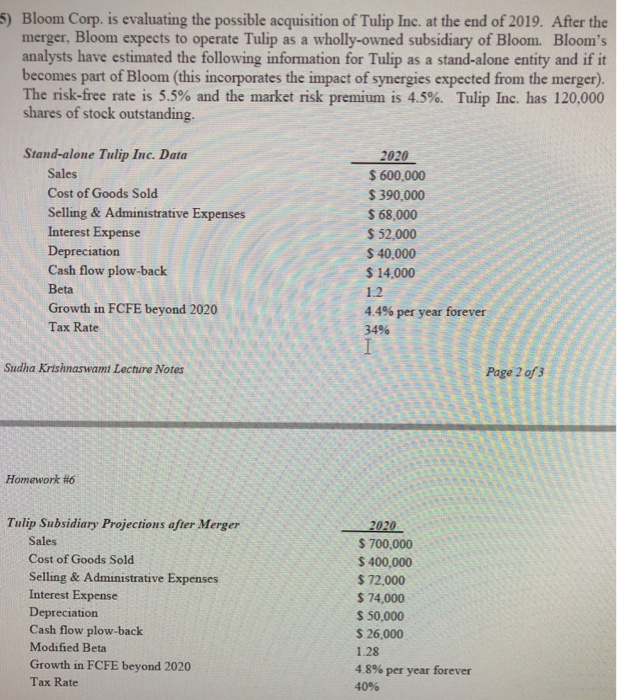

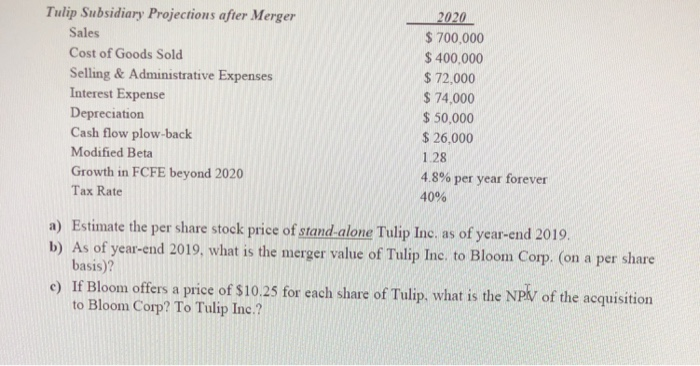

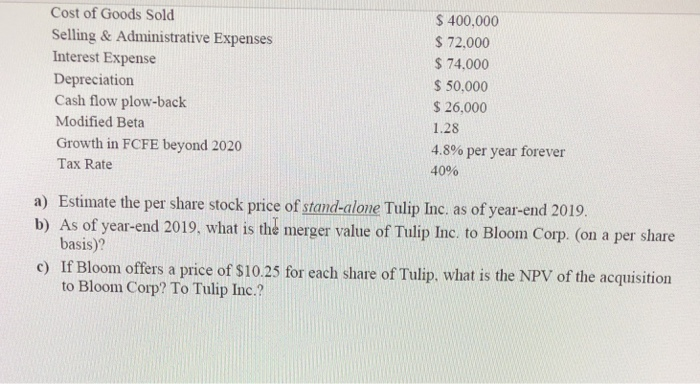

Bloom Corp. is evaluating the possible acquisition of Tulip Inc. at the end of 2019. After the merger, Bloom expects to operate Tulip as a wholly-owned subsidiary of Bloom. Bloom's analysts have estimated the following information for Tulip as a stand-alone entity and if it becomes part of Bloom (this incorporates the impact of synergies expected from the merger). The risk-free rate is 55% and the market risk premium is 4.5%. Tulip Inc. has 120,000 shares of stock outstanding. 5) Stand-alone Tulip Inc. Data Sales Cost of Goods Sold Selling & Administrative Expenses Interest Expense Depreciation Cash flow plow-back Beta Growth in FCFE beyond 2020 Tax Rate 2020 S 600,000 $ 390,000 $ 68,000 $52,000 $40,000 $ 14.000 1.2 44% per year forever 34% Sudha Krishnaswami Lecture Notes Page 2 of 3 Homework #6 Tulip Subsidiary Projections after Merger Sales Cost of Goods Sold Selling & Administrative Expenses Interest Expense Depreciation Cash flow plow-back Modified Beta Growth in FCFE beyond 2020 Tax Rate $ 700,000 $ 400,000 72.000 $ 74,000 $ 50,000 $ 26,000 1.28 4 8% per year forever 40% Tulip Subsidiary Projections after Merger Sales Cost of Goods Sold Selling & Administrative Expenses Interest Expense Depreciation Cash flow plow-back Modified Beta Growth in FCFE beyond 2020 Tax Rate $ 700,000 $ 400,000 $72,000 $ 74,000 $50,000 $ 26,000 1.28 48% per year forever 40% a) Estimate the per share stock price of stand alone Tulip Inc. as of year-end 2019 b) As of year-end 2019, what is the merger value of Tulip Inc. to Bloom Corp. (on a per share basis)? e) If Bloom offers a price of $1025 for ench share of Tulip, what is the NPlV of the acquisition to Bloom Corp? To Tulip Inc.? Cost of Goods Sold Selling & Administrative Expenses Interest Expense Depreciation Cash flow plow-back Modified Beta Growth in FCFE beyond 2020 Tax Rate $ 400,000 72.000 74,000 $50,000 26,000 1.28 4.8% per year forever 40% a) Estimate the per share stock price of stand-alone Tulip Inc. as of year-end 2019 b) As of year-end 2019, what is th merger value of Tulip nc to Bloom Corp. (on a per share 9 on a per share basis)? c) If Bloom offers a price of S10.25 for each share of Tulip, what is the NPV of the acquisition to Bloom Corp? To Tulip Inc.? 9 Bloom Corp. is evaluating the possible acquisition of Tulip Inc. at the end of 2019. After the merger, Bloom expects to operate Tulip as a wholly-owned subsidiary of Bloom. Bloom's analysts have estimated the following information for Tulip as a stand-alone entity and if it becomes part of Bloom (this incorporates the impact of synergies expected from the merger). The risk-free rate is 55% and the market risk premium is 4.5%. Tulip Inc. has 120,000 shares of stock outstanding. 5) Stand-alone Tulip Inc. Data Sales Cost of Goods Sold Selling & Administrative Expenses Interest Expense Depreciation Cash flow plow-back Beta Growth in FCFE beyond 2020 Tax Rate 2020 S 600,000 $ 390,000 $ 68,000 $52,000 $40,000 $ 14.000 1.2 44% per year forever 34% Sudha Krishnaswami Lecture Notes Page 2 of 3 Homework #6 Tulip Subsidiary Projections after Merger Sales Cost of Goods Sold Selling & Administrative Expenses Interest Expense Depreciation Cash flow plow-back Modified Beta Growth in FCFE beyond 2020 Tax Rate $ 700,000 $ 400,000 72.000 $ 74,000 $ 50,000 $ 26,000 1.28 4 8% per year forever 40% Tulip Subsidiary Projections after Merger Sales Cost of Goods Sold Selling & Administrative Expenses Interest Expense Depreciation Cash flow plow-back Modified Beta Growth in FCFE beyond 2020 Tax Rate $ 700,000 $ 400,000 $72,000 $ 74,000 $50,000 $ 26,000 1.28 48% per year forever 40% a) Estimate the per share stock price of stand alone Tulip Inc. as of year-end 2019 b) As of year-end 2019, what is the merger value of Tulip Inc. to Bloom Corp. (on a per share basis)? e) If Bloom offers a price of $1025 for ench share of Tulip, what is the NPlV of the acquisition to Bloom Corp? To Tulip Inc.? Cost of Goods Sold Selling & Administrative Expenses Interest Expense Depreciation Cash flow plow-back Modified Beta Growth in FCFE beyond 2020 Tax Rate $ 400,000 72.000 74,000 $50,000 26,000 1.28 4.8% per year forever 40% a) Estimate the per share stock price of stand-alone Tulip Inc. as of year-end 2019 b) As of year-end 2019, what is th merger value of Tulip nc to Bloom Corp. (on a per share 9 on a per share basis)? c) If Bloom offers a price of S10.25 for each share of Tulip, what is the NPV of the acquisition to Bloom Corp? To Tulip Inc.? 9