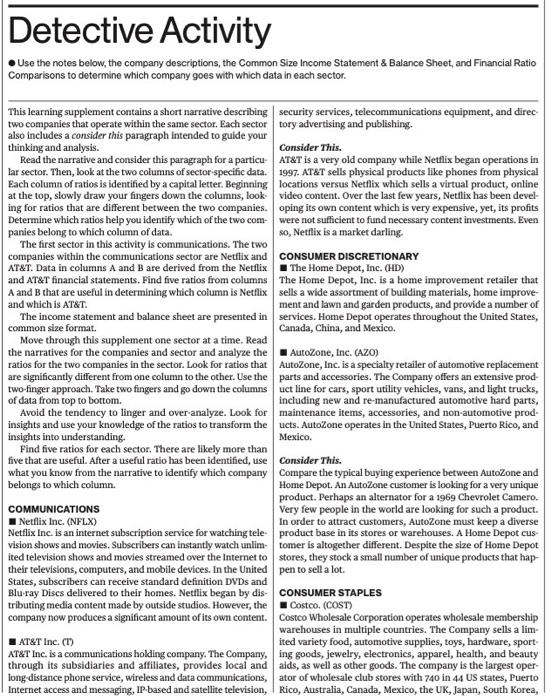

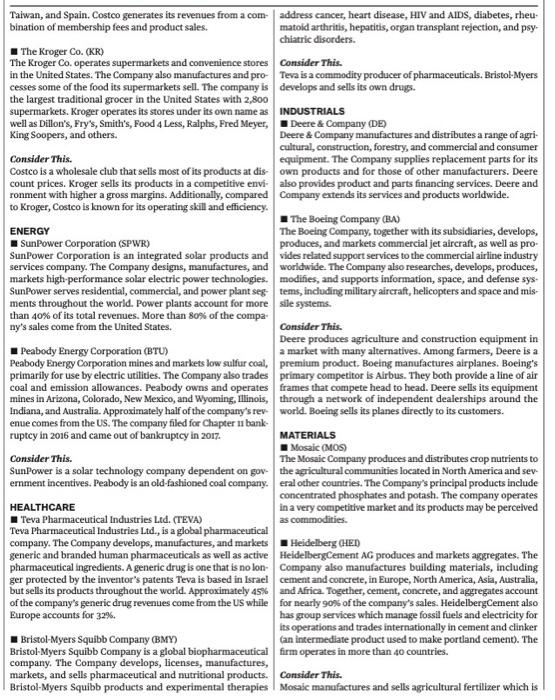

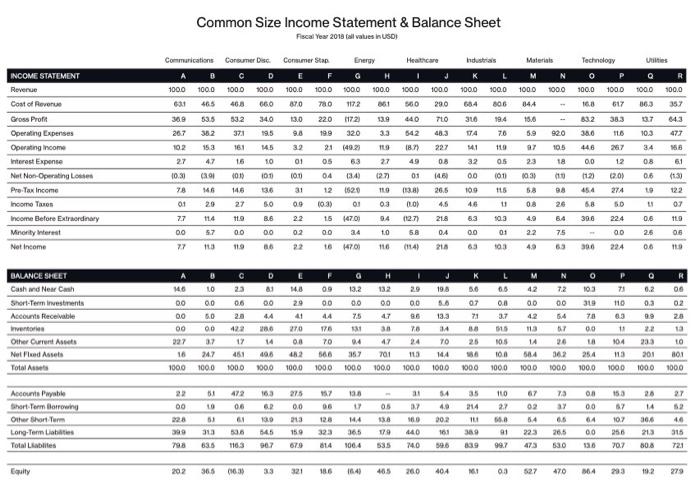

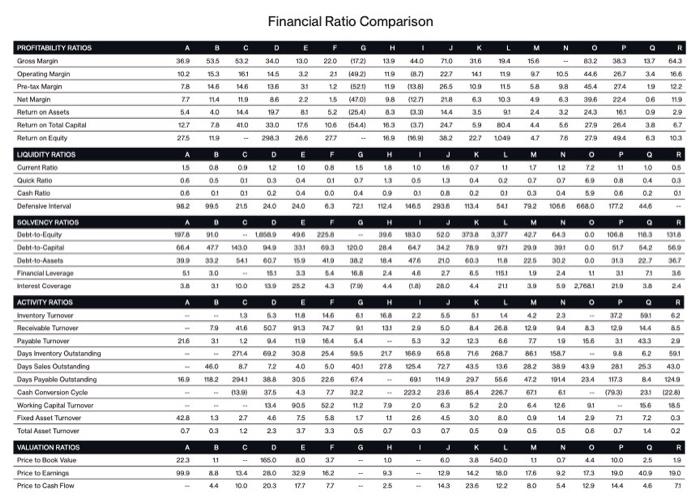

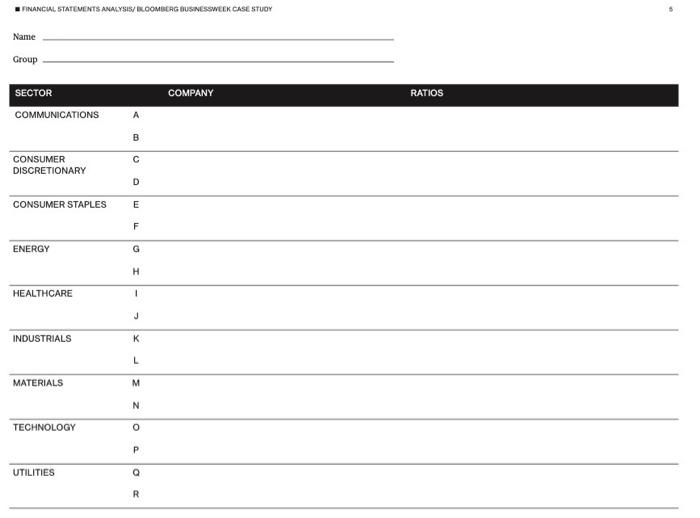

Bloomberg CASEO Businessweek STUDIES E Financial Statements Analysis Compare financial statement ratios The Financial Statements Analysis case study includes two sep- to identify critical objective elements of arate components: a company and diagnose a company's Detective Activity positives and risks. This activity compels you to understand why ratios are what they are for a given company or industy. You will practice inter- preting financial ratios by matching financial statements to their Companies are as unique as people. But, like people groups companies, sorted by sector. This activity includes nine sec of people share similarities. Companies that operate within the toes: communications, consumer discretionary, consumer sta same sector or industry tend to share certain characteristics. ples, energy, healthcare, industrials, materials, technology, and Such characteristics are highlighted by calculating and comper utilities. ing a company's financial ratios. Comparing a company's ratios over time show if a company Case Study is changing, for the better or for worse. Comparing ratios among the case study will require you to access and compare Disney's different companies bring a company's particular characteris financial statements to those of its peers. Use the Terminal tics into focus. Tutorial and Case Study Notes to answer the case questions. Detective Activity Use the notes below, the company descriptions, the Common Size Income Statement & Balance Sheet, and Financial Ratio Comparisons to determine which company goes with which data in each sector. This learning supplement contains a short narrative describing security services, telecommunications equipment, and direc two companies that operate within the same sector. Each sector tory advertising and publishing also includes a consider this paragraph intended to guide your thinking and analysis. Consider this. Read the narrative and consider this paragraph for a particu AT&T is a very old company while Netflix began operations in lar sector. Then, look at the two columns of sector-specific data. 1997. AT&T sells physical products like phones from physical Each column of ratios is identified by a capital letter. Beginning locations versus Netflix which sells a virtual product, online at the top, slowly draw your fingers down the columns, look video content. Over the last few years, Netflix has been devel- ing for ratios that are different between the two companies. oping its own content which is very expensive, yet, its profits Determine which ratios help you identify which of the two com- were not sufficient to fund necessary content investments. Even panies belong to which column of data. $0, Netflix is a market darling. The first sector in this activity is communications. The two companies within the communications sector are Netflix and CONSUMER DISCRETIONARY AT&T. Data in columns A and B are derived from the Netflix The Home Depot, Inc. (HD) and AT&T financial statements. Find five ratios from columns The Home Depot, Inc. is a home improvement retailer that A and B that are useful in determining which column is Netflix sells a wide assortment of building materials, home improve and which is AT&T. ment and lawn and garden products, and provide a number of The income statement and balance sheet are presented in services. Home Depot operates throughout the United States, common size format. Canada, China, and Mexico Move through this supplement one sector at a time. Read the narratives for the companies and sector and analyze the AutoZone, Inc. (AZO) ratios for the two companies in the sector. Look for ratios that AutoZone, Inc. is a specialty retailer of automotive replacement are significantly different from one column to the other. Use the parts and accessories. The Company offers an extensive prod. two-finger approach. Take two fingers and go down the columns uct line for cars, sport utility vehicles, vans, and light trucks, of data from top to bottom. including new and re-manufactured automotive hard parts, Avoid the tendency to linger and over-analyze. Look for maintenance items, accessories, and non-automotive prod- insights and use your knowledge of the ratios to transform the ucts. AutoZone operates in the United States, Puerto Rico, and Insights into understanding. Mexico. Find five ratios for each sector, There are likely more than five that are useful. After a useful ratio has been identified, use consider This. what you know from the narrative to identify which company Compare the typical buying experience between AutoZone and belongs to which column. Home Depot. An AutoZone customer is looking for a very unique product. Perhaps an alternator for a 1969 Chevrolet Camero COMMUNICATIONS Very few people in the world are looking for such a product. Netflix Inc. (NFLX) In order to attract customers, AutoZone must keep a diverse Netflix Inc. is an internet subscription service for watching tele product base in its stores or warehouses. A Home Depot cus vision shows and movies. Subscribers can instantly watch unlimtomer is altogether different. Despite the size of Home Depot ited television shows and movies streamed over the Internet to stores, they stock a small number of unique products that hap their televisions, computers, and mobile devices. In the United pen to sell a lot. States, subscribers can receive standard definition DVDs and Blu-ray Discs delivered to their homes. Netflix began by dis CONSUMER STAPLES tributing media content made by outside studios. However, the Costco. (COST) company now produces a significant amount of its own content. Costco Wholesale Corporation operates wholesale membership warehouses in multiple countries. The Company sells a lim- AT&T Inc. (T) ited variety food, automotive supplies, toys, hardware, sport AT&T Inc. is a communications holding company. The Company, ing goods, jewelry, electronics, apparel, health, and beauty through its subsidiaries and affiliates, provides local and aids, as well as other goods. The company is the largest oper- long-distance phone service, wireless and data communications, ator of wholesale club stores with 740 in 44 US states, Puerto Internet access and messaging, IP-based and satellite television, Rico, Australia, Canada, Mexico, the UK, Japan, South Korea, Taiwan, and Spain. Costco generates its revenues from a com address cancer, heart disease, HIV and AIDS, diabetes, theu bination of membership fees and product sales. matoid arthritis, hepatitis, organ transplant rejection, and psy chiatric disorders. The Kroger Co. (KR) The Kroger Co. operates supermarkets and convenience stores Consider This. in the United States. The Company also manufactures and pro Teva is a commodity producer of pharmaceuticals, Bristol-Myers cesses some of the food its supermarkets sell. The company is develops and sells its own drugs. the largest traditional grocer in the United States with 2,800 supermarkets. Kroger operates its stores under its own name as INDUSTRIALS well as Dillon's, Fry's, Smith's, Food 4 Less, Raiptis, Fred Meyer, Deere & Company (DE) King Soopers, and others. Deere & Company manufactures and distributes a range of agri- cultural, construction, forestry, and commercial and consumer Consider This. equipment. The Company supplies replacement parts for its Costco is a wholesale club that sells most of its products ar dis own products and for those of other manufacturers. Deere count prices. Kroger sells its products in a competitive envi- also provides product and parts financing services. Deere and ronment with higher a gross margins. Additionally, compared Company extends its services and products worldwide. to Kroger, Costco is known for its operating skill and efficiency. The Boeing Company (BA) ENERGY The Boeing Company, together with its subsidiaries, develops, SunPower Corporation (SPWR) produces, and markets commercial jet aircraft, as well as pro- SunPower Corporation is an integrated solar products and vides related support services to the commercial airline industry services company. The Company designs, manufactures, and worldwide. The Company also researches, develops, produces, markets high-performance solar electric power technologies. modifies, and supports information, space, and defense sys SunPower serves residential, commercial, and power plant seg tems, including military aircraft, helicopters and space and mis- ments throughout the world. Power plants account for more sile systems. than 40% of its total revenues. More than 80% of the compa ny's sales come from the United States. Consider This Deere produces agriculture and construction equipment in Peabody Energy Corporation (BTU) a market with many alternatives. Among farmers, Deere is a Peabody Energy Corporation mines and markets low sulfur coal, premium product. Boeing manufactures airplanes. Boeing's primarily for use by electric utilities. The Company also trades primary competitor is Airbus. They both provide a line of air coal and emission allowances. Peabody owns and operates frames that compete head to head. Deere sells its equipment mines in Arizona, Colorado, New Mexico, and Wyoming, Illinois, through a network of independent dealerships around the Indiana, and Australia. Approximately half of the company's rev world. Boeing sells its planes directly to its customers. enue comes from the US. The company filed for Chapter 11 bank ruptcy in 2016 and came out of bankruptcy in 2017. MATERIALS Mosaic (MOS) Consider this. The Mosaic Company produces and distributes crop nutrients to SunPower is a solar technology company dependent on gov the agricultural communities located in North America and sev ernment incentives. Peabody is an old-fashioned coal company. eral other countries. The Company's principal products include concentrated phosphates and potash. The company operates HEALTHCARE in a very competitive market and its products may be perceived Teva Pharmaceutical Industries Ltd. (TEVA) as commodities. Teva Pharmaceutical Industries Ltd., is a global pharmaceutical company. The Company develops, manufactures, and markets Heidelberg HED generic and branded human pharmaceuticals as well as active HeidelbergCement AG produces and markets aggregates. The pharmaceutical ingredients. A generic drug is one that is no lon Company also manufactures building materials, including ger protected by the inventor's patents Teva is based in Israel cement and concrete, in Europe, North America, Asia, Australia, but sells its products throughout the world. Approximately 45% and Africa Together, cement, concrete, and aggregates account of the company's generic drug revenues come from the US while for nearly 90% of the company's sales. HeidelbergCement also Europe accounts for 32%. has group services which manage fossil fuels and electricity for its operations and trades internationally in cement and clinker Bristol-Myers Squibb Company (BMY) (an intermediate product used to make portland cement). The Bristol-Myers Squibb Company is a global biopharmaceutical firm operates in more than 40 countries. company. The Company develops, licenses, manufactures, markets, and sells pharmaceutical and nutritional products. Consider this. Bristol-Myers Squibb products and experimental therapies Mosaic manufactures and sells agricultural fertilizer which is subject to the agricultural product cycle. Heidelberg is subject to a construction cycle. The agricultural cycle occurs every year while the construction cycle is longer in duration TECHNOLOGY Facebook Inc. (FB) Facebook, Inc. operates a social networking website. The Company website allows people to communicate with their family, friends, and co-workers. Facebook develops technolo- gies that facilitate the sharing of information, photographs, web- site links, and videos. Facebook users have the ability to both share and restrict information based on their own specific crite ria. Approximately 85% of the company's revenue comes from mobile advertising while 11.8% comes from desktop advertis- ing. The remaining revenue comes from payments and fees. Apple Inc. (AAPL) Apple Inc. designs, manufactures, and markets personal com puters and related personal computing and mobile communi- cation devices along with a variety of related software, services, peripherals, and networking solutions. Apple sells its products worldwide through its online stores, its retail stores, its direct sales force, third-party wholesalers, and resellers. One prod- uct, the iPhone, accounts for more than 60% of the company's total revenue. Consider This Apple produces a physical product while Facebook sells an online social media platform. Physical products come with costs and operating inefficiencies that online services do not incur. Facebook is a relatively young technology company that recently went public. Although they are very profitable, the company does not pay a dividend. UTILITIES Centrica (CNA) Centrica PLC operates as an integrated energy company offer ing a wide range of home and business energy solutions. The Company sources, generates, processes, stores, trades, saves, and supplies energy and provides a range of related services. American Electric Power Company, Inc. (AEP) American Electric Power Company, Inc. operates as a public utility holding company. The Company generates, transmits, distributes, and sells electricity to residential and commercial customers. AEP serves customers in the United States. Consider this. AEP is an old fashioned electric utility. It produces, transmits, and distributes electric power over a pre-defined service ter ritory as a regulated natural monopoly. Regulators are tasked with ensuring utility companies are sufficiently profitable to attract investment capital but not too profitable. Centrica is an energy marketer. The company generally markets energy pro duced by other firms. Common Size Income Statement & Balance Sheet Fiscal Year 2018 fall values in USO) Utilities Communications A B 1000 100.0 Industrials K L 100.0 100.0 Materiais M N 1000 1000 Q R Technology 0 P 100.0 1000 16.8 617 100.0 1000 063 631 46.5 780 684 144 35 30.9 53.5 310 19.4 15,6 832 38.3 13.7 64.3 382 & Consumer Dis. Consumer Stap Energy Healthcare C D E F O H J 100.0 100.0 100.0 1000 100.0 100.0 100.0 100.0 660 870 117.2 361 560 29.0 53.2 34.0 13.0 220 1172) 19 440 7LO 19.5 199 320 33 542 48.3 161 145 32 21 (49.21 TO 18.71 227 15 10 01 05 63 27 49 0.8 101 101 100 04 03:43 (27) 01 14.30 14,5 13.0 31 12 1620 119 138) 26.5 27 SO 09 10.3) 01 03 4.5 074 5.9 920 3800 10.3 26.7 102 477 141 110 27 105 446 267 3.4 INCOME STATEMENT Revenue Cost of Revenue Gross Profit Operating Experises Operating income Interest Expense Net Non-Operating contes Pre Tax Income Income Taron Income Before Extraordinary Minority interest Net Income 16 153 47 27 32 05 23 18 0.0 12 08 61 10.30 0.0 101 010 0201 0.6 (130 0301 166 1031 58 11:2) 45.4 78 10.9 11.5 98 274 122 01 20 00 4.6 0.8 26 58 SD 07 7.7 11.4 11.9 B.6 22 15 147.00 94 (12.71 21.8 53 10.3 4.9 6.4 396 224 0.6 186 119 CBGM 00 5.7 0.0 00 02 00 3.4 1.0 58 04 00 01 22 75 00 2.6 06 77 113 119 06 22 16 170 116 (114) 210 103 4.9 63 390 224 0.6 19 A C F a J . L M P O R N 72 16 to 23 14.8 09 2.0 06 42 71 0.2 06 13.2 00 198 1.6 103 319 06 00 00 0.3 00 00 00 5.0 00 4.7 0.8 3.7 00 42 00 64 110 6.3 0.0 86 70 02 20 20 44 44 7.5 133 71 BALANCE SHEET Cash Near Cash Short-Term investments Accounts Receivable we Other Ourrentes Nel Ford Assets Totale 70 00 & SEB 00 422 181 30 115 57 00 11 ta 29 41 270 0.0 R2 100.0 17 & S&S 14 04 24 1A 327 16 1000 20 3.7 247 1000 170 70 566 1000 34 10 144 1000 461 40,6 47 201 100,0 113 357 1000 100 1000 254 504 1000 104 113 1000 233 201 1000 to B01 1000 1000 1000 1000 100.0 51 163 13 11 14 35 110 67 73 00 28 472 06 275 0.0 157 06 153 67 27 52 05 3. 214 2.7 02 3 00 14 Accounts Payable Short Term Borrowing Other Short Term Long-Term Lab Total Lilies 22 00 228 399 798 61 130 213 128 14,4 138 ILI 1.8 5.4 65 64 107 306 40 63 313 63.5 505 159 19 91 265 00 20.2 161 596 213 145 967 315 323 814 365 106.4 440 74.0 380 339 223 473 256 70.7 1163 679 535 99.7 530 80.8 72.1 Equity 202 365 (163) 3.3 321 16 1.4) 485 260 404 03 527 470 14 233 102 229 Financial Ratio Comparison H N 0 Q R 53.2 161 220 D 34.0 15 (172) 70 316 794 15.6 82 383 369 102 132 535 153 643 13.0 3.2 119 141 119 27 105 44,6 2017 34 16.6 440 08.7 113.81 1271 78 145 146 31 119 22.7 26.5 218 115 58 9.8 45.4 274 19 77 119 2.2 23 (492) 152) (470) 5.2 125.4 106 (544) 98 63 103 63 06 09 SAGA 122 119 29 54 8.3 114 4.0 78 119 144 24 86 197 33.0 298.3 144 01.0 224 16:1 264 eless USB3 127 39.6 243 27,9 27,9 103 35 59 227 176 20.6 SCG:lle saab 67 13.7 18.01 3.2 5.6 76 247 382 804 1049 275 109 47 194 63 103 G H J P 15 08 15 18 18 B 08 05 01 99.5 C 09 01 01 215 D 12 03 0.2 240 06 00 952 E 10 04 04 240 0 Y2 69 10 0.5 01 M65 L 07 11 04 02 0.21 113.4 54 N 12 OY 04 1066 Q 10 04 0.2 Oy 04 721 R 05 03 03 11 0.8 0.6 1772 13 0.8 2936 0.0 0.3 792 124 0680 446 D C F H Q R 400 225.8 1068 DLA A 1978 064 300 910 427 020 342 0.377 971 1430 541 M 42.7 200 225 159 396 28.4 184 24 410 PROFITABILITY RATIOS Gross Margin Operating Margin Pretax Margin Net Margin Return on Assets Retum on Town Cape Return on Euty LIQUIDITY RATIOS Current Ratio Quick Ratio Cash Ratio Defensive interval SOLVENCY RATIOS Debt tot Debt-to-Capital Debt to Aset Financial interest Coverage ACTIVITY RATIOS Inventory Turnover Receivable Turower Payable Turnover Days Inventory Outstanding Days Sales Outstanding Days Payable Outstanding Cath Conversion Cycle Working Capital Turnover Fixed Aare Turnover Total Asset Turnov VALUATION RATIOS Price to Book Vie Price toaming Price to Cash Flow 049 007 151 130 1200 302 16.6 210 1830 647 476 40 CLA 332 10 31 373 980 003 0.5 44 51 569 307 36 24 110 1151 211 27 gla allo 30 10.0 43 179 200 A N 0 643 00 301 00 302 00 24 11 50 2,7681 N 23 94 83 19156 1587 389 439 B F L M C 18 416 D 3 507 16 88 END & S SEBESS6 H 16A 131 14 42 CSSBBEDELSE 512 542 13 3.1 73 21.0 3.0 P 37.2 1 2.0 31 433 9.8 62 281 K 61 84 Sele. 22 29 118 913 110 308 79 R 62 85 216 31 94 164 25.4 5.5 50 3.2 658 727 1 5.4 59.5 401 29 26.8 86 2687 2714 716 217 278 1669 125.4 GESEBB 8.7 40 435 136 692 72 38.8 37.5 46.0 182 120 77 861 282 472 671 64 169 500 43.0 1240 1228) 20:41 225 674 691 1149 297 556 1014 234 84 1173 (793) ao lalalalalalalala 113.81 EX EO Ble 32.2 2232 854 226.7 61 23 : 43 905 75 13.4 522 20 2.0 91 23.6 6a 45 07 27 186 03 112 17 0.5 8.0 428 0.7 13 03 7.2 4.6 23 126 14 05 11 0.7 26 03 20 0.8 71 0.7 0.5 05 14 02 B C D E F H 1 J L M N O . A 223 990 11 10 60 38 11 2.5 1650 280 20.3 034 P 100 19.0 37 16.2 22 329 R 10 190 71 93 5400 16.0 122 129 142 0.7 92 54 12.6 80 400 100 177 25 143 296 129 14.4 FINANCIAL STATEMENTS ANALYSIS OOMBERG BUSINESSWEEK CASE STUDY Name Group SECTOR COMPANY RATIOS COMMUNICATIONS B CONSUMER DISCRETIONARY D CONSUMER STAPLES E F ENERGY G H HEALTHCARE 1 J INDUSTRIALS K L MATERIALS M N TECHNOLOGY O P UTILITIES Q R Bloomberg CASEO Businessweek STUDIES E Financial Statements Analysis Compare financial statement ratios The Financial Statements Analysis case study includes two sep- to identify critical objective elements of arate components: a company and diagnose a company's Detective Activity positives and risks. This activity compels you to understand why ratios are what they are for a given company or industy. You will practice inter- preting financial ratios by matching financial statements to their Companies are as unique as people. But, like people groups companies, sorted by sector. This activity includes nine sec of people share similarities. Companies that operate within the toes: communications, consumer discretionary, consumer sta same sector or industry tend to share certain characteristics. ples, energy, healthcare, industrials, materials, technology, and Such characteristics are highlighted by calculating and comper utilities. ing a company's financial ratios. Comparing a company's ratios over time show if a company Case Study is changing, for the better or for worse. Comparing ratios among the case study will require you to access and compare Disney's different companies bring a company's particular characteris financial statements to those of its peers. Use the Terminal tics into focus. Tutorial and Case Study Notes to answer the case questions. Detective Activity Use the notes below, the company descriptions, the Common Size Income Statement & Balance Sheet, and Financial Ratio Comparisons to determine which company goes with which data in each sector. This learning supplement contains a short narrative describing security services, telecommunications equipment, and direc two companies that operate within the same sector. Each sector tory advertising and publishing also includes a consider this paragraph intended to guide your thinking and analysis. Consider this. Read the narrative and consider this paragraph for a particu AT&T is a very old company while Netflix began operations in lar sector. Then, look at the two columns of sector-specific data. 1997. AT&T sells physical products like phones from physical Each column of ratios is identified by a capital letter. Beginning locations versus Netflix which sells a virtual product, online at the top, slowly draw your fingers down the columns, look video content. Over the last few years, Netflix has been devel- ing for ratios that are different between the two companies. oping its own content which is very expensive, yet, its profits Determine which ratios help you identify which of the two com- were not sufficient to fund necessary content investments. Even panies belong to which column of data. $0, Netflix is a market darling. The first sector in this activity is communications. The two companies within the communications sector are Netflix and CONSUMER DISCRETIONARY AT&T. Data in columns A and B are derived from the Netflix The Home Depot, Inc. (HD) and AT&T financial statements. Find five ratios from columns The Home Depot, Inc. is a home improvement retailer that A and B that are useful in determining which column is Netflix sells a wide assortment of building materials, home improve and which is AT&T. ment and lawn and garden products, and provide a number of The income statement and balance sheet are presented in services. Home Depot operates throughout the United States, common size format. Canada, China, and Mexico Move through this supplement one sector at a time. Read the narratives for the companies and sector and analyze the AutoZone, Inc. (AZO) ratios for the two companies in the sector. Look for ratios that AutoZone, Inc. is a specialty retailer of automotive replacement are significantly different from one column to the other. Use the parts and accessories. The Company offers an extensive prod. two-finger approach. Take two fingers and go down the columns uct line for cars, sport utility vehicles, vans, and light trucks, of data from top to bottom. including new and re-manufactured automotive hard parts, Avoid the tendency to linger and over-analyze. Look for maintenance items, accessories, and non-automotive prod- insights and use your knowledge of the ratios to transform the ucts. AutoZone operates in the United States, Puerto Rico, and Insights into understanding. Mexico. Find five ratios for each sector, There are likely more than five that are useful. After a useful ratio has been identified, use consider This. what you know from the narrative to identify which company Compare the typical buying experience between AutoZone and belongs to which column. Home Depot. An AutoZone customer is looking for a very unique product. Perhaps an alternator for a 1969 Chevrolet Camero COMMUNICATIONS Very few people in the world are looking for such a product. Netflix Inc. (NFLX) In order to attract customers, AutoZone must keep a diverse Netflix Inc. is an internet subscription service for watching tele product base in its stores or warehouses. A Home Depot cus vision shows and movies. Subscribers can instantly watch unlimtomer is altogether different. Despite the size of Home Depot ited television shows and movies streamed over the Internet to stores, they stock a small number of unique products that hap their televisions, computers, and mobile devices. In the United pen to sell a lot. States, subscribers can receive standard definition DVDs and Blu-ray Discs delivered to their homes. Netflix began by dis CONSUMER STAPLES tributing media content made by outside studios. However, the Costco. (COST) company now produces a significant amount of its own content. Costco Wholesale Corporation operates wholesale membership warehouses in multiple countries. The Company sells a lim- AT&T Inc. (T) ited variety food, automotive supplies, toys, hardware, sport AT&T Inc. is a communications holding company. The Company, ing goods, jewelry, electronics, apparel, health, and beauty through its subsidiaries and affiliates, provides local and aids, as well as other goods. The company is the largest oper- long-distance phone service, wireless and data communications, ator of wholesale club stores with 740 in 44 US states, Puerto Internet access and messaging, IP-based and satellite television, Rico, Australia, Canada, Mexico, the UK, Japan, South Korea, Taiwan, and Spain. Costco generates its revenues from a com address cancer, heart disease, HIV and AIDS, diabetes, theu bination of membership fees and product sales. matoid arthritis, hepatitis, organ transplant rejection, and psy chiatric disorders. The Kroger Co. (KR) The Kroger Co. operates supermarkets and convenience stores Consider This. in the United States. The Company also manufactures and pro Teva is a commodity producer of pharmaceuticals, Bristol-Myers cesses some of the food its supermarkets sell. The company is develops and sells its own drugs. the largest traditional grocer in the United States with 2,800 supermarkets. Kroger operates its stores under its own name as INDUSTRIALS well as Dillon's, Fry's, Smith's, Food 4 Less, Raiptis, Fred Meyer, Deere & Company (DE) King Soopers, and others. Deere & Company manufactures and distributes a range of agri- cultural, construction, forestry, and commercial and consumer Consider This. equipment. The Company supplies replacement parts for its Costco is a wholesale club that sells most of its products ar dis own products and for those of other manufacturers. Deere count prices. Kroger sells its products in a competitive envi- also provides product and parts financing services. Deere and ronment with higher a gross margins. Additionally, compared Company extends its services and products worldwide. to Kroger, Costco is known for its operating skill and efficiency. The Boeing Company (BA) ENERGY The Boeing Company, together with its subsidiaries, develops, SunPower Corporation (SPWR) produces, and markets commercial jet aircraft, as well as pro- SunPower Corporation is an integrated solar products and vides related support services to the commercial airline industry services company. The Company designs, manufactures, and worldwide. The Company also researches, develops, produces, markets high-performance solar electric power technologies. modifies, and supports information, space, and defense sys SunPower serves residential, commercial, and power plant seg tems, including military aircraft, helicopters and space and mis- ments throughout the world. Power plants account for more sile systems. than 40% of its total revenues. More than 80% of the compa ny's sales come from the United States. Consider This Deere produces agriculture and construction equipment in Peabody Energy Corporation (BTU) a market with many alternatives. Among farmers, Deere is a Peabody Energy Corporation mines and markets low sulfur coal, premium product. Boeing manufactures airplanes. Boeing's primarily for use by electric utilities. The Company also trades primary competitor is Airbus. They both provide a line of air coal and emission allowances. Peabody owns and operates frames that compete head to head. Deere sells its equipment mines in Arizona, Colorado, New Mexico, and Wyoming, Illinois, through a network of independent dealerships around the Indiana, and Australia. Approximately half of the company's rev world. Boeing sells its planes directly to its customers. enue comes from the US. The company filed for Chapter 11 bank ruptcy in 2016 and came out of bankruptcy in 2017. MATERIALS Mosaic (MOS) Consider this. The Mosaic Company produces and distributes crop nutrients to SunPower is a solar technology company dependent on gov the agricultural communities located in North America and sev ernment incentives. Peabody is an old-fashioned coal company. eral other countries. The Company's principal products include concentrated phosphates and potash. The company operates HEALTHCARE in a very competitive market and its products may be perceived Teva Pharmaceutical Industries Ltd. (TEVA) as commodities. Teva Pharmaceutical Industries Ltd., is a global pharmaceutical company. The Company develops, manufactures, and markets Heidelberg HED generic and branded human pharmaceuticals as well as active HeidelbergCement AG produces and markets aggregates. The pharmaceutical ingredients. A generic drug is one that is no lon Company also manufactures building materials, including ger protected by the inventor's patents Teva is based in Israel cement and concrete, in Europe, North America, Asia, Australia, but sells its products throughout the world. Approximately 45% and Africa Together, cement, concrete, and aggregates account of the company's generic drug revenues come from the US while for nearly 90% of the company's sales. HeidelbergCement also Europe accounts for 32%. has group services which manage fossil fuels and electricity for its operations and trades internationally in cement and clinker Bristol-Myers Squibb Company (BMY) (an intermediate product used to make portland cement). The Bristol-Myers Squibb Company is a global biopharmaceutical firm operates in more than 40 countries. company. The Company develops, licenses, manufactures, markets, and sells pharmaceutical and nutritional products. Consider this. Bristol-Myers Squibb products and experimental therapies Mosaic manufactures and sells agricultural fertilizer which is subject to the agricultural product cycle. Heidelberg is subject to a construction cycle. The agricultural cycle occurs every year while the construction cycle is longer in duration TECHNOLOGY Facebook Inc. (FB) Facebook, Inc. operates a social networking website. The Company website allows people to communicate with their family, friends, and co-workers. Facebook develops technolo- gies that facilitate the sharing of information, photographs, web- site links, and videos. Facebook users have the ability to both share and restrict information based on their own specific crite ria. Approximately 85% of the company's revenue comes from mobile advertising while 11.8% comes from desktop advertis- ing. The remaining revenue comes from payments and fees. Apple Inc. (AAPL) Apple Inc. designs, manufactures, and markets personal com puters and related personal computing and mobile communi- cation devices along with a variety of related software, services, peripherals, and networking solutions. Apple sells its products worldwide through its online stores, its retail stores, its direct sales force, third-party wholesalers, and resellers. One prod- uct, the iPhone, accounts for more than 60% of the company's total revenue. Consider This Apple produces a physical product while Facebook sells an online social media platform. Physical products come with costs and operating inefficiencies that online services do not incur. Facebook is a relatively young technology company that recently went public. Although they are very profitable, the company does not pay a dividend. UTILITIES Centrica (CNA) Centrica PLC operates as an integrated energy company offer ing a wide range of home and business energy solutions. The Company sources, generates, processes, stores, trades, saves, and supplies energy and provides a range of related services. American Electric Power Company, Inc. (AEP) American Electric Power Company, Inc. operates as a public utility holding company. The Company generates, transmits, distributes, and sells electricity to residential and commercial customers. AEP serves customers in the United States. Consider this. AEP is an old fashioned electric utility. It produces, transmits, and distributes electric power over a pre-defined service ter ritory as a regulated natural monopoly. Regulators are tasked with ensuring utility companies are sufficiently profitable to attract investment capital but not too profitable. Centrica is an energy marketer. The company generally markets energy pro duced by other firms. Common Size Income Statement & Balance Sheet Fiscal Year 2018 fall values in USO) Utilities Communications A B 1000 100.0 Industrials K L 100.0 100.0 Materiais M N 1000 1000 Q R Technology 0 P 100.0 1000 16.8 617 100.0 1000 063 631 46.5 780 684 144 35 30.9 53.5 310 19.4 15,6 832 38.3 13.7 64.3 382 & Consumer Dis. Consumer Stap Energy Healthcare C D E F O H J 100.0 100.0 100.0 1000 100.0 100.0 100.0 100.0 660 870 117.2 361 560 29.0 53.2 34.0 13.0 220 1172) 19 440 7LO 19.5 199 320 33 542 48.3 161 145 32 21 (49.21 TO 18.71 227 15 10 01 05 63 27 49 0.8 101 101 100 04 03:43 (27) 01 14.30 14,5 13.0 31 12 1620 119 138) 26.5 27 SO 09 10.3) 01 03 4.5 074 5.9 920 3800 10.3 26.7 102 477 141 110 27 105 446 267 3.4 INCOME STATEMENT Revenue Cost of Revenue Gross Profit Operating Experises Operating income Interest Expense Net Non-Operating contes Pre Tax Income Income Taron Income Before Extraordinary Minority interest Net Income 16 153 47 27 32 05 23 18 0.0 12 08 61 10.30 0.0 101 010 0201 0.6 (130 0301 166 1031 58 11:2) 45.4 78 10.9 11.5 98 274 122 01 20 00 4.6 0.8 26 58 SD 07 7.7 11.4 11.9 B.6 22 15 147.00 94 (12.71 21.8 53 10.3 4.9 6.4 396 224 0.6 186 119 CBGM 00 5.7 0.0 00 02 00 3.4 1.0 58 04 00 01 22 75 00 2.6 06 77 113 119 06 22 16 170 116 (114) 210 103 4.9 63 390 224 0.6 19 A C F a J . L M P O R N 72 16 to 23 14.8 09 2.0 06 42 71 0.2 06 13.2 00 198 1.6 103 319 06 00 00 0.3 00 00 00 5.0 00 4.7 0.8 3.7 00 42 00 64 110 6.3 0.0 86 70 02 20 20 44 44 7.5 133 71 BALANCE SHEET Cash Near Cash Short-Term investments Accounts Receivable we Other Ourrentes Nel Ford Assets Totale 70 00 & SEB 00 422 181 30 115 57 00 11 ta 29 41 270 0.0 R2 100.0 17 & S&S 14 04 24 1A 327 16 1000 20 3.7 247 1000 170 70 566 1000 34 10 144 1000 461 40,6 47 201 100,0 113 357 1000 100 1000 254 504 1000 104 113 1000 233 201 1000 to B01 1000 1000 1000 1000 100.0 51 163 13 11 14 35 110 67 73 00 28 472 06 275 0.0 157 06 153 67 27 52 05 3. 214 2.7 02 3 00 14 Accounts Payable Short Term Borrowing Other Short Term Long-Term Lab Total Lilies 22 00 228 399 798 61 130 213 128 14,4 138 ILI 1.8 5.4 65 64 107 306 40 63 313 63.5 505 159 19 91 265 00 20.2 161 596 213 145 967 315 323 814 365 106.4 440 74.0 380 339 223 473 256 70.7 1163 679 535 99.7 530 80.8 72.1 Equity 202 365 (163) 3.3 321 16 1.4) 485 260 404 03 527 470 14 233 102 229 Financial Ratio Comparison H N 0 Q R 53.2 161 220 D 34.0 15 (172) 70 316 794 15.6 82 383 369 102 132 535 153 643 13.0 3.2 119 141 119 27 105 44,6 2017 34 16.6 440 08.7 113.81 1271 78 145 146 31 119 22.7 26.5 218 115 58 9.8 45.4 274 19 77 119 2.2 23 (492) 152) (470) 5.2 125.4 106 (544) 98 63 103 63 06 09 SAGA 122 119 29 54 8.3 114 4.0 78 119 144 24 86 197 33.0 298.3 144 01.0 224 16:1 264 eless USB3 127 39.6 243 27,9 27,9 103 35 59 227 176 20.6 SCG:lle saab 67 13.7 18.01 3.2 5.6 76 247 382 804 1049 275 109 47 194 63 103 G H J P 15 08 15 18 18 B 08 05 01 99.5 C 09 01 01 215 D 12 03 0.2 240 06 00 952 E 10 04 04 240 0 Y2 69 10 0.5 01 M65 L 07 11 04 02 0.21 113.4 54 N 12 OY 04 1066 Q 10 04 0.2 Oy 04 721 R 05 03 03 11 0.8 0.6 1772 13 0.8 2936 0.0 0.3 792 124 0680 446 D C F H Q R 400 225.8 1068 DLA A 1978 064 300 910 427 020 342 0.377 971 1430 541 M 42.7 200 225 159 396 28.4 184 24 410 PROFITABILITY RATIOS Gross Margin Operating Margin Pretax Margin Net Margin Return on Assets Retum on Town Cape Return on Euty LIQUIDITY RATIOS Current Ratio Quick Ratio Cash Ratio Defensive interval SOLVENCY RATIOS Debt tot Debt-to-Capital Debt to Aset Financial interest Coverage ACTIVITY RATIOS Inventory Turnover Receivable Turower Payable Turnover Days Inventory Outstanding Days Sales Outstanding Days Payable Outstanding Cath Conversion Cycle Working Capital Turnover Fixed Aare Turnover Total Asset Turnov VALUATION RATIOS Price to Book Vie Price toaming Price to Cash Flow 049 007 151 130 1200 302 16.6 210 1830 647 476 40 CLA 332 10 31 373 980 003 0.5 44 51 569 307 36 24 110 1151 211 27 gla allo 30 10.0 43 179 200 A N 0 643 00 301 00 302 00 24 11 50 2,7681 N 23 94 83 19156 1587 389 439 B F L M C 18 416 D 3 507 16 88 END & S SEBESS6 H 16A 131 14 42 CSSBBEDELSE 512 542 13 3.1 73 21.0 3.0 P 37.2 1 2.0 31 433 9.8 62 281 K 61 84 Sele. 22 29 118 913 110 308 79 R 62 85 216 31 94 164 25.4 5.5 50 3.2 658 727 1 5.4 59.5 401 29 26.8 86 2687 2714 716 217 278 1669 125.4 GESEBB 8.7 40 435 136 692 72 38.8 37.5 46.0 182 120 77 861 282 472 671 64 169 500 43.0 1240 1228) 20:41 225 674 691 1149 297 556 1014 234 84 1173 (793) ao lalalalalalalala 113.81 EX EO Ble 32.2 2232 854 226.7 61 23 : 43 905 75 13.4 522 20 2.0 91 23.6 6a 45 07 27 186 03 112 17 0.5 8.0 428 0.7 13 03 7.2 4.6 23 126 14 05 11 0.7 26 03 20 0.8 71 0.7 0.5 05 14 02 B C D E F H 1 J L M N O . A 223 990 11 10 60 38 11 2.5 1650 280 20.3 034 P 100 19.0 37 16.2 22 329 R 10 190 71 93 5400 16.0 122 129 142 0.7 92 54 12.6 80 400 100 177 25 143 296 129 14.4 FINANCIAL STATEMENTS ANALYSIS OOMBERG BUSINESSWEEK CASE STUDY Name Group SECTOR COMPANY RATIOS COMMUNICATIONS B CONSUMER DISCRETIONARY D CONSUMER STAPLES E F ENERGY G H HEALTHCARE 1 J INDUSTRIALS K L MATERIALS M N TECHNOLOGY O P UTILITIES Q R