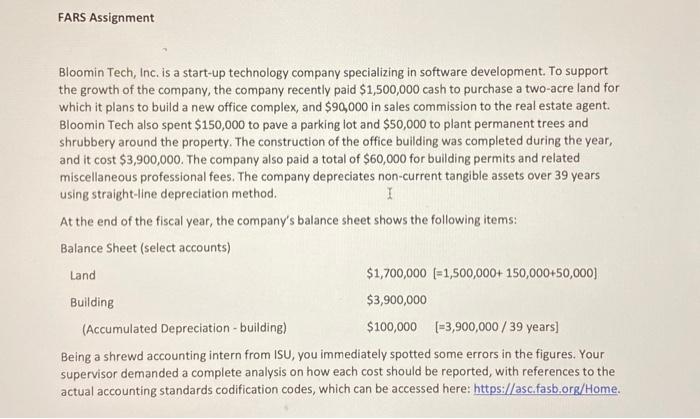

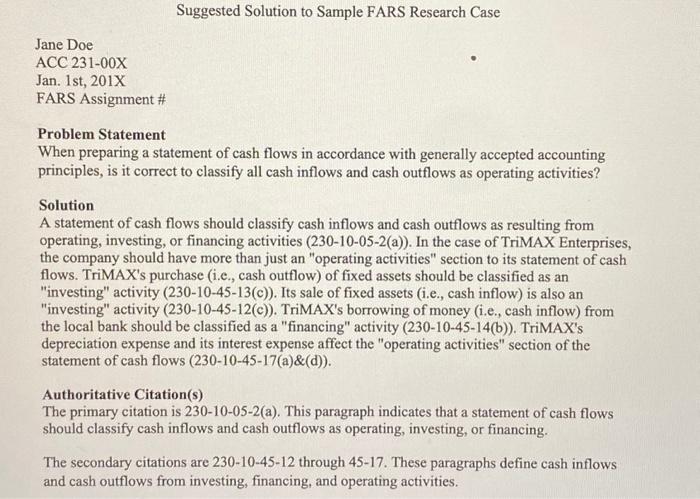

Bloomin Tech, Inc. is a start-up technology company specializing in software development. To support the growth of the company, the company recently paid $1,500,000 cash to purchase a two-acre land for which it plans to build a new office complex, and $90,000 in sales commission to the real estate agent. Bloomin Tech also spent $150,000 to pave a parking lot and $50,000 to plant permanent trees and shrubbery around the property. The construction of the office building was completed during the year, and it cost $3,900,000. The company also paid a total of $60,000 for building permits and related miscellaneous professional fees. The company depreciates non-current tangible assets over 39 years using straight-line depreciation method. At the end of the fiscal year, the company's balance sheet shows the following items: Balance Sheet (select accounts) Being a shrewd accounting intern from ISU, you immediately spotted some errors in the figures. Your supervisor demanded a complete analysis on how each cost should be reported, with references to the actual accounting standards codification codes, which can be accessed here: https://asc. fasb.org/Home. Suggested Solution to Sample FARS Research Case Jane Doe ACC 231-00X Jan. 1st, 201X FARS Assignment \# Problem Statement When preparing a statement of cash flows in accordance with generally accepted accounting principles, is it correct to classify all cash inflows and cash outflows as operating activities? Solution A statement of cash flows should classify cash inflows and cash outflows as resulting from operating, investing, or financing activities (230-10-05-2(a)). In the case of TriMAX Enterprises, the company should have more than just an "operating activities" section to its statement of cash flows. TriMAX's purchase (i.c., cash outflow) of fixed assets should be classified as an "investing" activity (230-10-45-13(c)). Its sale of fixed assets (i.e., cash inflow) is also an "investing" activity (230-10-45-12(c)). TriMAX's borrowing of money (i.e., cash inflow) from the local bank should be classified as a "financing" activity (230-10-45-14(b)). TriMAX's depreciation expense and its interest expense affect the "operating activities" section of the statement of cash flows (230-10-45-17(a)\&(d)). Authoritative Citation(s) The primary citation is 230-10-05-2(a). This paragraph indicates that a statement of cash flows should classify cash inflows and cash outflows as operating, investing, or financing. The secondary citations are 230-10-45-12 through 4517. These paragraphs define cash inflows and cash outflows from investing, financing, and operating activities