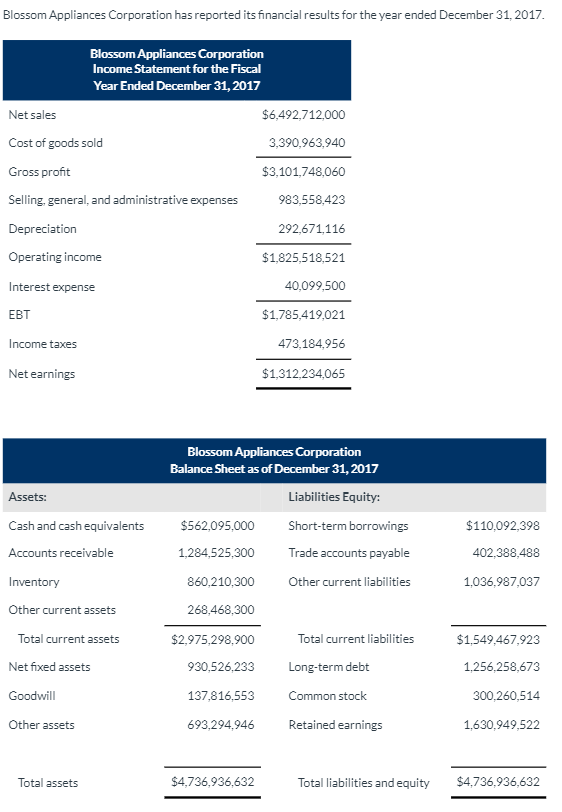

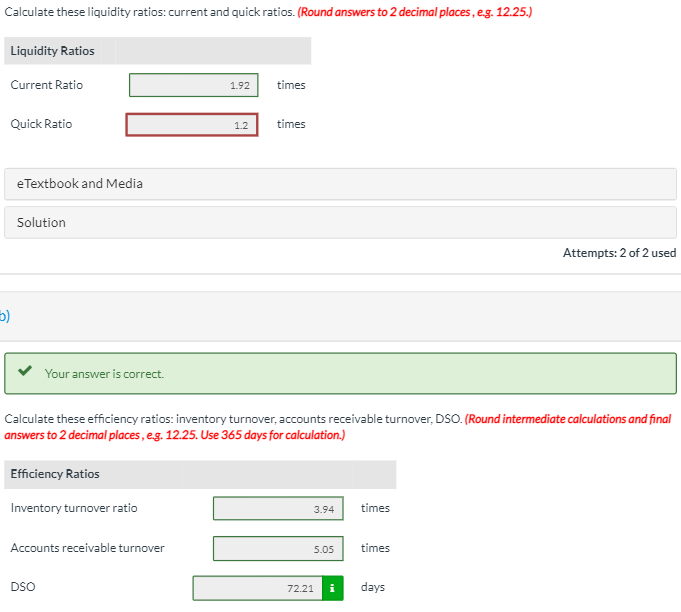

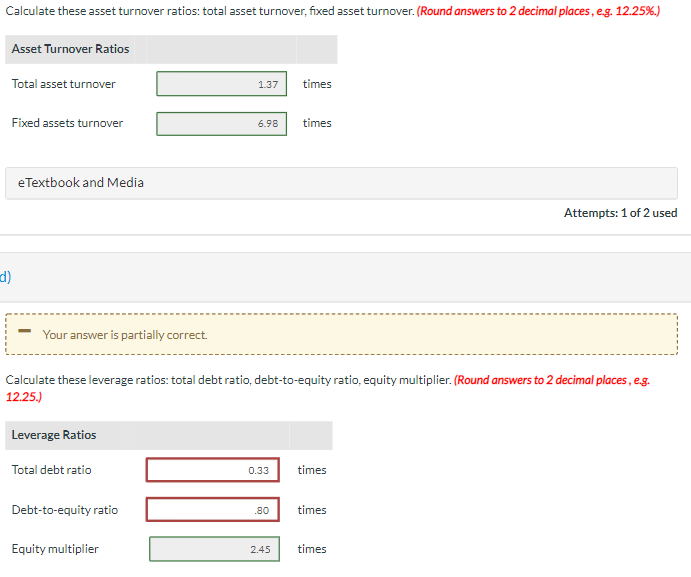

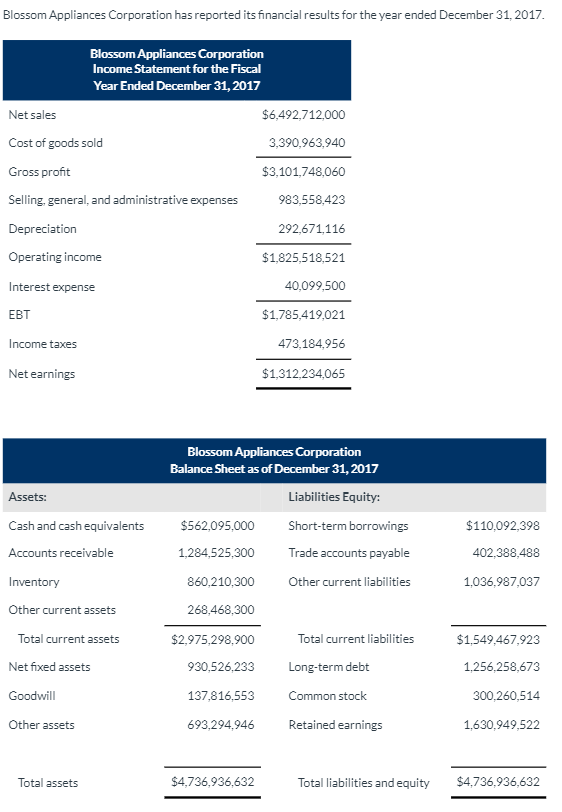

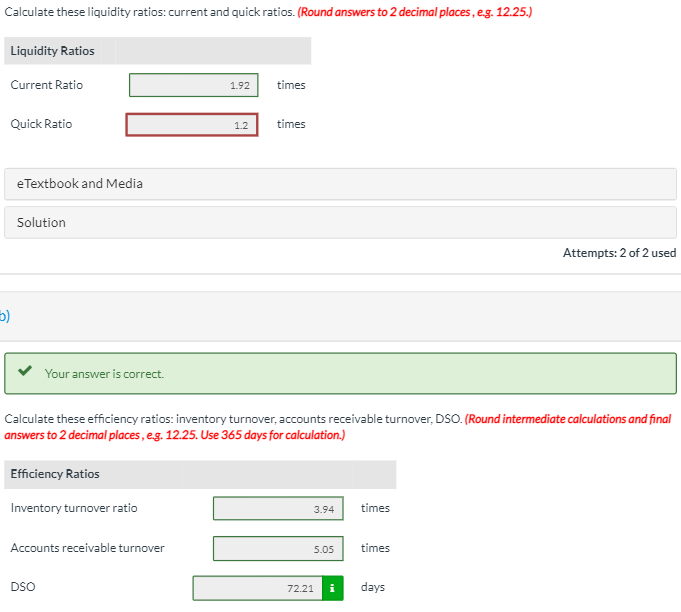

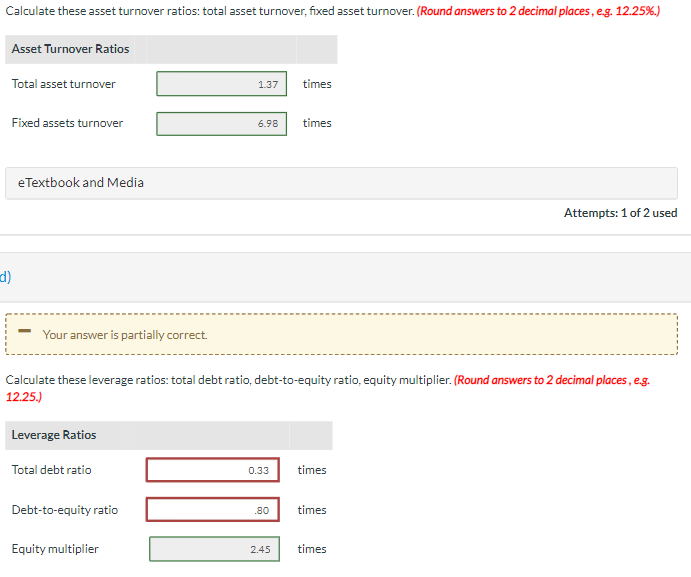

Blossom Appliances Corporation has reported its financial results for the year ended December 31, 2017 Blossom Appliances Corporation Income Statement for the Fiscal Year Ended December 31, 2017 $6,492,712,000 3,390,963,940 $3,101,748,060 983,558,423 Net sales Cost of goods sold Gross profit Selling, general, and administrative expenses Depreciation Operating income Interest expense EBT 292,671,116 $1,825,518,521 40,099,500 $1,785,419,021 Income taxes 473,184.956 Net earnings $1,312,234,065 Assets: Cash and cash equivalents Accounts receivable Inventory Blossom Appliances Corporation Balance Sheet as of December 31, 2017 Liabilities Equity: $562,095,000 Short-term borrowings 1,284,525,300 Trade accounts payable 860,210,300 Other current liabilities 268,468,300 $110,092,398 402,388,488 1,036,987,037 Other current assets Total current assets Net fixed assets $2,975,298,900 930,526,233 $1,549,467,923 1,256,258,673 Total current liabilities Long-term debt Common stock Retained earnings Goodwill 300,260,514 137,816,553 693,294,946 Other assets 1,630,949,522 Total assets $4,736,936,632 Total liabilities and equity $4,736,936,632 Calculate these liquidity ratios: current and quick ratios. (Round answers to 2 decimal places, eg. 12.25.) Liquidity Ratios Current Ratio 1.92 times Quick Ratio 1.2 times eTextbook and Media Solution Attempts: 2 of 2 used 5) Your answer is correct. Calculate these efficiency ratios: inventory turnover, accounts receivable turnover, DSO. (Round intermediate calculations and final answers to 2 decimal places, eg. 12.25. Use 365 days for calculation.) Efficiency Ratios Inventory turnover ratio 3.94 times Accounts receivable turnover 5.05 times DSO 72.21 i days Calculate these asset turnover ratios. total asset turnover, fixed asset turnover. (Round answers to 2 decimal places, e.g. 12.25%.) Asset Turnover Ratios Total asset turnover 1.37 times Fixed assets turnover 6.98 times e Textbook and Media Attempts: 1 of 2 used d) Your answer is partially correct. Calculate these leverage ratios: total debt ratio, debt-to-equity ratio, equity multiplier. (Round answers to 2 decimal places, eg. 12.25.) Leverage Ratios Total debt ratio 0.33 times Debt-to-equity ratio .80 times Equity multiplier 2.45 times