Blossom Company is considering two different, mutually exclusive capital expenditure proposals. Project A will cost $450,000,...

Fantastic news! We've Found the answer you've been seeking!

Question:

Transcribed Image Text:

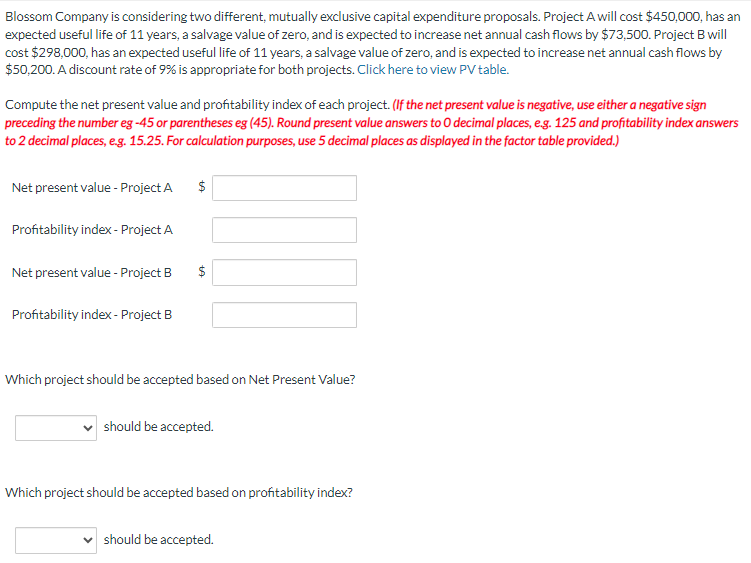

Blossom Company is considering two different, mutually exclusive capital expenditure proposals. Project A will cost $450,000, has an expected useful life of 11 years, a salvage value of zero, and is expected to increase net annual cash flows by $73,500. Project B will cost $298,000, has an expected useful life of 11 years, a salvage value of zero, and is expected to increase net annual cash flows by $50,200. A discount rate of 9% is appropriate for both projects. Click here to view PV table. Compute the net present value and profitability index of each project. (If the net present value is negative, use either a negative sign preceding the number eg-45 or parentheses eg (45). Round present value answers to O decimal places, e.g. 125 and profitability index answers to 2 decimal places, e.g. 15.25. For calculation purposes, use 5 decimal places as displayed in the factor table provided.) Net present value - Project A Profitability index- Project A Net present value - Project B Profitability index- Project B $ +A $ Which project should be accepted based on Net Present Value? should be accepted. Which project should be accepted based on profitability index? should be accepted. Blossom Company is considering two different, mutually exclusive capital expenditure proposals. Project A will cost $450,000, has an expected useful life of 11 years, a salvage value of zero, and is expected to increase net annual cash flows by $73,500. Project B will cost $298,000, has an expected useful life of 11 years, a salvage value of zero, and is expected to increase net annual cash flows by $50,200. A discount rate of 9% is appropriate for both projects. Click here to view PV table. Compute the net present value and profitability index of each project. (If the net present value is negative, use either a negative sign preceding the number eg-45 or parentheses eg (45). Round present value answers to O decimal places, e.g. 125 and profitability index answers to 2 decimal places, e.g. 15.25. For calculation purposes, use 5 decimal places as displayed in the factor table provided.) Net present value - Project A Profitability index- Project A Net present value - Project B Profitability index- Project B $ +A $ Which project should be accepted based on Net Present Value? should be accepted. Which project should be accepted based on profitability index? should be accepted.

Expert Answer:

Answer rating: 100% (QA)

To calculate the net present value NPV and profitability index PI for each project we need to discount the expected net annual cash flows using the ap... View the full answer

Related Book For

Managerial Accounting Tools for Business Decision Making

ISBN: 978-1118856994

4th Canadian edition

Authors: Jerry J. Weygandt, Paul D. Kimmel, Donald E. Kieso, Ibrahim M. Aly

Posted Date:

Students also viewed these accounting questions

-

**DO NOT LEAVE ANY FIELDS BLANK, ENTER A "O" IN THE DEBIT OR CREDIT THAT DOES NOT APPLY** Kelly's Yard Service, Inc. Cash Accounts Receivable Equipment; Supplies Building Studio Accounts Payable...

-

Jonczyk Company is considering two different, mutually exclusive capital expenditure proposals. Project A will cost $537,000, has an expected useful life of 15 years and a salvage value of zero, and...

-

Wildhorse Company is considering two different, mutually exclusive capital expenditure proposals. Project A will cost $ 4 6 6 , 0 0 0 , has an expected useful life of 1 3 years and a salvage value of...

-

5. (8 points) (Determining a hidden "dot product vector") Consider the problem where one is given black-box access to a function f: {0, 1}" {0, 1} such that f(x) = a-z, where a {0,1}" is unknown....

-

Find an expression for the function whose graph is the given curve. The line segment joining the points (1, -3) and (5, 7)

-

A leading broker has advertised money multiplier certificates that will triple your money in nine years; that is, if you buy one for $333.33 today, it will pay you $1,000 at the end of nine years....

-

Cooby Company purchased land containing an estimated 5 million tons of ore for a cost of $8,800,000. The land without the ore is estimated to be worth $500,000. During its first year of operation,...

-

Jakes Roof Repair has provided the following data concerning its costs: Cost per Fixed Cost Repair-Hour Per Month $16.30 Wages and salaries $23,200 Parts and supplies . $8.60 Equipment depreciation...

-

Monthly Production of Company for the year 2 0 2 3 is 5 0 0 0 units. Each units required 3 gram of direct material at a cost of $ 5 per gram, compute the cost of direct material usage monthly? Answer

-

The Illustrative Corporation recorded the following budgeted and actual information relating to fixed overhead costs for its Z - Line of products: \ table [ [ Standard fixed overhead per direct labor...

-

1. What are the differences between Directional, Market Neutral, and Event-Driven Strategies? 2. What are the differences between Absolute return and relative return measurements?

-

Duell Clinic uses patient-visits as its measure of activity. Planning, 3,700 ; Actual Result 3,600 If standard for medicat supplies 15 ( $900+4,30 a); Panning Budget $16,810, and Actual Result,...

-

Your 504 Technologies client is thinking about buying either tablets or smartphones for her traveling crew, and has asked you to verify if it would be a financially good investment. The client...

-

Chivaka & Cairney, 2007) points out that in order to have a more accurate picture of the costs of products and services, it is required that you understand and identify the activities that the...

-

What amounts are included in the asset cost of buying an imported machine from overseas (China to USA) for business purposes? Is general overhead included in this?

-

Susan escribe 3 ABC llamadas cubiertas del 35 de enero a $3.25.Las acciones de ABC suben a $40 y se asigna a Susan. Cules sonsus ganancias netas totales de estaestrategia?$12,000$ 1 answer

-

(a) Prove that form an orthonormal basis for R3 for the usual dot product. (b) Find the coordinates of v = (1, 1, 1)T relative to this basis. (c) Verify formula (5.5) in this particular case. 48-65...

-

In what ways is organizational politics destructive?

-

When should different influence strategies be used?

-

Could Chriss behavior be considered sexual harassment? If so, what should Teresa do? One year ago, Teresa, a hospital CEO, approached her supervisor, Kent, the health systems regional vice president,...

Study smarter with the SolutionInn App