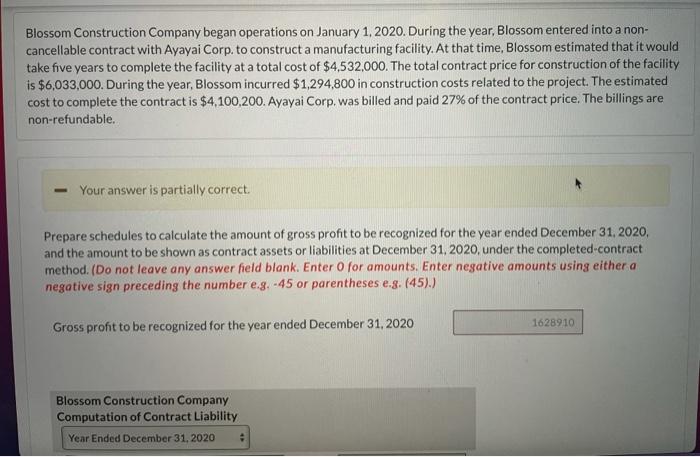

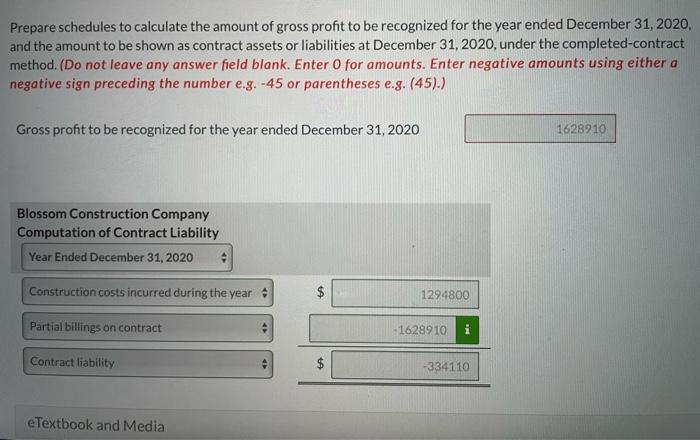

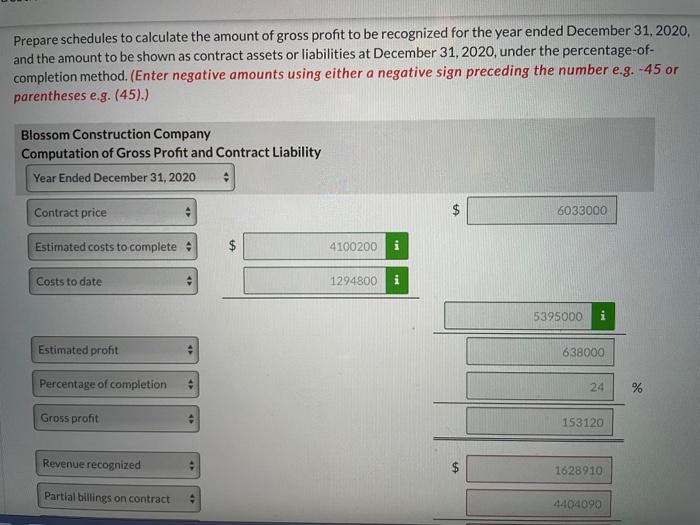

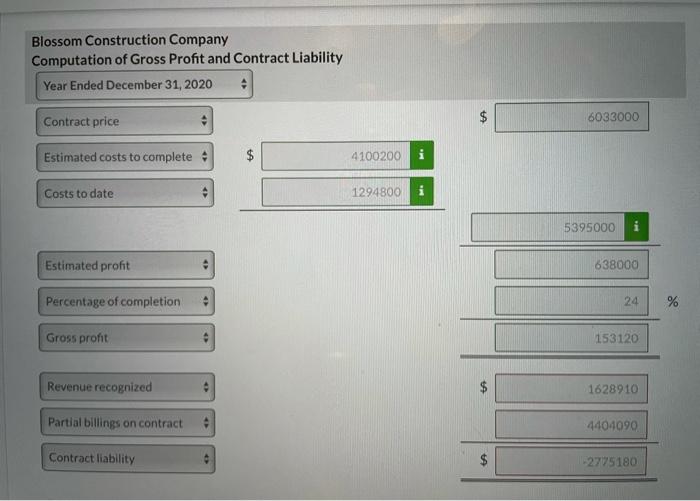

Blossom Construction Company began operations on January 1, 2020. During the year, Blossom entered into a non- cancellable contract with Ayayai Corp. to construct a manufacturing facility. At that time, Blossom estimated that it would take five years to complete the facility at a total cost of $4,532,000. The total contract price for construction of the facility is $6,033,000. During the year, Blossom incurred $1,294,800 in construction costs related to the project. The estimated cost to complete the contract is $4,100,200. Ayayai Corp.was billed and paid 27% of the contract price. The billings are non-refundable. Your answer is partially correct. Prepare schedules to calculate the amount of gross profit to be recognized for the year ended December 31, 2020, and the amount to be shown as contract assets or liabilities at December 31, 2020, under the completed-contract method. (Do not leave any answer held blank. Enter o for amounts. Enter negative amounts using either a negative sign preceding the number e.g.-45 or parentheses e.s. (45).) Gross profit to be recognized for the year ended December 31, 2020 1628910 Blossom Construction Company Computation of Contract Liability Year Ended December 31, 2020 Prepare schedules to calculate the amount of gross profit to be recognized for the year ended December 31, 2020, and the amount to be shown as contract assets or liabilities at December 31, 2020, under the completed-contract method. (Do not leave any answer field blank. Enter o for amounts. Enter negative amounts using either a negative sign preceding the number e.g. -45 or parentheses e.g. (45).) Gross profit to be recognized for the year ended December 31, 2020 1628910 Blossom Construction Company Computation of Contract Liability Year Ended December 31, 2020 Construction costs incurred during the year TA 1294800 Partial billings on contract -1628910 i Contract liability A -334110 e Textbook and Media Prepare schedules to calculate the amount of gross profit to be recognized for the year ended December 31, 2020, and the amount to be shown as contract assets or liabilities at December 31, 2020, under the percentage-of- completion method. (Enter negative amounts using either a negative sign preceding the number e.g.-45 or parentheses e.g. (45).) Blossom Construction Company Computation of Gross Profit and Contract Liability Year Ended December 31, 2020 Contract price $ 6033000 Estimated costs to complete $ $ 4100200 i Costs to date 1294800 i 5395000 Estimated profit 638000 Percentage of completion 24 % Gross profit 153120 Revenue recognized 1628910 Partial billings on contract 4404090 Blossom Construction Company Computation of Gross Profit and Contract Liability Year Ended December 31, 2020 Contract price 6033000 Estimated costs to complete $ 4100200 Costs to date 1294800 5395000 Estimated profit 638000 Percentage of completion 24 se Gross pront 153120 Revenue recognized 1628910 Partial billings on contract 4404090 Contract liability $ 2775180