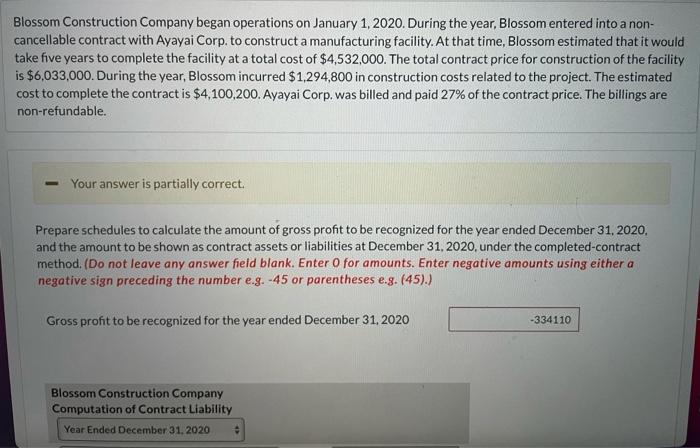

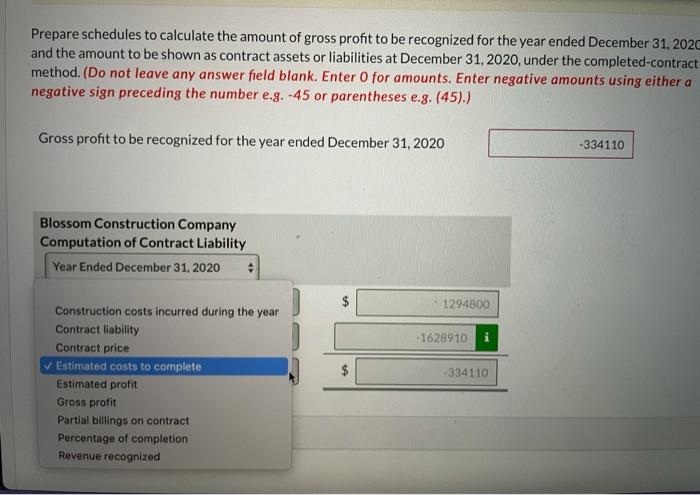

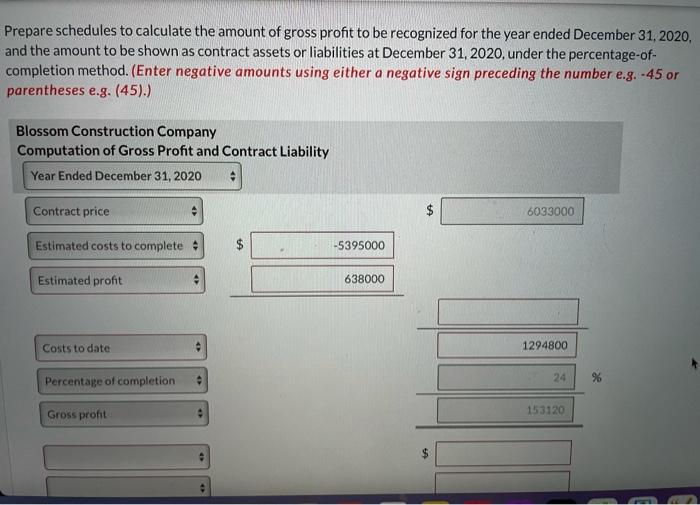

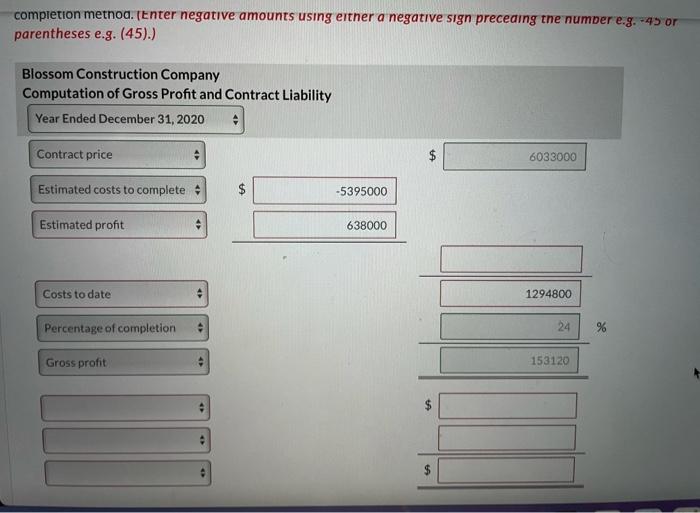

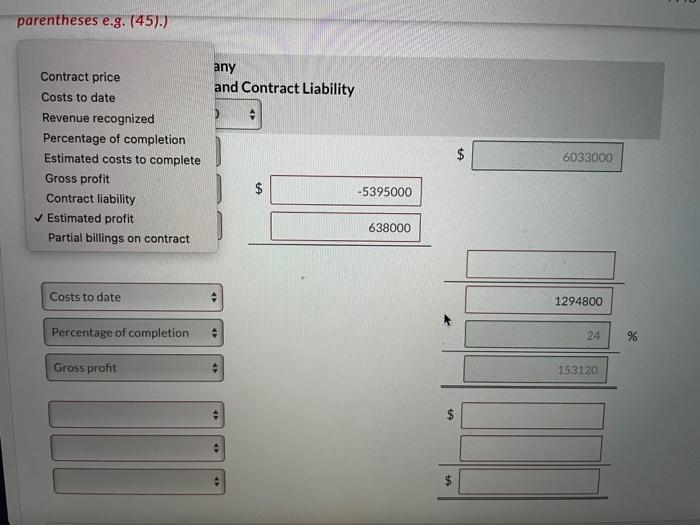

Blossom Construction Company began operations on January 1, 2020. During the year, Blossom entered into a non- cancellable contract with Ayayai Corp. to construct a manufacturing facility. At that time, Blossom estimated that it would take five years to complete the facility at a total cost of $4,532,000. The total contract price for construction of the facility is $6,033,000. During the year, Blossom incurred $1,294,800 in construction costs related to the project. The estimated cost to complete the contract is $4,100,200. Ayayai Corp. was billed and paid 27% of the contract price. The billings are non-refundable. Your answer is partially correct. Prepare schedules to calculate the amount of gross profit to be recognized for the year ended December 31, 2020, and the amount to be shown as contract assets or liabilities at December 31, 2020, under the completed-contract method. (Do not leave any answer field blank. Enter O for amounts. Enter negative amounts using either a negative sign preceding the number e.g.-45 or parentheses e.g. (45).) Gross profit to be recognized for the year ended December 31, 2020 -334110 Blossom Construction Company Computation of Contract Liability Year Ended December 31, 2020 Prepare schedules to calculate the amount of gross profit to be recognized for the year ended December 31, 2020 and the amount to be shown as contract assets or liabilities at December 31, 2020, under the completed-contract method. (Do not leave any answer field blank. Enter O for amounts. Enter negative amounts using either a negative sign preceding the number e.g. -45 or parentheses e.g. (45).) Gross profit to be recognized for the year ended December 31, 2020 -334110 Blossom Construction Company Computation of Contract Liability Year Ended December 31, 2020 $ 1294800 . 1628910 $ 334110 Construction costs incurred during the year Contract liability Contract price Estimated costs to complete Estimated profit Gross profit Partial billings on contract Percentage of completion Revenue recognized Prepare schedules to calculate the amount of gross profit to be recognized for the year ended December 31, 2020, and the amount to be shown as contract assets or liabilities at December 31, 2020, under the percentage-of- completion method. (Enter negative amounts using either a negative sign preceding the number e.g. -45 or parentheses e.g. (45).) Blossom Construction Company Computation of Gross Profit and Contract Liability Year Ended December 31, 2020 Contract price HA 6033000 Estimated costs to complete -5395000 Estimated profit 638000 Costs to date 1294800 24 % Percentage of completion Gross profit 153120 $ completion method. tenter negative amounts using either a negative sign preceding the number e.g. -45 or parentheses e.g. (45).) Blossom Construction Company Computation of Gross Profit and Contract Liability Year Ended December 31, 2020 Contract price 6033000 Estimated costs to complete $ -5395000 Estimated profit 638000 Costs to date 1294800 Percentage of completion 24 % Gross profit 153120 parentheses e.g. (45).) any and Contract Liability Contract price Costs to date Revenue recognized Percentage of completion Estimated costs to complete Gross profit Contract liability Estimated profit Partial billings on contract $ 6033000 -5395000 638000 Costs to date 1294800 Percentage of completion 24 % Gross profit 153120 Blossom Construction Company began operations on January 1, 2020. During the year, Blossom entered into a non- cancellable contract with Ayayai Corp. to construct a manufacturing facility. At that time, Blossom estimated that it would take five years to complete the facility at a total cost of $4,532,000. The total contract price for construction of the facility is $6,033,000. During the year, Blossom incurred $1,294,800 in construction costs related to the project. The estimated cost to complete the contract is $4,100,200. Ayayai Corp. was billed and paid 27% of the contract price. The billings are non-refundable. Your answer is partially correct. Prepare schedules to calculate the amount of gross profit to be recognized for the year ended December 31, 2020, and the amount to be shown as contract assets or liabilities at December 31, 2020, under the completed-contract method. (Do not leave any answer field blank. Enter O for amounts. Enter negative amounts using either a negative sign preceding the number e.g.-45 or parentheses e.g. (45).) Gross profit to be recognized for the year ended December 31, 2020 -334110 Blossom Construction Company Computation of Contract Liability Year Ended December 31, 2020 Prepare schedules to calculate the amount of gross profit to be recognized for the year ended December 31, 2020 and the amount to be shown as contract assets or liabilities at December 31, 2020, under the completed-contract method. (Do not leave any answer field blank. Enter O for amounts. Enter negative amounts using either a negative sign preceding the number e.g. -45 or parentheses e.g. (45).) Gross profit to be recognized for the year ended December 31, 2020 -334110 Blossom Construction Company Computation of Contract Liability Year Ended December 31, 2020 $ 1294800 . 1628910 $ 334110 Construction costs incurred during the year Contract liability Contract price Estimated costs to complete Estimated profit Gross profit Partial billings on contract Percentage of completion Revenue recognized Prepare schedules to calculate the amount of gross profit to be recognized for the year ended December 31, 2020, and the amount to be shown as contract assets or liabilities at December 31, 2020, under the percentage-of- completion method. (Enter negative amounts using either a negative sign preceding the number e.g. -45 or parentheses e.g. (45).) Blossom Construction Company Computation of Gross Profit and Contract Liability Year Ended December 31, 2020 Contract price HA 6033000 Estimated costs to complete -5395000 Estimated profit 638000 Costs to date 1294800 24 % Percentage of completion Gross profit 153120 $ completion method. tenter negative amounts using either a negative sign preceding the number e.g. -45 or parentheses e.g. (45).) Blossom Construction Company Computation of Gross Profit and Contract Liability Year Ended December 31, 2020 Contract price 6033000 Estimated costs to complete $ -5395000 Estimated profit 638000 Costs to date 1294800 Percentage of completion 24 % Gross profit 153120 parentheses e.g. (45).) any and Contract Liability Contract price Costs to date Revenue recognized Percentage of completion Estimated costs to complete Gross profit Contract liability Estimated profit Partial billings on contract $ 6033000 -5395000 638000 Costs to date 1294800 Percentage of completion 24 % Gross profit 153120