Answered step by step

Verified Expert Solution

Question

1 Approved Answer

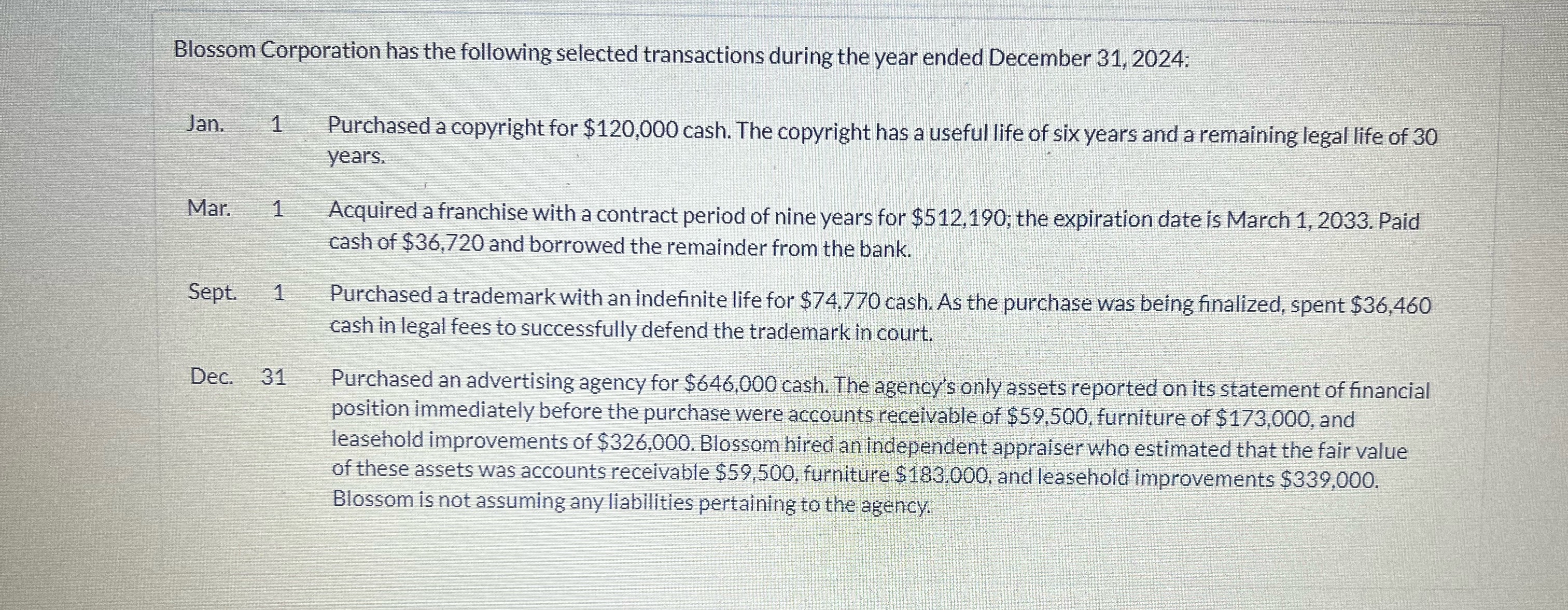

Blossom Corporation has the following selected transactions during the year ended December 3 1 , 2 0 2 4 : Jan. 1 Purchased a copyright

Blossom Corporation has the following selected transactions during the year ended December :

Jan. Purchased a copyright for $ cash. The copyright has a useful life of six years and a remaining legal life of years.

Mar. Acquired a franchise with a contract period of nine years for $; the expiration date is March Paid cash of $ and borrowed the remainder from the bank.

Sept. Purchased a trademark with an indefinite life for $ cash. As the purchase was being finalized, spent $ cash in legal fees to successfully defend the trademark in court.

Dec. Purchased an advertising agency for $cash. The agency's only assets reported on its statement of financial position immediately before the purchase were accounts receivable of $ furniture of $ and leasehold improvements of $ Blossom hired an independent appraiser who estimated that the fair value of these assets was accounts receivable $ furniture $ and leasehold improvements $ Blossom is not assuming any liabilities pertaining to the agency.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started